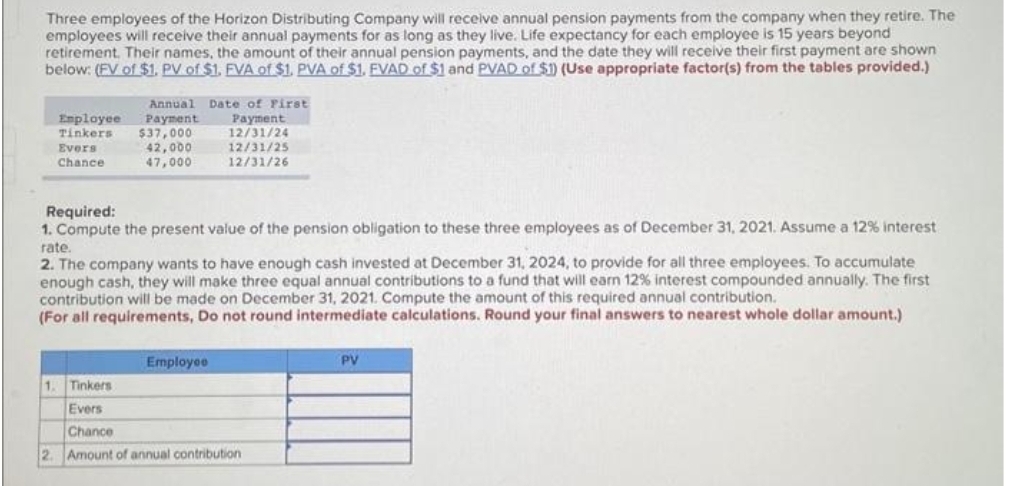

Three employees of the Horizon Distributing Company will receive annual pension payments from the company when they retire. The employees will receive their annual payments for as long as they live. Life expectancy for each employee is 15 years beyond retirement. Their names, the amount of their annual pension payments, and the date they will receive their first payment are shown below: (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Annual Date of First Payment 12/31/24 Employee Payment Tinkers $37,000 Evers 42,000 47,000 Chance 12/31/25 12/31/26 Required: 1. Compute the present value of the pension obligation to these three employees as of December 31, 2021. Assume a 12% interest rate. 2. The company wants to have enough cash invested at December 31, 2024, to provide for all three employees. To accumulate enough cash, they will make three equal annual contributions to a fund that will earn 12% interest compounded annually. The first contribution will be made on December 31, 2021. Compute the amount of this required annual contribution. (For all requirements, Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) Employee 1. Tinkers Evers Chance 2. Amount of annual contribution PV

Three employees of the Horizon Distributing Company will receive annual pension payments from the company when they retire. The employees will receive their annual payments for as long as they live. Life expectancy for each employee is 15 years beyond retirement. Their names, the amount of their annual pension payments, and the date they will receive their first payment are shown below: (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Annual Date of First Payment 12/31/24 Employee Payment Tinkers $37,000 Evers 42,000 47,000 Chance 12/31/25 12/31/26 Required: 1. Compute the present value of the pension obligation to these three employees as of December 31, 2021. Assume a 12% interest rate. 2. The company wants to have enough cash invested at December 31, 2024, to provide for all three employees. To accumulate enough cash, they will make three equal annual contributions to a fund that will earn 12% interest compounded annually. The first contribution will be made on December 31, 2021. Compute the amount of this required annual contribution. (For all requirements, Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) Employee 1. Tinkers Evers Chance 2. Amount of annual contribution PV

Chapter6: Business Expenses

Section: Chapter Questions

Problem 50P

Related questions

Question

Ee.37.

Transcribed Image Text:Three employees of the Horizon Distributing Company will receive annual pension payments from the company when they retire. The

employees will receive their annual payments for as long as they live. Life expectancy for each employee is 15 years beyond

retirement. Their names, the amount of their annual pension payments, and the date they will receive their first payment are shown

below: (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Employee

Tinkers

Evers

Chance

Annual Date of First

Payment

$37,000

Payment

12/31/24

12/31/25

12/31/26

42,000

47,000

Required:

1. Compute the present value of the pension obligation to these three employees as of December 31, 2021. Assume a 12% interest

rate.

2

2. The company wants to have enough cash invested at December 31, 2024, to provide for all three employees. To accumulate

enough cash, they will make three equal annual contributions to a fund that will earn 12% interest compounded annually. The first

contribution will be made on December 31, 2021. Compute the amount of this required annual contribution.

(For all requirements, Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.)

Employee

1. Tinkers

Evers

Chance

Amount of annual contribution

PV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College