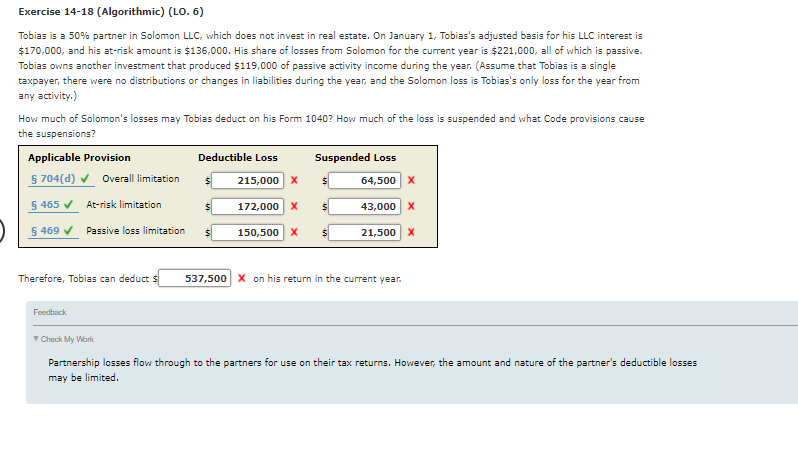

Tobias is a 50% partner in Solomon LLC, which does not invest in real estate. On January 1, Tobias's adjusted basis for his LLC interest is $170,000, and his at-risk amount is $136,000. His share of losses from Solomon for the current year is $221,000, all of which is passive. Tobias owns another investment that produced $119,000 of passive activity income during the year. (Assume that: Tobias is a single taxpayer, there were no distributions or changes in liabilities during the year, and the Solomon loss is Tobias's only loss for the year from any activity.) How much of Solomon's losses may Tobias deduct on his Form 1040? How much of the loss is suspended and what Code provisions cause the suspensions?

Tobias is a 50% partner in Solomon LLC, which does not invest in real estate. On January 1, Tobias's adjusted basis for his LLC interest is $170,000, and his at-risk amount is $136,000. His share of losses from Solomon for the current year is $221,000, all of which is passive. Tobias owns another investment that produced $119,000 of passive activity income during the year. (Assume that: Tobias is a single taxpayer, there were no distributions or changes in liabilities during the year, and the Solomon loss is Tobias's only loss for the year from any activity.) How much of Solomon's losses may Tobias deduct on his Form 1040? How much of the loss is suspended and what Code provisions cause the suspensions?

Chapter11: Investor Losses

Section: Chapter Questions

Problem 49P

Related questions

Question

100%

Please, look at image.

Transcribed Image Text:Exercise 14-18 (Algorithmic) (LO. 6)

Tobias is a 50% partner in Solomon LLC, which does not invest in real estate. On January 1, Tobias's adjusted basis for his LLC interest is

$170,000, and his at-risk amount is $136,000. His share of losses from Solomon for the current year is $221,000, all of which is passive.

Tobias owns another investment that produced $119,000 of passive activity income during the year. (Assume that Tobias is a single

taxpayer, there were no distributions or changes in liabilities during the year, and the Solomon loss is Tobias's only loss for the year from

any activity.)

How much of Solomon's losses may Tobias deduct on his Form 1040? How much of the loss is suspended and what Code provisions cause

the suspensions?

Applicable Provision

Deductible Los

Suspended Loss

5 704(d) v

Overall limitation

215,000 x

64,500 X

5 465 V

At-risk limitation

172,000 X

43,000 X

5 469 v

Passive loss limitation

150,500 X

21,500 X

Therefore, Tobias can deduct

537,500 X on his return in the current year.

Feedback

T Check My Wark

Partnership losses flow through to the partners for use on their tax returns. However, the amount and nature of the partner's deductible losses

may be limited.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT