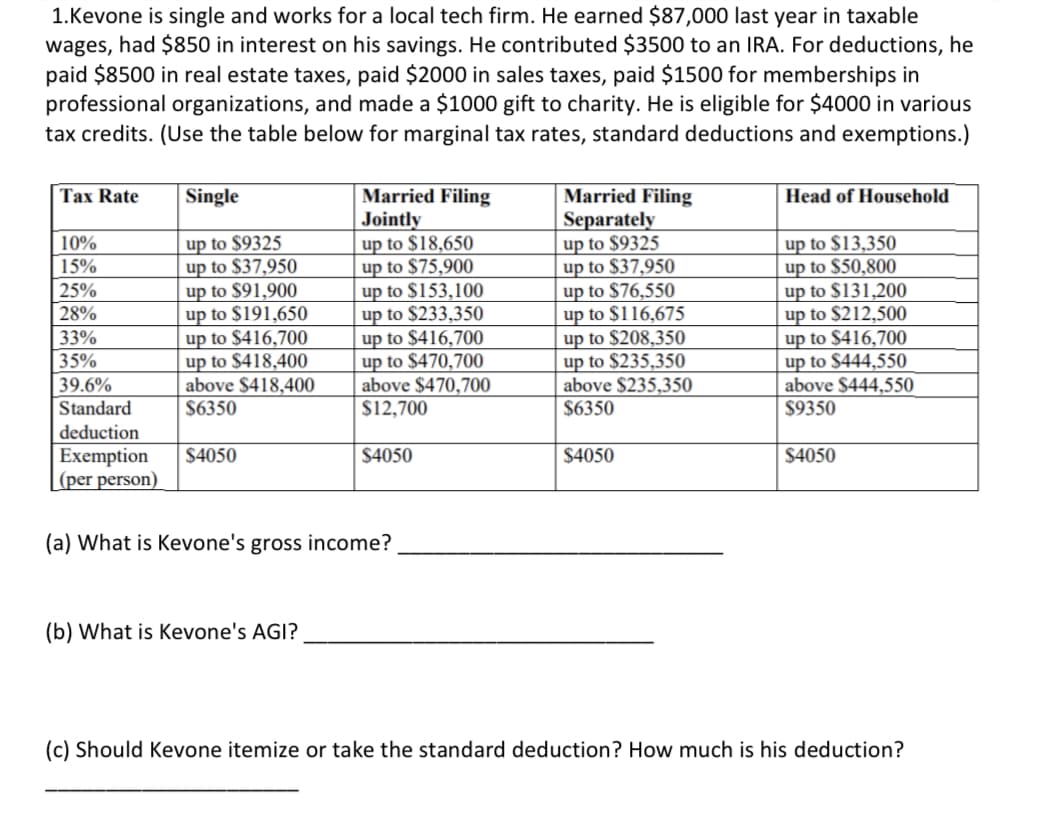

1.Kevone is single and works for a local tech firm. He earned $87,000 last year in taxable wages, had $850 in interest on his savings. He contributed $3500 to an IRA. For deductions, he paid $8500 in real estate taxes, paid $2000 in sales taxes, paid $1500 for memberships in professional organizations, and made a $1000 gift to charity. He is eligible for $4000 in various tax credits. (Use the table below for marginal tax rates, standard deductions and exemptions.) Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Single up to $9325 up to $37.950 up to $91,900 up to $191,650 up to $416,700 up to $418,400 above $418,400 $6350 $4050 Married Filing Jointly (b) What is Kevone's AGI? up to $18,650 up to $75,900 up to $153,100 up to $233,350 up to $416,700 up to $470,700 above $470,700 $12,700 $4050 (a) What is Kevone's gross income? Married Filing Separately up to $9325 up to $37.950 up to $76,550 up to $116,675 up to $208,350 up to $235,350 above $235,350 $6350 $4050 Head of Household up to $13,350 up to $50,800 up to $131,200 up to $212,500 up to $416,700 up to $444,550 above $444,550 $9350 $4050 (c) Should Kevone itemize or take the standard deduction? How much is his deduction?

1.Kevone is single and works for a local tech firm. He earned $87,000 last year in taxable wages, had $850 in interest on his savings. He contributed $3500 to an IRA. For deductions, he paid $8500 in real estate taxes, paid $2000 in sales taxes, paid $1500 for memberships in professional organizations, and made a $1000 gift to charity. He is eligible for $4000 in various tax credits. (Use the table below for marginal tax rates, standard deductions and exemptions.) Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Single up to $9325 up to $37.950 up to $91,900 up to $191,650 up to $416,700 up to $418,400 above $418,400 $6350 $4050 Married Filing Jointly (b) What is Kevone's AGI? up to $18,650 up to $75,900 up to $153,100 up to $233,350 up to $416,700 up to $470,700 above $470,700 $12,700 $4050 (a) What is Kevone's gross income? Married Filing Separately up to $9325 up to $37.950 up to $76,550 up to $116,675 up to $208,350 up to $235,350 above $235,350 $6350 $4050 Head of Household up to $13,350 up to $50,800 up to $131,200 up to $212,500 up to $416,700 up to $444,550 above $444,550 $9350 $4050 (c) Should Kevone itemize or take the standard deduction? How much is his deduction?

Chapter3: Income Sources

Section: Chapter Questions

Problem 51P

Related questions

Question

Transcribed Image Text:1.Kevone is single and works for a local tech firm. He earned $87,000 last year in taxable

wages, had $850 in interest on his savings. He contributed $3500 to an IRA. For deductions, he

paid $8500 in real estate taxes, paid $2000 in sales taxes, paid $1500 for memberships in

professional organizations, and made a $1000 gift to charity. He is eligible for $4000 in various

tax credits. (Use the table below for marginal tax rates, standard deductions and exemptions.)

Tax Rate

Single

up to $9325

up to $37,950

up to $91,900

up to $191,650

up to $416,700

up to $418,400

above $418,400

$6350

10%

15%

25%

28%

33%

35%

39.6%

Standard

deduction

Exemption $4050

(per person)

Married Filing

Jointly

up to $18,650

up to $75,900

up to $153,100

up to $233,350

up to $416,700

up to $470,700

above $470,700

$12,700

(b) What is Kevone's AGI?

$4050

(a) What is Kevone's gross income?

Married Filing

Separately

up to $9325

up to $37,950

up to $76,550

up to $116,675

up to $208,350

up to $235,350

above $235,350

$6350

$4050

Head of Household

up to $13,350

up to $50,800

up to $131,200

up to $212,500

up to $416,700

up to $444,550

above $444,550

$9350

$4050

(c) Should Kevone itemize or take the standard deduction? How much is his deduction?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT