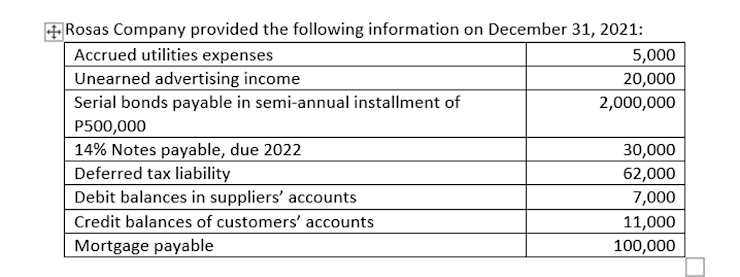

On December 31, 2021, what total amount should be reported as current liabilities? a.) 1,066,000 b.) 1,077,000 c.) 1,004,000 d.) 1,146,000 e.) none of the above

Q: A company uses a predetermined manufacturing overhead rate of 80% based on direct labor dollars. Dur...

A: The overhead is applied to the production on the basis of predetermined overhead rate.

Q: The Gorman Group issued $810,000 of 11% bonds on June 30, 2021, for $879,498. The bonds were dated o...

A: The journal entries are prepared to keep the record of day to day transactions of the business. The...

Q: In your report to the CEO, you are to provide the following: A flexible budget based on the actual v...

A: Flexible Budget- A flexible budget is a financial plan that adjusts to the action or capacity levels...

Q: MKG, Inc. paid $400,000 for a piece of equipment that is expected to have a 12 year useful life. In ...

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage a...

Q: From these particulars prepare a Bank Reconciliation Statement of Brindha Ltd. by taking Balance as ...

A: Bank Reconciliation is used to reconcile the balance as per bank and balance as per books of account...

Q: In 2010 Casey made a taxable gift of $5.7 million to both Stephanie and Linda (a total of $11.4 mill...

A: Gift taxes The calculation of gift tax is some what complex while considering the whole factors rela...

Q: o the questions displayed below.] Morning Sky, Inc. (MSI), manufactures and sells computer games. T...

A: Make or buy analysis compares the relevant cost under the two alternatives and chooses the alternati...

Q: LMN Company purchased factory equipment for $64,000 on January 1, 2016. The equipment is estimated t...

A: Formula: Straight line method depreciation = ( Asset cost - Salvage value ) / Useful life

Q: Which of the following transactions will increase the home office account in the branch's separate s...

A: The question is related to Branch Accounting. In case of branch Accounting the branch will be a debt...

Q: Murphy Hardware bought 800 3-cubic-feet bags of organic peat moss from Mitchell Garden Distributors ...

A: Journal is the book of original entry in which all the financial transactions relating to the busine...

Q: Hongtao is single and has a gross income of $92,700. His allowable deductions for adjusted gross inc...

A: Solution Taxable income refers to any individual's or business compensation that is used to determin...

Q: rucking fleet. The company performed a major overhaul on one of its trucks in the amount of $50,000 ...

A: The expenditure that increases useful life of assets (Property, Plant and Equipment) or leads to inc...

Q: Aya Company Sold a total of 7,000 units of its product. More data are as follows: Sales 700,000 Vari...

A: >The relationship between Cost, Volume and profit is necessary as it tells how each of them are d...

Q: ???????? Gregory and Brenda Morris, filing 1040 ?????? ?????? married, filing jointly ?????????? 2...

A: Here asked for multi sub part question we will solve firs three sub part question for you. If you n...

Q: Capital gains. This year, Haruto had one transaction involving a capital asset he held for more than...

A: Capital gain refers to the additional income earned by a taxpayer on the sale of a capital asset hel...

Q: Periodic Inventory Using FIFO, LIFO, and Weighted Average Cost Methods The units of an item availab...

A: The term inventory refers to both raw materials used in production and completed goods that are read...

Q: MLBC Corp. manufactures a particular product component. Manufacturing costs per unit for 10,000 unit...

A: Total manufacturing cost = Prime cost + Variable overhead + Fixed overhead Fixed overhead = Avoidabl...

Q: e applicable to the pla

A: A statement showing the item-wise amount of all the money received by an individual from the employe...

Q: Which of the following account will be least likely involved in the purchasing sub-process of the pu...

A: Purchasing and Disbursement Cycle is the whole process which starts with purchase of inventory and e...

Q: Davis Company exchanged an old machine with a cost of $120,000, total accumulated depreciation of $7...

A: The exchange refers to the situation where old assets are exchanged with new assets. The new acquire...

Q: Doll Company is selling sounds and lights equipment. The company's fiscal year ends on March 31. The...

A: Warranty expense is the assurance being given by the seller to the buyer that in case product will h...

Q: Upto 100 3% 101 - 200 5% 201 - 300 8% >300 10% Find the gross earnings if Ahmed sells worth RO 320. ...

A: The commission is based on sales revenue earned.

Q: s and used the house for personal purposes for 12 days. Rental income was $65,00 =xpenses were $67,0...

A: The answer is stated below:

Q: The partnership of Dina and Zia has assets of P 2,000,000 and liabilities of P 600,000. The capital ...

A: The partnership comes into existence when two or more persons comes together to do the business and ...

Q: Operating data for Coronado Corporation are presented as follows. 2022 2021 Net sales $7...

A: Vertical analysis: It is a method of analyzing the financial statement in which each item is shows a...

Q: Analysis Case 15-4 Lease concepts; Walmart L LO15-1 though LO15-4 Real World Financials Walmart Inc....

A: Finance lease is the one in which the user of the lease that is the lessee will get ownership of the...

Q: Olongapo Sports Corporation distributes two premium golf balls-Flight Dynamic and Sure Shot. Monthly...

A: The break even sales are the sales where business earns no profit no loss during the period.

Q: In an obligation to give a parcel of land subject to a suspensive condition, who is entitled to the ...

A: Obligations are the dues and conditions which needs to be fulfilled by particular person. These can ...

Q: a. Prepare the relevant journal entries in the first year of the lease. b. Prepare the relevant fina...

A: Leasee Magnitude Ltd Term of Lease 3 years Use full life of Plant 7 years Lease Rental ...

Q: Explain how each of the following work: a green tax, a subsidy, and an emissions trading system.

A: Environmental taxes often referred to as green taxes, contamination taxes, or ecotaxes seem to be a ...

Q: years, but the company requires it only for the first 5 years. It enters into an agreement with hala...

A: Viraj Limited obtains a machine costing $ 45 Lakhs by way of lease, The life of asset is 14 years an...

Q: A Machine was purchased on 1st January 2004 at a cost, of P58,000 and the cost of installation Rs 8 ...

A: Given that the cost of machine = P58,000 Cost of installation = P 8,000 Hence total cost of machine ...

Q: Crush and Ni are in partnership and prepare their accounts to December 31 each year. On July 1, 2015...

A: “Since you have asked multiple questions, we will solve the first question for you. If youwant any s...

Q: Lando, a family man decided to open up his own Laundry Shop. He named it: Lando Laundry The followin...

A: Journal entry: It is the first step of recording transactions of a company. Before this, no other ...

Q: REQUIREMENTS: 1. How much is the total current assets? 2. How much is the total non current assets? ...

A: Total equity is inclusive of investors money and the surplus held by the company. It can also be com...

Q: Micro Corporation has budgeted sales of its microchips for the next four-month as follows: Units Sol...

A: The budget is prepared to record the requirements for the future period.

Q: pany is y=48x+1,500,000. The total break ev

A: Breakeven point is the point where the contribution and fixed cost are equal. There is no profit or ...

Q: In the choice of mechanical equipment you are required to submit your recommendation as to which of ...

A: Many companies compare various capital expenditures while selecting from various alternatives. Prese...

Q: Which of the following would produce a labor rate variance? Multiple Choice Use of persons with high...

A: Labor Rate Variance = (Standard Rate − Actual Rate)Actual Hour

Q: Given the following excerpt from the Statement of Cash Flows under Operating Activities, how much of...

A: Cash flow statement is the statement prepared along with financial statements as its part, shows the...

Q: Distinguish between Tax Exemption and Tax Amnesty?

A:

Q: Suppose GENERAL MILLS originally purchased the GENERAL MILLS office building in Downtown LA for $200...

A: Depreciation is an expense which is recorded in income statement. It shows the decrease in the value...

Q: (a) Prepare a statement of equivalent production to determine the equivalent units for direct materi...

A: All Things Brass produces brass handles for the furniture industry in the four stage accounting proc...

Q: 15. Noreen Company provided the following information for 2020: Accounts receivable - January 1 Cred...

A: Amortized cost of Accounts receivable = Ending Accounts receivable - Estimated uncollectible account...

Q: What are the principles of a sound tax system? Briefly explain each

A: Introduction:- The tax system is described as a legally controlled system of public relations based ...

Q: In January 2021, you are asked to provide tax advice to Ms. Leslie Garond. She has provided you with...

A: Since you have asked multiple questions, we will solve the first question for you. If you want any s...

Q: Apex Fitness Club uses straight-line depreciation for a machine costing $21,950, with an estimated f...

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets ...

Q: Which of the following accounts does not belong in the purchases and disbursement cycle?

A: A disbursement is the paying out of funds, whether to make a purchase or other transaction. Disburse...

Q: Find the compound amount for the deposit and the amount of interest earned. $3000 at 3% compounded a...

A: Compound interest refers to the interest on loan is calculated using initial loan amount and interes...

Q: Doll Company is selling sounds and lights equipment. The company's fiscal year ends on March 31. The...

A: Bond Amortization Amortization of bond which are include with whether it is treated in the interest ...

On December 31, 2021, what total amount should be reported as current liabilities?

Step by step

Solved in 2 steps

- Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000Recording Various Liabilities Glenview Hardware had the following transactions that produced liabilities during 2020: a. Purchased merchandise on credit for $30,000. ( Note: Assume a periodic inventory system.) b. Year-end wages of $10,000 were incurred, but not paid. Related federal income taxes of $1,200, Social Security of $620 (employee portion), and Medicare taxes of $145 were with-held from employees. c. Year-end estimated income taxes payable, but unpaid, for the year were $42,850. d. Sold merchandise on account for $1,262, including state sales taxes of S48. ( Note: Assume a periodic inventory system.) e. Employers share of Social Security and Medicare taxes for the period were $620 and $145, respectively. f. Borrowed cash under a 90-day, 9%, $25,000 note. Required: Prepare the entry to record each of these transactions (treat each transaction independently).Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?

- Bonus Obligation and Income Tax Expense James Kimberley, president of National Motors, receives a bonus of 10% of Nationals profits above 1,500,000, before the bonus and the corporations income taxes are deducted. Nationals effective income tax rate is 21%. Profits before income taxes and his bonus are 5,000,000 for 2019. Required: 1. Compute the amount of Kimberleys bonus for 2019. 2. Compute National Motors income tax expense for 2019. 3. Prepare journal entries at the end of 2019 to record the bonus and income taxes. 4. Show how the bonus and income taxes would be reported on National Motors December 31,2019, balance sheet.Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________SUTA taxes on July 31, 20--. WORKERS COMPENSATION INSURANCE AND ADJUSTMENT Columbia Industries estimated that its total payroll for the coming year would be 385,000. The workers compensation insurance premium rate is 0.2%. REQUIRED 1. Calculate the estimated workers compensation insurance premium and prepare the journal entry for the payment as of January 2, 20--. 2. Assume that Columbia Industries actual payroll for the year is 396,000. Calculate the total insurance premium owed and prepare a journal entry as of December 31, 20--, to record the adjustment for the underpayment. The actual payment of the additional premium will take place in January of the next year.

- Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.

- Saverin, Inc. produces and sells outdoor equipment. On July 1, 2016, Saverin, Inc. issued 62,500,000 of 10-year, 9% bonds at a market (effective) interest rate of 8%, receiving cash of 66,747,178. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Instructions 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds. 2. Journalize the entries to record the following: a. The first semiannual interest payment on December 31, 2016, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) b. The interest payment on June 30, 2017, and the amortization of the bond premium, using the interest method. (Round to the nearest dollar.) 3. Determine the total interest expense for 2016.Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.