This is a more difficult but informative problem. James Brodrick & Sons, Incorporated, is growing rapidly and, if at all possible, would like to finance its growth without selling new equity. Selected information from the company's five-year financial forecast follows. Year Earnings after tax (5 millions) Capital investment ($ millions) Target book value debt-to-equity ratio (%) Dividend payout ratio (%) Marketable securities ($ millions) (Year e marketable securities $200 million) Year 1 100 Dividends (millions) 180 130 200 2 118 300 130 7 200 (5 millions). 3 158 300 130 ? 200 4 212 360 130 7 200 a. According to this forecast, what dividends will the company be able to distribute annually without raising new equity and while maintaining a balance of $200 million in marketable securities? What will the annual dividend payout ratio be? (Hint: Remember sources of cash must equal uses at all times.) Note: Round dividends to the nearest million dollars and the payout ratio % to the nearest ones place. 300 490 130 200

This is a more difficult but informative problem. James Brodrick & Sons, Incorporated, is growing rapidly and, if at all possible, would like to finance its growth without selling new equity. Selected information from the company's five-year financial forecast follows. Year Earnings after tax (5 millions) Capital investment ($ millions) Target book value debt-to-equity ratio (%) Dividend payout ratio (%) Marketable securities ($ millions) (Year e marketable securities $200 million) Year 1 100 Dividends (millions) 180 130 200 2 118 300 130 7 200 (5 millions). 3 158 300 130 ? 200 4 212 360 130 7 200 a. According to this forecast, what dividends will the company be able to distribute annually without raising new equity and while maintaining a balance of $200 million in marketable securities? What will the annual dividend payout ratio be? (Hint: Remember sources of cash must equal uses at all times.) Note: Round dividends to the nearest million dollars and the payout ratio % to the nearest ones place. 300 490 130 200

Chapter14: Capital Structure Management In Practice

Section: Chapter Questions

Problem 20P

Related questions

Question

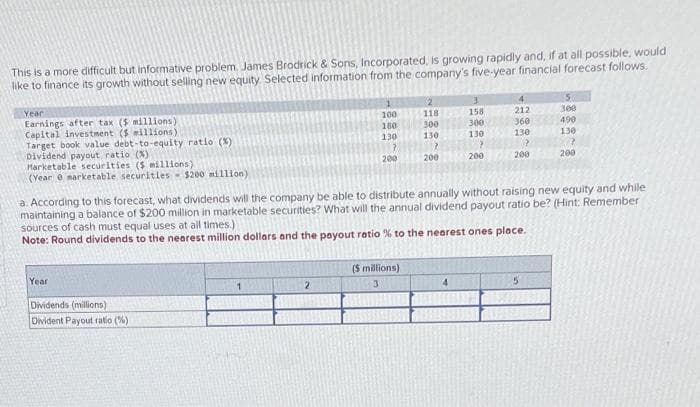

Transcribed Image Text:This is a more difficult but informative problem. James Brodrick & Sons, Incorporated, is growing rapidly and, if at all possible, would

like to finance its growth without selling new equity. Selected information from the company's five-year financial forecast follows.

Year

Earnings after tax (5 millions)

Capital investment (5 millions)

Target book value debt-to-equity ratio (%)

Dividend payout ratio (%)

Marketable securities (5 millions)

(Year e marketable securities $200 million)

Year

Dividends (millions)

Divident Payout ratio (%)

1

100

180

130

2

?

200

2

118

300

130

7

200

($ millions)

3

3

158

300

130

>

200

a. According to this forecast, what dividends will the company be able to distribute annually without raising new equity and while

maintaining a balance of $200 million in marketable securities? What will the annual dividend payout ratio be? (Hint: Remember

sources of cash must equal uses at all times.)

Note: Round dividends to the nearest million dollars and the payout ratio % to the nearest ones place.

4

212

360

130

?

200

5

300

490

130

7

200

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning