Three years ago, you purchased an year bond issued by Thrumbauer Inc. for At that time the bond had a BBB credit rating. Year Expected Payments to Bond Owner The yield on an 8 year Treasury note at that time was (1) What interest rate (%/year) did this bond yield when you purchased it? $2,335.00 $2,335.00 $2,335.00 2.65% (1) What is the risk premium on the 8 year Thrumbauer bonds? $43,255 $2,335.00 Year Expected Payments to Bond Owner $2,335.00 $2,335.00 43,255 $2,335.00 8 $2,335.00 $47,750.00 4 $2,335.00 $2,335.00 $2,335.00 $2,335.00 $2,335.00 $2,335.00 $47,750.00

Three years ago, you purchased an year bond issued by Thrumbauer Inc. for At that time the bond had a BBB credit rating. Year Expected Payments to Bond Owner The yield on an 8 year Treasury note at that time was (1) What interest rate (%/year) did this bond yield when you purchased it? $2,335.00 $2,335.00 $2,335.00 2.65% (1) What is the risk premium on the 8 year Thrumbauer bonds? $43,255 $2,335.00 Year Expected Payments to Bond Owner $2,335.00 $2,335.00 43,255 $2,335.00 8 $2,335.00 $47,750.00 4 $2,335.00 $2,335.00 $2,335.00 $2,335.00 $2,335.00 $2,335.00 $47,750.00

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 26P

Related questions

Question

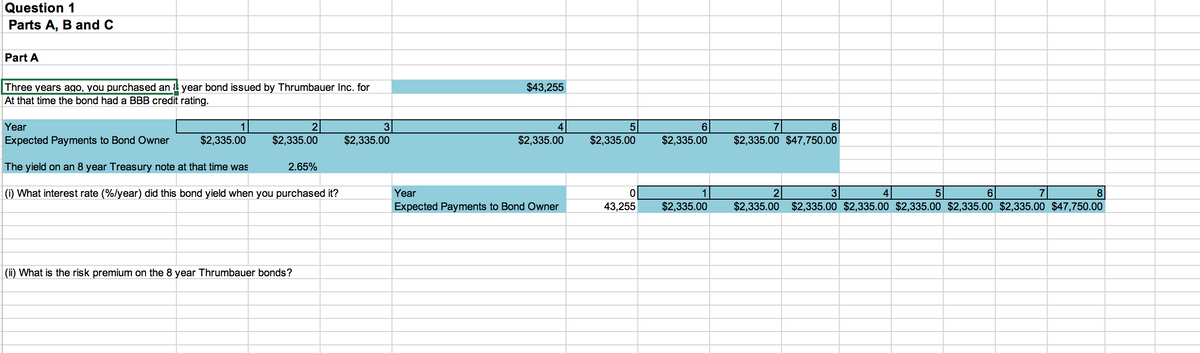

Transcribed Image Text:Question 1

Parts A, B and C

Part A

Three years ago, you purchased an year bond issued by Thrumbauer Inc. for

At that time the bond had a BBB credit rating.

Year

1

$2,335.00

Expected Payments to Bond Owner

The yield on an 8 year Treasury note at that time was

(i) What interest rate (%/year) did this bond yield when you purchased it?

2

$2,335.00

2.65%

(ii) What is the risk premium on the 8 year Thrumbauer bonds?

3

$2,335.00

$43,255

4

$2,335.00

Year

Expected Payments to Bond Owner

5

6

$2,335.00 $2,335.00

43,255

$2,335.00

7

8

$2,335.00 $47,750.00

2

3

4

5

6

7

8

$2,335.00 $2,335.00 $2,335.00 $2,335.00 $2,335.00 $2,335.00 $47,750.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

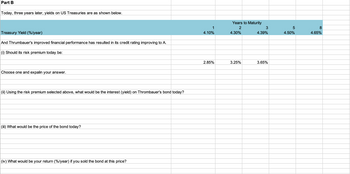

Transcribed Image Text:Part B

Today, three years later, yields on US Treasuries are as shown below.

Treasury Yield (%/year)

And Thrumbauer's improved financial performance has resulted in its credit rating improving to A.

(i) Should its risk premium today be:

Choose one and expalin your answer.

(ii) Using the risk premium selected above, what would be the interest (yield) on Thrombauer's bond today?

(iii) What would be the price of the bond today?

(iv) What would be your return (%/year) if you sold the bond at this price?

1

4.10%

2.85%

Years to Maturity

2

4.30%

3.25%

3

4.39%

3.65%

5

4.50%

8

4.65%

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning