Prince Corporation acquired 1O0 percent of Sword Company on January 1, 20X7, for $178,000. The trial balances for the two companies on December 31, 20X7, included the following amounts: Sword Company Prince Corporation Credit Debit Credit Debit $ 34,000 66,000 118,000 29,000 157,000 Item Cash Accounts Receivable Inventory Land Buildings and Equipment Investment in Sword Company Cost of Goods Sold Depreciation Expense other Expenses 93,000 61,000 175,000 91,000 494,000 228,000 494,000 23,000 60,000 69,000 2$ 255,000 13,000 60,000 21,000 Dividends Declared Accumulated Depreciation Accounts Payable Mortgages Payable Common Stock Retained Earnings Sales Income from Sword Company $ 151,000 59,000 181,000 294,000 342,000 690,000 71,000 $1,788,000 $ 65,000 33,000 129,000 42,000 82,000 402,000 $1,788,000 $753,000 $753,000

Prince Corporation acquired 1O0 percent of Sword Company on January 1, 20X7, for $178,000. The trial balances for the two companies on December 31, 20X7, included the following amounts: Sword Company Prince Corporation Credit Debit Credit Debit $ 34,000 66,000 118,000 29,000 157,000 Item Cash Accounts Receivable Inventory Land Buildings and Equipment Investment in Sword Company Cost of Goods Sold Depreciation Expense other Expenses 93,000 61,000 175,000 91,000 494,000 228,000 494,000 23,000 60,000 69,000 2$ 255,000 13,000 60,000 21,000 Dividends Declared Accumulated Depreciation Accounts Payable Mortgages Payable Common Stock Retained Earnings Sales Income from Sword Company $ 151,000 59,000 181,000 294,000 342,000 690,000 71,000 $1,788,000 $ 65,000 33,000 129,000 42,000 82,000 402,000 $1,788,000 $753,000 $753,000

Chapter6: Corporations: Redemptions And Liquidations

Section: Chapter Questions

Problem 63P

Related questions

Question

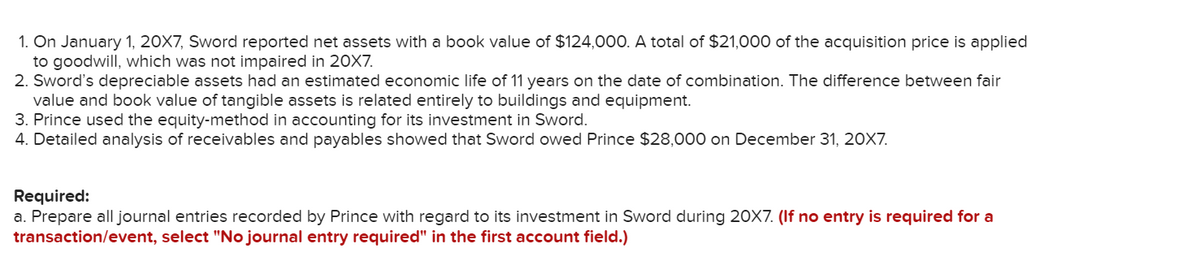

Transcribed Image Text:1. On January 1, 20X7, Sword reported net assets with a book value of $124,000. A total of $21,000 of the acquisition price is applied

to goodwill, which was not impaired in 20X7.

2. Sword's depreciable assets had an estimated economic life of 11 years on the date of combination. The difference between fair

value and book value of tangible assets is related entirely to buildings and equipment.

3. Prince used the equity-method in accounting for its investment in Sword.

4. Detailed analysis of receivables and payables showed that Sword owed Prince $28,000 on December 31, 20X7.

Required:

a. Prepare all journal entries recorded by Prince with regard to its investment in Sword during 2OX7. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field.)

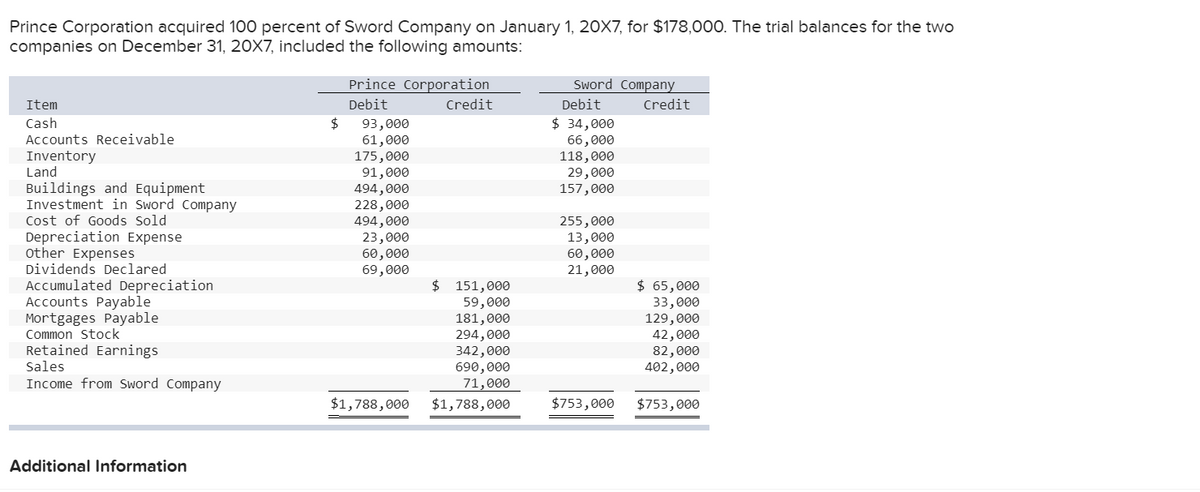

Transcribed Image Text:Prince Corporation acquired 100 percent of Sword Company on January 1, 20X7, for $178,000. The trial balances for the two

companies on December 31, 20X7, included the following amounts:

Prince Corporation

Sword Company

Item

Debit

Credit

Debit

Credit

$ 34,000

66,000

118,000

29,000

157,000

Cash

$

93,000

61,000

175,000

91,000

494,000

228,000

494,000

23,000

60,000

69,000

Accounts Receivable

Inventory

Land

Buildings and Equipment

Investment in Sword Company

Cost of Goods Sold

Depreciation Expense

other Expenses

Dividends Declared

255,000

13,000

60,000

21,000

$ 151,000

59,000

181,000

294,000

342,000

690,000

71,000

$ 65,000

Accumulated Depreciation

Accounts Payable

Mortgages Payable

Common Stock

Retained Earnings

33,000

129,000

42,000

82,000

402,000

Sales

Income from Sword Company

$1,788,000

$1,788,000

$753,000

$753,000

Additional Information

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning