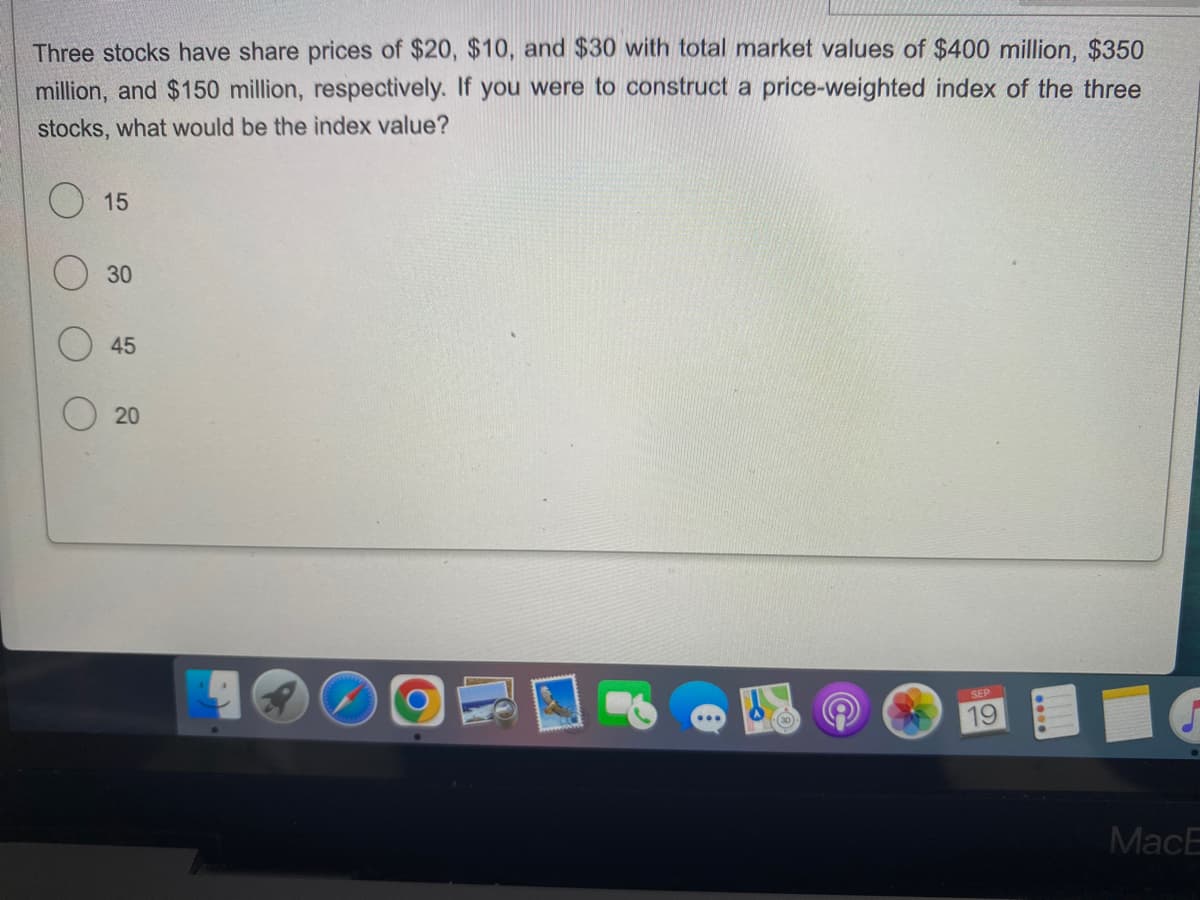

Three stocks have share prices of $20, $10, and $30 with total market values of $400 million, $350 million, and $150 million, respectively. If you were to construct a price-weighted index of the three stocks, what would be the index value?

Q: An ice cream producer has fixed costs of Php 3,500,000 per month, and it can produce up to 15,000…

A: The breakeven point is the degree of production at which the costs of production equivalent the…

Q: A large wood products company is negotiating a contract to sell plywood overseas. The fixed cost…

A: Given, p=$600-0.05DFixed cost = $885,093Variable cost = $135 per thousand feet

Q: 2) Every week Laura´s rabbit, Baxter, eats a mix of carrots and lettuce. Baxter's combination of…

A: Indifference curves are the locus of points of combination of two goods which give same level of…

Q: PProblem 3-Page (174): The following table gives you information on the total cost of Mac's ice…

A: Average total cost is alluded to as the entirety of all production costs divided by the total…

Q: 1. Given the estimated market demand and supply functions for coffee as: Qxd= 85.6 –10Px –3Ps +Y and…

A: Price is determined through market mechanism. Demand and supply are the function which help to…

Q: By Walter E. Williams socialism to free market capitalism. summary

A: Summary By Walter E. Williams socialism to free market capitalism. The following is the definition…

Q: *"Roshan Farhan, who grew up in Guwahati, saw first-hand how little people in small towns thought of…

A: Human resources ( in short HR) is the division inside a business that is liable for everything…

Q: A firm is producing 1,000 units at a total cost of $5,000. If it were to increase production to…

A: The total cost is the sum of the fixed and variable costs. The term "fixed cost" refers to the cost…

Q: Suppose a low-income family that earns K750 per month consumes 8 Kgs of Hamburgers and 2 Kgs of Beef…

A: Income elasticity of demand is the responsivenesses of the quantity demanded for a good to a change…

Q: According to the expectations theory of the term structure of interest rates, if the interest rate…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: The demand and supply schedules in this table list the quantity supplied and quantity demanded of…

A: Demand and Supply Find out the cost of the goods and how much is produced and consumed.By making…

Q: Question 3 Maureen spends her budget on pizza and salad. Suppose that the price of salad increases,…

A: The substitution effect is that as costs rise, or income fall, customers supplant more-expensive…

Q: Individuals or companies whose needs are far ahead of market trends are referred to as high…

A: Solution: Option-c will be correct i.e. Lead users Explanation: Option-c will be correct. Being far…

Q: A recent trend in health insurance is the Health Savings Account (HSA). The idea behind Health…

A: Demand for healthcare refers to the level of consumption of healthcare by an individual in case of…

Q: 10. All of the following are part of M1 money except? A. Currency B. Demand deposits C. Other…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: An oil refinery produces one base type of crude oil. The total cost is given by the equation Total…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: The rent on an apartment in a particular building near campus is $1,200 per month. If Min would be…

A: Grpahically, consumer surplus is the area below the demand curve and area above the price line. It…

Q: Question 14 options: An entity formed between two or more parties to undertake economic activity…

A: At the marketplace, different types of firms enter to generate economic output by making various…

Q: The minimum wage in Arizona is $10.50. This is higher than the federal minimum wage of $7.25. Which…

A: Macroeconomics refers to the branch of economics that deals with the economy as a whole. For…

Q: Once a common resource is available for consumption, policymakers need to be concerned with

A: Thank you for the question. According to Bartleby's answering guidelines, we answer only one…

Q: Suppose that Country A's no-trade PPF is y = -2x + 40 and Country B's no-trade PPF is y= -x +30,…

A:

Q: To secure a return of 4%, at what price should a bond be purchased if it is redeemable at P 1,000 in…

A: So, to secure the return of 4%, at what price should a bond be purchased if it is redeemable at P…

Q: Discuss the major shortcomings of the Basle I accord.

A: Basel I was the first global agreement on adequate amount of bank capital. Criticisms include that…

Q: Match the following International trade theory name with the concept 1)One country should be able to…

A: All of these are concepts from the international trade. Hence we will first explain theories and…

Q: According to economic theory, a government with a contractionary fiscal policy would decrease…

A: DISCLAIMER “Since you have asked multiple question, we will solve the first question for you. If…

Q: In briefly Explain the government budget deficit and debt and how this can cause crowding out for…

A: A deficit occurs when the government spends more than it receives, and the state's debt is equal to…

Q: Market Commodity Basket Milk Eggs Bread Quantity 10 gallons 10 dozen 10 loaves 2010 2011 Price price…

A: Inflation is the rate at which prices for products and services increase. Inflation is sometimes…

Q: (1) Given the following demand and supply functions: Demand : QD=2900-125P (a) Solve for market…

A: Elasticity of supply measures the responsiveness of quantity supplied with respect to change in…

Q: and

A: With the increase in world price of wheat, the total revenue of exporting country will increase,…

Q: In an hour, Sue can produce 40 caps or 4 jackets and Tessa can produce 80 caps or 4 jackets. If Sue…

A: Comparative advantage is the production of goods at a lower cost than others.

Q: If there is no tax placed on the product in this market, consumer surplus is the area O a. A. O O O…

A: The price a person is willing to pay for a good and the market price for that good are separated by…

Q: Consider the labour market for heath care workers, which is in equilibrium. Because of the aging…

A: The equilibrium is decided where the demand and supply of labor force is equal. Change in either…

Q: Perform these same calculations for 2018 and 2019, and enter the results in the following table.…

A: CSPI measures the overall price of market basket of goods and services which is fixed throughout the…

Q: Units of rice 1 2 3 4 5 6 7 8 O 4 utils O 50 utils 53 utils O 28 utils Marginal Utility of rice O 25…

A: Since you have posted multiple question, as per the guidelines we can solve only one question per…

Q: Refer to Table 6.2. Assume that this economy produces only two goods Good X and Good Y. If year 1 is…

A: In an economy real GDP measures the value of the items and services produced in a defined time frame…

Q: Suppose that Country A's no-trade PPF is y = -2x + 40 and Country B's no-trade PPF is y = -x +30,…

A: Country A's PPF equation: y=40-2x ..... (1) Country B's PPF equation: y=30-x…

Q: Derive the formula to estimate the volatility parameter (used in the Black-Scholes formula) using…

A: The formula to estimate the volatility parameter is as follows: Volatility Parameter = Square Root…

Q: David spends his budget on chocolate and chip. His utility function is given by U(q₁, 92) = 29192,…

A: Given David utility function: U(q1, q2)=2q1q2 ..... (1) Where q1 denotes the number of…

Q: 1. Given the Philippine labor statistics in the table below: a. Derive the demand and supply…

A: The labor demand curve is the relationship between the wage rate and the number of people employed…

Q: What are the 5 economic

A: Governments and societies used economic systems to distribute, plan, and distribute resources,…

Q: What is the purpose of an economic system? Select all that apply. Multiple answers: Multiple answers…

A: An economic system aims at proper organization and distribution of the available resources. It aims…

Q: The graph below shows the market for labor (coal miners). New coal-mining equipment is invente that…

A: Demand curve is downward sloping and it shows an inverse relationship between price and quantity.…

Q: 2-18 Last year, at Northern Manufacturing Company, 200 people had colds during the year. One hundred…

A: Given data, Total number of Employees: n (T) = 1000 Employees with a cold : n (C) =200 Employees…

Q: 11 Q3. y=LAK and (p = $10, w = $5,r= $5). Find the optimal labor and capital, (L", K") to maximize…

A: The amount of labour that maximises production and profit while minimising expenses is referred to…

Q: Due to a recession that lowered incomes, the 2008 market prices for last-minute rentals of U.S.…

A: Given that, Inverse Demand Function, p = 1000 - Q + Y/10 Inverse Supply Function, p = 1000 - Q/4 +…

Q: B04

A: Fiscal policy is the use of government spending and taxation by the government to influence the…

Q: Long-run average cost (AC) of operation may decrease for three reasons. a. List and explain the…

A: DISCLAIMER “Since you have asked multiple question, we will solve the first 3 subparts for you. If…

Q: The manufacture of Prolene is an industry that offers such large production economies of scale that…

A: "Since you have asked multiple questions, we will solve first question for you .. If you want any…

Q: Most lighthouses are operated by the government because Select one: a. most lighthouses are only…

A: "Since you have asked multiple questions, we will solve first question for you .. If you want any…

Q: Suppose a monopolist M sells two products, X and Y. • Demand for X is qX = 1000 − pX − 1/2pY •…

A: Information given in question states:- Demand for X is qX = 1000 − pX − 1/2pY Demand for Y is qY =…

Step by step

Solved in 2 steps

- In June, an investor purchased 250 shares of Oracle (an information technology company) stock at $23 per share. In August, she purchased an additional 360 shares at $23 per share. In November, she purchased an additional 510 shares, but the stock increased to $29 per share. What is the weighted mean price per share? (Round your answer to 2 decimal places.)The Best Buy Company, Inc., is a leading specialty retailer of consumer electronics, personal computers, entertainment software, and appliances. The company operates retail stores and commercial websites, the best known of which is bestbuy.com. Recently, this site offered a home theater unit with a 5-disc DVD player, MP3 playback, and digital AM/FM. At a price of $1100, weekly sales totaled 2500 units. After a $100 online rebate was offered, weekly sales jumped to 5000 units. Using these two price-output combinations, the relevant linear demand and marginal revenue curves can be estimated as P = 1200 – 0.04Q (A)Calculate the revenue-maximizing price-output combination and revenue level. If Best Buy's marginal cost per unit is constant at $800, calculate profits at this activity level. (B) Calculate the profit-maximizing price-output combination. Also calculate revenues and profits at the profit-maximizing activity level.Engro Foods (Pvt) Ltd. is a FMCG manufacturer in Pakistan. Its main products are milk, icecream, and flavored juices. Last year the company has sold around 8 million units of milk, 5million units of ice-cream and 3 million units of flavored juices. The average current marketprice of the milk is Rs.100; the ice-cream is 60; and the Juices is Rs.40.In an attempt to improve revenue, the managers of the company have decided to increase allprices by 5%. Market research has suggested that the price elasticity of demand for eachproduct is: Milk: (-) 1.5; Ice-cream: (-) 1.0; Flavored juices: (-) 0.5You are required to calculate, evaluate and suggest the planned price change on followingsituations.a. Would a 5% price increase have been better for some or all of the products?b. Would a 5% price reduction have been better for some or all of the products?c. Should the company retain their current market price? If yes then why? If not thenwhy not?d. How Engro Foods (Pvt) Ltd. can maximize their…

- Andria Mullins, financial manager of Webster Electronics, has been asked by the firm's CEO, Fred Weygandt, to evaluate the company's inventory control techniques and to lead a discussion of the subject with the senior executives. Andria plans to use as an example one of Webster's "big ticket" items, a customized computer microchip which the firm uses in its laptop computer. Each chip costs Webster P200, and in addition it must pay its supplier a P1,000 fee on each order. Further, the minimum order size is 250 units; Webster's annual usage forecast is 5,000 units; and the annual carrying cost of this item is estimated to be 20 percent of the average inventory unit cost. Andria plans to begin her session with the senior executives by reviewing some basic inventory concepts, after which she will apply the EOQ model to Webster's microchip inventory. Question: What is the formula for the total costs of carrying and ordering inventory? and then use the formula to derive the EOQ model.A herbal tea producer company has 24 different products in the market, each are produced in one of the 3 factories owned by the company. The weights of the products in monthly sales may vary depending on time of the year (demands of certain products shift to others in each of the 4 seasons), age of the products and market conditions, but yearly aggregate demand has a very strong correlation with the price of the product (Here, we ignore any other factor and assume that the yearly aggregate demand is directly and linearly effected by the price). The company found out that when the price for a packet of 20 herbal tea bags is 10 TL, yearly demand is 337500 packets. When the price increases to 11 TL, demand decreases to 337125 packets. On the cost side, the company has 1200000 TL of yearly administrative costs regardless of the price or the number of units sold, including the rents, depreciation of the buildings and other related assets and salaries of 58 workers (average monthly salary…Your pharmaceutical firm is seeking to open up new international markets by partnering with various local distributors. The different distributors within a country are stronger with different market segments (hospitals, retail pharmacies, etc.) but also have substantial overlap. a. In Egypt, you calculate that the annual value created by one distributor is $60 million per year, but would be $80 million if two distributors carried your product line. How much of the value can you expect to capture? b. Argentina also has two distributors with values similar to those in Egypt, but both are run by the government. How does this affect the amount you could capture? c. In Argentina, if you do not reach an agreement with the government distributors, you can set up a less efficient Internet-based distribution system that would generate $20 million in value to you. How does this affect the amount you could capture?

- Q59 Assume that Cronos Group, a nondiscriminating monopolist of cannabis products finds that it can sell its 82nd unit of output for $12. We can surmise that the marginal Multiple Choice revenue of the 82nd unit is less than $12. revenue of the 82nd unit is also $12. revenue of the 82nd unit is greater than $12. cost of the 82nd unit is also $12. cost cannot be calculated from the data given.A construction company is considering two different investments. I sent the cash flows of these investments to you. Find the current net value of these two investments, assuming the desired rate of profit as 15%.An entrepreneur named Khadijah has total revenue shown by the equation TR = 150Q - 5Q² and total costs shown by the equation TC = 20 - 10Q. Determine the amount of output that must be produced by Khadijah to get the maximum profit and what is the maximum profit from that amount of output. Prove that the value obtained is the maximum!

- Kingdom Enterprises is a Indian exporter of agriculture products and files all of its financial statements in Indian Rupees (INR). The company’s director, George Bidden, an American national has been praised for his performance. The head office management disagrees, arguing that sales in America have dropped significantly in recent years. Discuss whose point of view is more realistic. 2018 2019 2020 Total Net Sales, INR 2,542,991 2,831,711 3,010,000 Percent sales from America 26% 28% 23% Average Exchange Rate (INR/$) INR 70/$ INR 69.5/$ INR 71.21/$18. Calculate the approximate price relatives to two decimal places for the MTN and Vodacom stocks over the period in question. A. 0.71, 0.67 B. 0.57, 0.75 C. 0.75, 0.77 D. 0.70, 0.81On September 2, 2021, the Malaysian government set a ceiling retail price of RM19.90 for COVID-19 Self-Test Kit, which would take effect on September 5, 2021. Discuss the advantages and disadvantages of the policy.