Three years ago, Kenesha purchased $10,000 worth of stock in major U.S. corporations. She spent $6000 on PEACH and $4,000 on GlobalHealth. Today, Kenesha decides to sell all her shares for $9,000. PEACH had decreased in value to $1,000 and GlogalHealth has increased in value to $8,000. What does she owe in taxes on this income? Show your work.

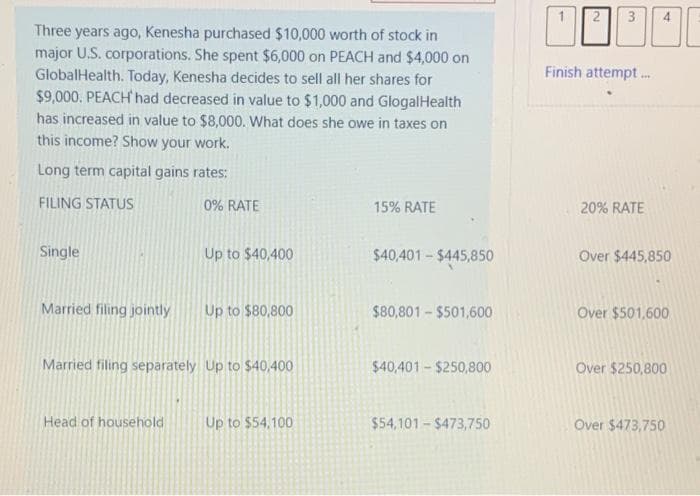

Three years ago, Kenesha purchased $10,000 worth of stock in major U.S. corporations. She spent $6000 on PEACH and $4,000 on GlobalHealth. Today, Kenesha decides to sell all her shares for $9,000. PEACH had decreased in value to $1,000 and GlogalHealth has increased in value to $8,000. What does she owe in taxes on this income? Show your work.

Chapter13: Property Transactions: Determination Of Gain Or Loss, Basis Considerations, And Nonta Xable Exchanges

Section: Chapter Questions

Problem 2DQ

Related questions

Question

4

Transcribed Image Text:4

Three years ago, Kenesha purchased $10,000 worth of stock in

major U.S. corporations. She spent $6,000 on PEACH and $4,000 on

GlobalHealth. Today, Kenesha decides to sell all her shares for

$9,000. PEACH had decreased in value to $1,000 and GlogalHealth

has increased in value to $8,000. What does she owe in taxes on

this income? Show your work.

Finish attempt..

Long term capital gains rates:

FILING STATUS

0% RATE

15% RATE

20% RATE

Single

Up to $40,400

$40,401-$445,850

Over $445,850

Married filing jointly

Up to $80,800

$80,801 - $501,600

Over $501,600

Married filing separately Up to $40,400

$40,401-$250,800

Over $250,800

Head of household

Up to $54,100

$54,101 - $473,750

Over $473,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT