Toast, a Belleville, Ontario, restaurant, began with investments by

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 32P

Related questions

Question

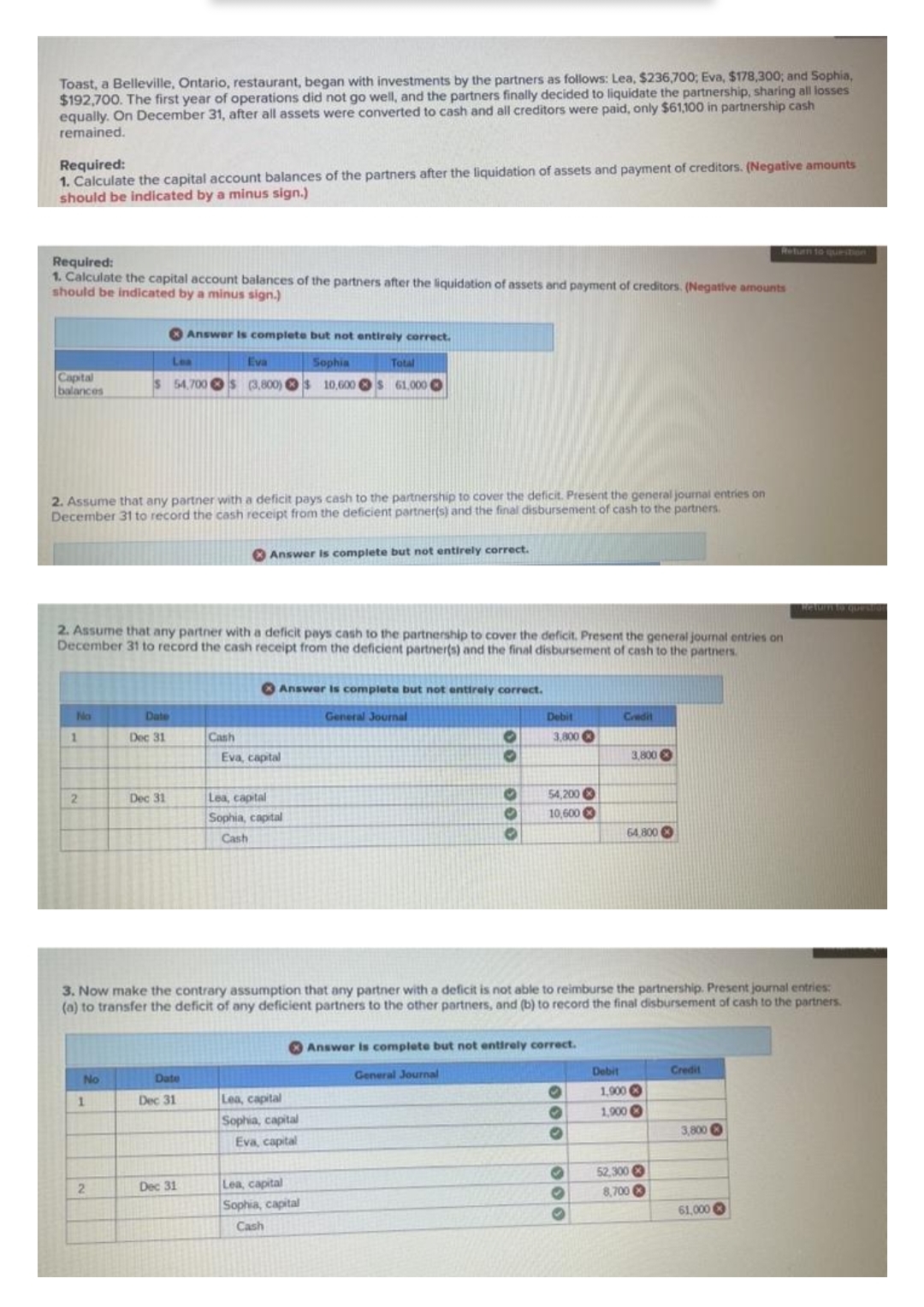

Transcribed Image Text:Toast, a Belleville, Ontario, restaurant, began with investments by the partners as follows: Lea, $236,700; Eva, $178,300; and Sophia,

$192,700. The first year of operations did not go well, and the partners finally decided to liquidate the partnership, sharing all losses

equally. On December 31, after all assets were converted to cash and all creditors were paid, only $61,100 in partnership cash

remained.

Required:

1. Calculate the capital account balances of the partners after the liquidation of assets and payment of creditors. (Negative amounts

should be indicated by a minus sign.)

Required:

1. Calculate the capital account balances of the partners after the liquidation of assets and payment of creditors. (Negative amounts

should be indicated by a minus sign.)

Capital

balances

2. Assume that any partner with a deficit pays cash to the partnership to cover the deficit. Present the general journal entries on

December 31 to record the cash receipt from the deficient partner(s) and the final disbursement of cash to the partners.

1

2

Answer is complete but not entirely correct.

Eva

Sophia

Total

S 54.700$ (3,800) $10,600S 61.000 0

2. Assume that any partner with a deficit pays cash to the partnership to cover the deficit. Present the general journal entries on

December 31 to record the cash receipt from the deficient partner(s) and the final disbursement of cash to the partners.

No

1

2

Date

Dec 31

Lea

Dec 31

Date

Dec

Answer is complete but not entirely correct.

Cash

Dec 31

Answer is complete but not entirely correct.

Eva, capital

Lea, capital

Sophia, capital

Cash

Lea, capital

Sophia, capital

Eva, capital

General Journal

Lea, capital

Sophia, capital

Cash

O

000

Debit

3,800

3. Now make the contrary assumption that any partner with a deficit is not able to reimburse the partnership. Present journal entries:

(a) to transfer the deficit of any deficient partners to the other partners, and (b) to record the final disbursement of cash to the partners.

54,200

10,600

Answer is complete but not entirely correct.

General Journal

000

O

♥

O

O

Credit

Debit

1,900

1.900

3,800

64,800

52,300

8,700

Return to question

Credit

3,800

61,000

Return to questo

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning