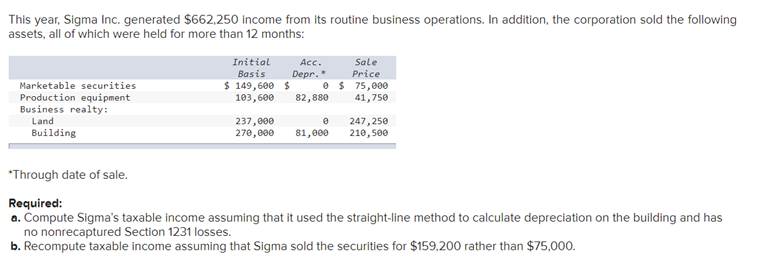

This year, Sigma Inc. generated $662.250 income from its routine business operations. In addition, the corporation sold the following assets, all of which were held for more than 12 months: Initial Basis $ 149,600 $ 103,600 Acc. Sale Depr. es 75,000 41,750 Price Marketable securities Production equipment Business realty: 82,880 237,000 278,e00 Land 247,250 210,500 Building 81,000 *Through date of sale. Required: a. Compute Sigma's taxable income assuming that it used the straight-line method to calculate depreciation on the building and has no nonrecaptured Section 1231 losses. b. Recompute taxable income assuming that Sigma sold the securities for $159,200 rather than $75,000.

This year, Sigma Inc. generated $662.250 income from its routine business operations. In addition, the corporation sold the following assets, all of which were held for more than 12 months: Initial Basis $ 149,600 $ 103,600 Acc. Sale Depr. es 75,000 41,750 Price Marketable securities Production equipment Business realty: 82,880 237,000 278,e00 Land 247,250 210,500 Building 81,000 *Through date of sale. Required: a. Compute Sigma's taxable income assuming that it used the straight-line method to calculate depreciation on the building and has no nonrecaptured Section 1231 losses. b. Recompute taxable income assuming that Sigma sold the securities for $159,200 rather than $75,000.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Transcribed Image Text:This year, Sigma Inc. generated $662,250 income from its routine business operations. In addition, the corporation sold the following

assets, all of which were held for more than 12 months:

Initial

Sale

Price

O$ 75,000

41,750

Acc.

Basis

Depr.*

$ 149,600 $

103,600

Marketable securities

Production equipment

Business realty:

Land

Building

82,880

237,000

270,000

247,250

210,500

81,000

*Through date of sale.

Required:

a. Compute Sigma's taxable income assuming that it used the straight-line method to calculate depreciation on the building and has

no nonrecaptured Section 1231 losses.

b. Recompute taxable income assuming that Sigma sold the securities for $159,200 rather than $75,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning