three checks outstanding on October 31: no. 1417 for $110.00, no. 1420 for $144.35, and no. 1422 for $151.00. Check no. 1417 and no. 1422 were returned with the November bank statement; however, check no. 1420 was not returned. Check no. 1500 for $160.00, no. 1517 for $147.00, no. 1518 for $243.00, and no. 1519 for $146.15 were written during November and have not been returned by the bank. A deposit of $935 was placed in the night depository on November 30 and did not appear on the bank statement. The canceled checks were compared with the entries in the checkbook, and it was observed that check no. 1487, for $24, was written correctly, payable to M. A. Golden, the owner, for

three checks outstanding on October 31: no. 1417 for $110.00, no. 1420 for $144.35, and no. 1422 for $151.00. Check no. 1417 and no. 1422 were returned with the November bank statement; however, check no. 1420 was not returned. Check no. 1500 for $160.00, no. 1517 for $147.00, no. 1518 for $243.00, and no. 1519 for $146.15 were written during November and have not been returned by the bank. A deposit of $935 was placed in the night depository on November 30 and did not appear on the bank statement. The canceled checks were compared with the entries in the checkbook, and it was observed that check no. 1487, for $24, was written correctly, payable to M. A. Golden, the owner, for

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter6: Cash And Internal Control

Section: Chapter Questions

Problem 6.4E

Related questions

Question

Haas's Men's Shop deposits all receipts in the bank each evening and makes all payments by check. On November 30, its ledger balance of cash is $2,160.00. The bank statement balance of cash as of November 30 is $3,292.50. Use the following information to reconcile the bank statement:

- The reconciliation for October, the previous month, showed three checks outstanding on October 31: no. 1417 for $110.00, no. 1420 for $144.35, and no. 1422 for $151.00. Check no. 1417 and no. 1422 were returned with the November bank statement; however, check no. 1420 was not returned.

- Check no. 1500 for $160.00, no. 1517 for $147.00, no. 1518 for $243.00, and no. 1519 for $146.15 were written during November and have not been returned by the bank.

- A deposit of $935 was placed in the night depository on November 30 and did not appear on the bank statement.

- The canceled checks were compared with the entries in the checkbook, and it was observed that check no. 1487, for $24, was written correctly, payable to M. A. Golden, the owner, for personal use, but was recorded in the checkbook as $42.

- Included in the bank statement was a bank debit memo for service charges, $21.

- A bank credit memo was also enclosed for the collection of a note signed by C.G. Tolson, $1,230.00, including $1,200 principal and $30.00 interest.

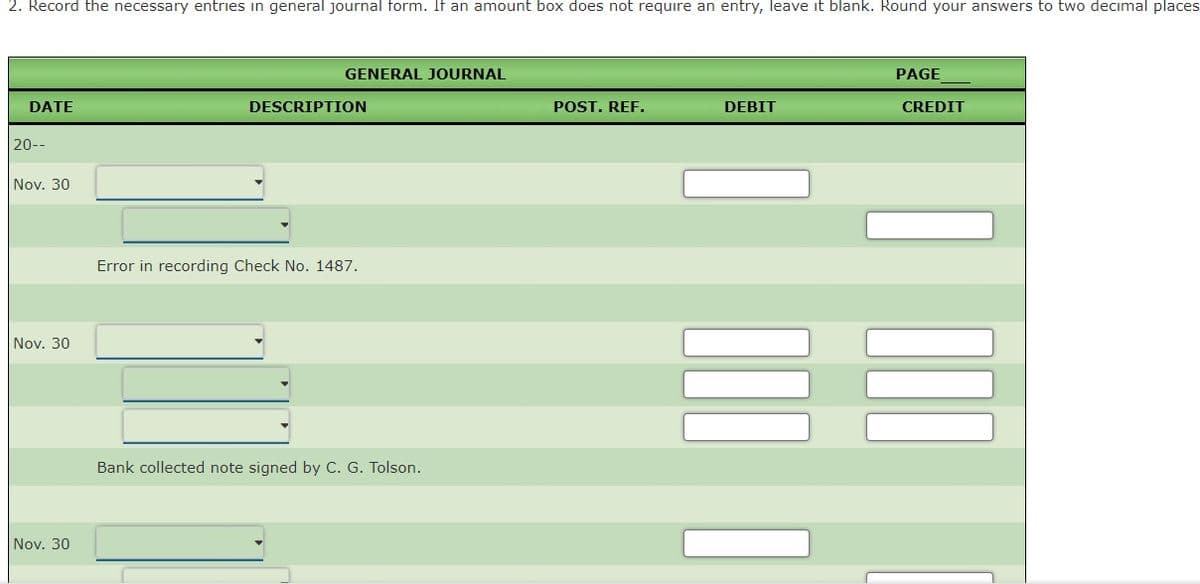

Transcribed Image Text:2. Record the necessary entries in general journal form. If an amount box does not require an entry, leave it blank. Round your answers to two decimal places

GENERAL JOURNAL

PAGE

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

20--

Nov. 30

Error in recording Check No. 1487.

Nov. 30

Bank collected note signed by C. G. Tolson.

Nov. 30

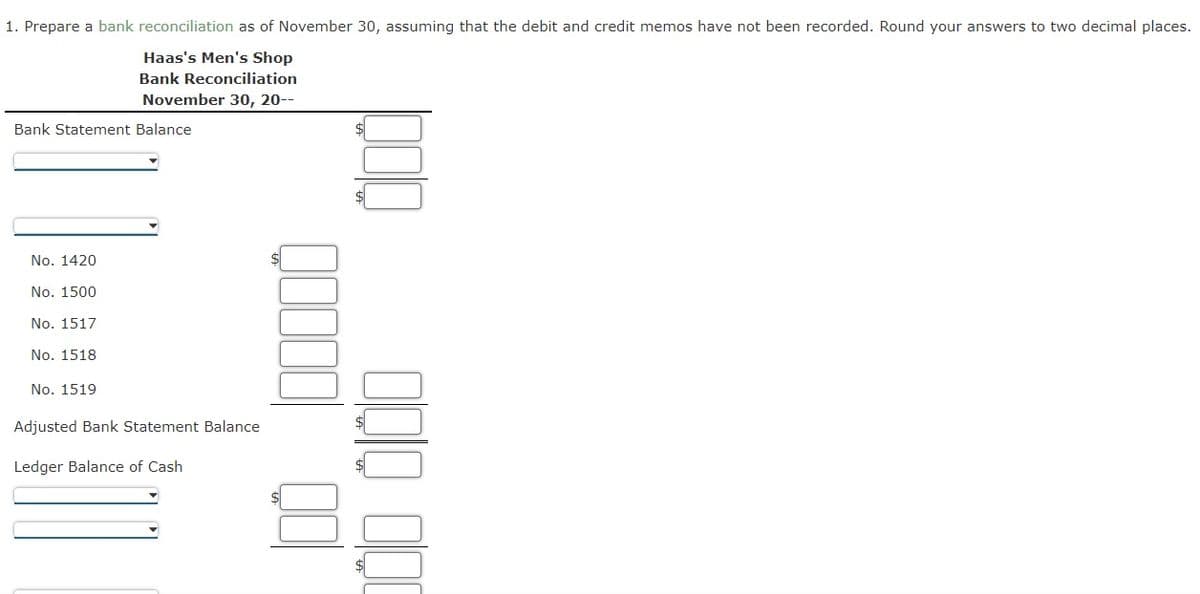

Transcribed Image Text:1. Prepare a bank reconciliation as of November 30, assuming that the debit and credit memos have not been recorded. Round your answers to two decimal places.

Haas's Men's Shop

Bank Reconciliation

November 30, 20--

Bank Statement Balance

No. 1420

No. 1500

No. 1517

No. 1518

No. 1519

Adjusted Bank Statement Balance

Ledger Balance of Cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,