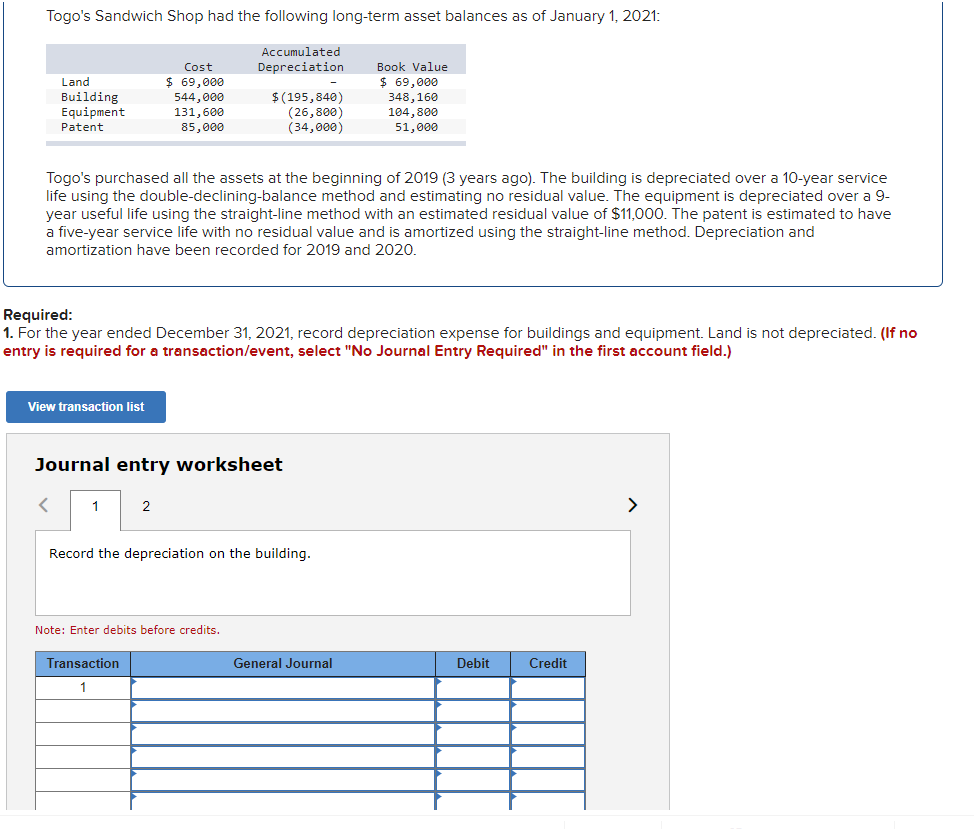

Togo's Sandwich Shop had the following long-term asset balances as of January 1, 2021: Accumulated Depreciation Cost $ 69,000 Land Building Equipment 544,000 131,600 85,000 $(195,840) (26,800) (34,000) Book Value $ 69,000 348,160 104,800 51,000 Patent Togo's purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 10-year service life using the double-declining-balance method and estimating no residual value. The equipment is depreciated over a 9- year useful life using the straight-line method with an estimated residual value of $11,000. The patent is estimated to have a five-year service life with no residual value and is amortized using the straight-line method. Depreciation and amortization have been recorded for 2019 and 2020. Required: 1. For the year ended December 31, 2021, record depreciation expense for buildings and equipment. Land is not depreciated. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

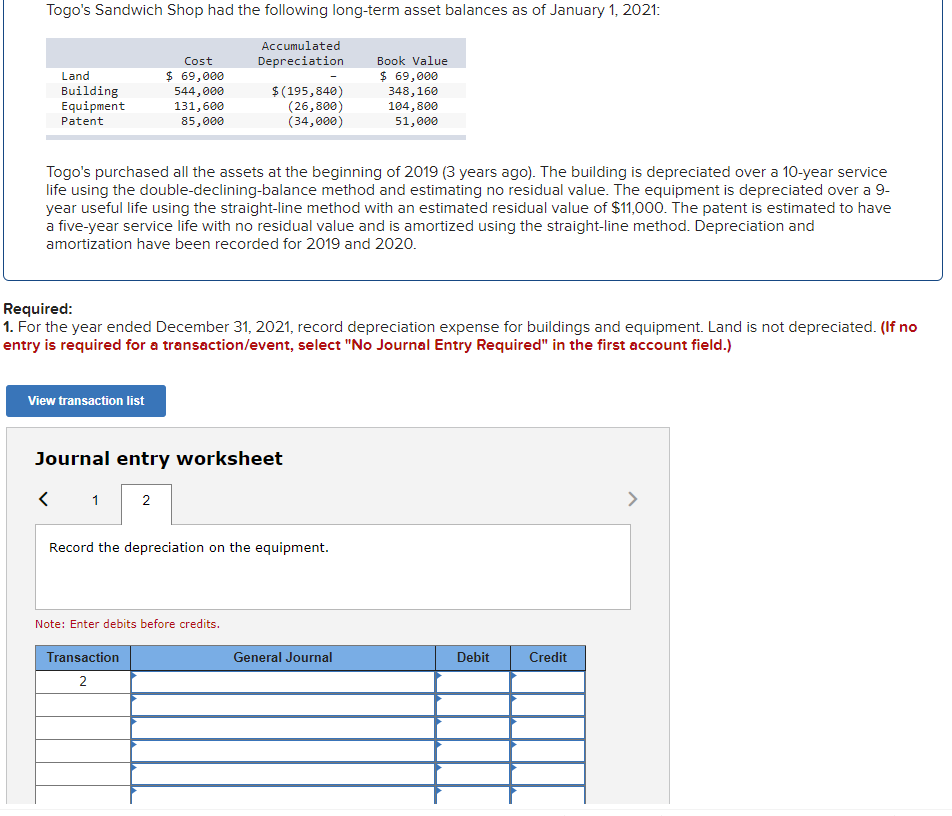

Togo's Sandwich Shop had the following long-term asset balances as of January 1, 2021: Accumulated Depreciation Cost $ 69,000 Land Building Equipment 544,000 131,600 85,000 $(195,840) (26,800) (34,000) Book Value $ 69,000 348,160 104,800 51,000 Patent Togo's purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 10-year service life using the double-declining-balance method and estimating no residual value. The equipment is depreciated over a 9- year useful life using the straight-line method with an estimated residual value of $11,000. The patent is estimated to have a five-year service life with no residual value and is amortized using the straight-line method. Depreciation and amortization have been recorded for 2019 and 2020. Required: 1. For the year ended December 31, 2021, record depreciation expense for buildings and equipment. Land is not depreciated. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 9P: During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the...

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

Transcribed Image Text:Togo's Sandwich Shop had the following long-term asset balances as of January 1, 2021:

Accumulated

Depreciation

Cost

Book Value

Land

$ 69,000

$ 69,000

Building

Equipment

544,000

131,600

85,000

$(195,840)

(26,800)

(34,000)

348,160

104,800

51,000

Patent

Togo's purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 10-year service

life using the double-declining-balance method and estimating no residual value. The equipment is depreciated over a 9-

year useful life using the straight-line method with an estimated residual value of $11,000. The patent is estimated to have

a five-year service life with no residual value and is amortized using the straight-line method. Depreciation and

amortization have been recorded for 2019 and 2020.

Required:

1. For the year ended December 31, 2021, record depreciation expense for buildings and equipment. Land is not depreciated. (If no

entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

1

2

>

Record the depreciation on the building.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Transcribed Image Text:Togo's Sandwich Shop had the following long-term asset balances as of January 1, 2021:

Accumulated

Cost

Depreciation

Book Value

$ 69,000

544,000

131,600

85,000

$ 69,000

348,160

104,800

Land

Building

Equipment

$(195,840)

(26,800)

(34,000)

Patent

51,000

Togo's purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 10-year service

life using the double-declining-balance method and estimating no residual value. The equipment is depreciated over a 9-

year useful life using the straight-line method with an estimated residual value of $11,000. The patent is estimated to have

a five-year service life with no residual value and is amortized using the straight-line method. Depreciation and

amortization have been recorded for 2019 and 2020.

Required:

1. For the year ended December 31, 2021, record depreciation expense for buildings and equipment. Land is not depreciated. (If no

entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

2

Record the depreciation on the equipment.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College