to the accounts payable control le = ledger. unts Payable to prove the balance

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.11AMCP: Entries Prepared from a Trial Balance and Proof of the Cash Balance Russell Company was incorporated...

Related questions

Question

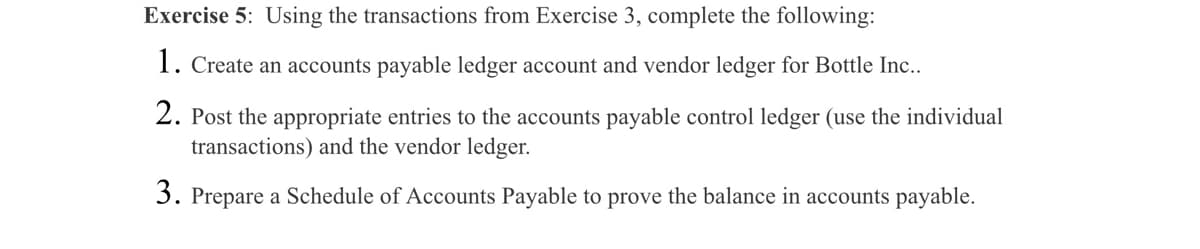

Transcribed Image Text:Exercise 5: Using the transactions from Exercise 3, complete the following:

1. Create an accounts payable ledger account and vendor ledger for Bottle Inc..

2. Post the appropriate entries to the accounts payable control ledger (use the individual

transactions) and the vendor ledger.

3. Prepare a Schedule of Accounts Payable to prove the balance in accounts payable.

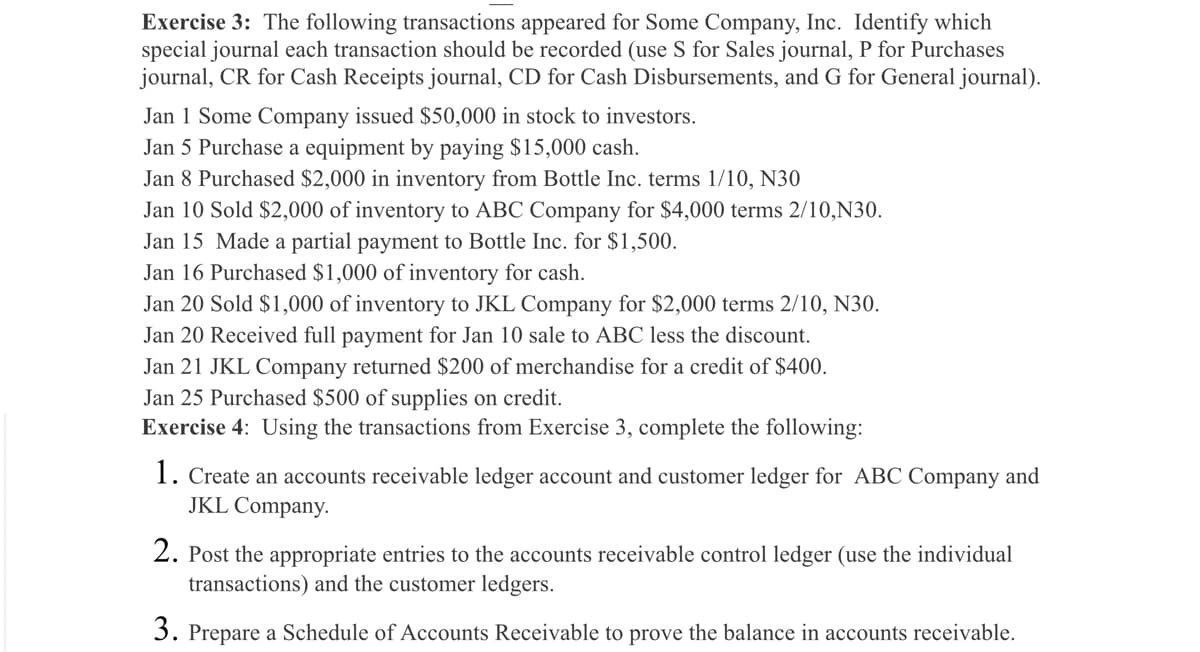

Transcribed Image Text:Exercise 3: The following transactions appeared for Some Company, Inc. Identify which

special journal each transaction should be recorded (use S for Sales journal, P for Purchases

journal, CR for Cash Receipts journal, CD for Cash Disbursements, and G for General journal).

Jan 1 Some Company issued $50,000 in stock to investors.

Jan 5 Purchase a equipment by paying $15,000 cash.

Jan 8 Purchased $2,000 in inventory from Bottle Inc. terms 1/10, N30

Jan 10 Sold $2,000 of inventory to ABC Company for $4,000 terms 2/10,N30.

Jan 15 Made a partial payment to Bottle Inc. for $1,500.

Jan 16 Purchased $1,000 of inventory for cash.

Jan 20 Sold $1,000 of inventory to JKL Company for $2,000 terms 2/10, N30.

Jan 20 Received full payment for Jan 10 sale to ABC less the discount.

Jan 21 JKL Company returned $200 of merchandise for a credit of $400.

Jan 25 Purchased $500 of supplies on credit.

Exercise 4: Using the transactions from Exercise 3, complete the following:

1. Create an accounts receivable ledger account and customer ledger for ABC Company and

JKL Company.

2. Post the appropriate entries to the accounts receivable control ledger (use the individual

transactions) and the customer ledgers.

3. Prepare a Schedule of Accounts Receivable to prove the balance in accounts receivable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,