tion of costs to the activity cost pools. Removing asbestos Estimating and Job Setup Working on Nonroutine Jobs Other Total < Reg 1 Req 2 >

tion of costs to the activity cost pools. Removing asbestos Estimating and Job Setup Working on Nonroutine Jobs Other Total < Reg 1 Req 2 >

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 1PB: Entries for costs in a job order cost system Royal Technology Company uses a job order cost system....

Related questions

Question

Transcribed Image Text:Req 1

Req 2

Req 3A to 3с

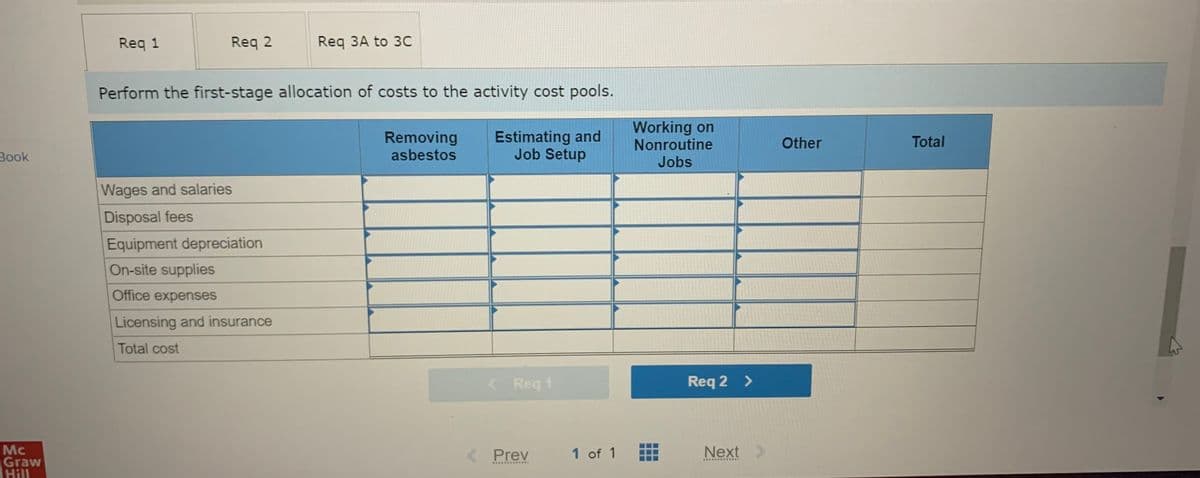

Perform the first-stage allocation of costs to the activity cost pools.

Removing

asbestos

Estimating and

Job Setup

Working on

Nonroutine

Jobs

Other

Total

Вook

Wages and salaries

Disposal fees

Equipment depreciation

On-site supplies

Office expenses

Licensing and insurance

Total cost

Req 1

Req 2 >

Mc

Graw

Hill

Prev

1 of 1

Next>

............

.............

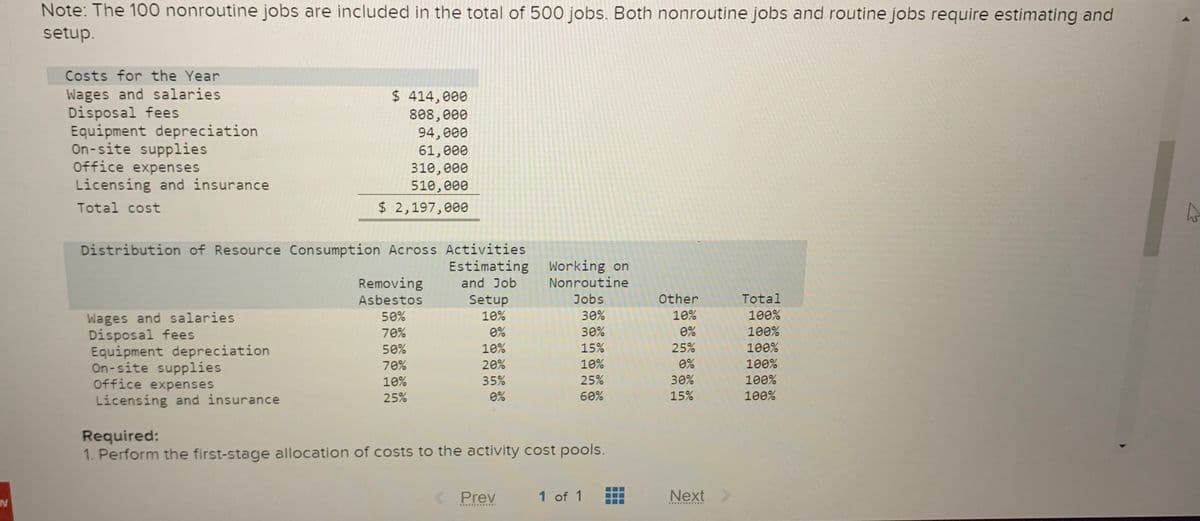

Transcribed Image Text:Note: The 100 nonroutine jobs are included in the total of 500 jobs. Both nonroutine jobs and routine jobs require estimating and

setup.

Costs for the Year

Wages and salaries

Disposal fees

Equipment depreciation

On-site supplies

Office expenses

Licensing and insurance

$ 414,000

808,000

94,000

61,000

310,000

510,000

$ 2,197,000

Total cost

Distribution of Resource Consumption Across Activities

Estimating

Removing and Job

Setup

10%

TTT11

Working on

Nonroutine

Total

Jobs

30%

Asbestos

Other

Wages and salaries

Disposal fees

Equipment depreciation

On-site supplies

Office expenses

Licensing and insurance

50%

10%

100%

70%

0%

30%

0%

100%

50%

10%

15%

25%

100%

70%

20%

10%

0%

100%

10%

35%

25%

30%

100%

25%

0%

60%

15%

100%

Required:

1. Perform the first-stage allocation of costs to the activity cost pools.

Prev

1 of 1

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning