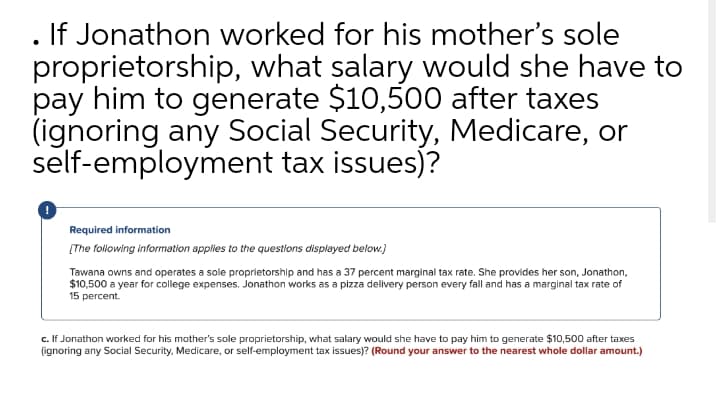

If Jonathon worked for his mother's sole proprietorship, what salary would she have to pay him to generate $10,500 after taxes (ignoring any Social Security, Medicare, or self-employment tax issues)? Required information [The following information applies to the questions displayed below.) Tawana owns and operates a sole proprietorship and has a 37 percent marginal tax rate. She provides her son, Jonathon, $10,500 a year for college expenses. Jonathon works as a pizza delivery person every fall and has a marginal tax rate of 15 percent. c. If Jonathon worked for his mother's sole proprietorship, what salary would she have to pay him to generate $10,500 after taxes (ignoring any Social Security, Medicare, or self-employment tax issues)? (Round your answer to the nearest whole dollar amount.)

If Jonathon worked for his mother's sole proprietorship, what salary would she have to pay him to generate $10,500 after taxes (ignoring any Social Security, Medicare, or self-employment tax issues)? Required information [The following information applies to the questions displayed below.) Tawana owns and operates a sole proprietorship and has a 37 percent marginal tax rate. She provides her son, Jonathon, $10,500 a year for college expenses. Jonathon works as a pizza delivery person every fall and has a marginal tax rate of 15 percent. c. If Jonathon worked for his mother's sole proprietorship, what salary would she have to pay him to generate $10,500 after taxes (ignoring any Social Security, Medicare, or self-employment tax issues)? (Round your answer to the nearest whole dollar amount.)

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 78TPC: Bonnie is married and has one child. She owns Bonnies Rib Joint, which produces a taxable income of...

Related questions

Question

Transcribed Image Text:If Jonathon worked for his mother's sole

proprietorship, what salary would she have to

pay him to generate $10,500 after taxes

(ignoring any Social Security, Medicare, or

self-employment tax issues)?

Required information

[The following information applies to the questions displayed below.)

Tawana owns and operates a sole proprietorship and has a 37 percent marginal tax rate. She provides her son, Jonathon,

$10,500 a year for college expenses. Jonathon works as a pizza delivery person every fall and has a marginal tax rate of

15 percent.

c. If Jonathon worked for his mother's sole proprietorship, what salary would she have to pay him to generate $10,500 after taxes

(ignoring any Social Security, Medicare, or self-employment tax issues)? (Round your answer to the nearest whole dollar amount.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT