Total Effect Current Current on Net Assets Ratio Income a. Cash is acquired through issuance of additional common stock. b. Merchandise is sold for cash. C. Federal income tax due for the previous year is paid. d. A fixed asset is sold for less than book value. e. A fixed asset is sold for more than book value. f. Merchandise is sold on credit. g. Payment is made to trade creditors for previous purchases. h. A cash dividend is declared and paid. i. Cash is obtained through short-term bank loans. j. Short-term notes receivable are sold at a discount. k. Marketable securities are sold below cost. I. Advances are made to employees. m. Current operating expenses are paid. Short-term promissory notes are issued to trade creditors in exchange for past due accounts payable. n. 10-year notes are issued to pay off accounts payable. O. A fully depreciated asset is retired. p. q. Accounts receivable are collected. r. Equipment is purchased with short-term notes. S. Merchandise is purchased on credit. t. The estimated taxes payable are increased.

Total Effect Current Current on Net Assets Ratio Income a. Cash is acquired through issuance of additional common stock. b. Merchandise is sold for cash. C. Federal income tax due for the previous year is paid. d. A fixed asset is sold for less than book value. e. A fixed asset is sold for more than book value. f. Merchandise is sold on credit. g. Payment is made to trade creditors for previous purchases. h. A cash dividend is declared and paid. i. Cash is obtained through short-term bank loans. j. Short-term notes receivable are sold at a discount. k. Marketable securities are sold below cost. I. Advances are made to employees. m. Current operating expenses are paid. Short-term promissory notes are issued to trade creditors in exchange for past due accounts payable. n. 10-year notes are issued to pay off accounts payable. O. A fully depreciated asset is retired. p. q. Accounts receivable are collected. r. Equipment is purchased with short-term notes. S. Merchandise is purchased on credit. t. The estimated taxes payable are increased.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 4E

Related questions

Question

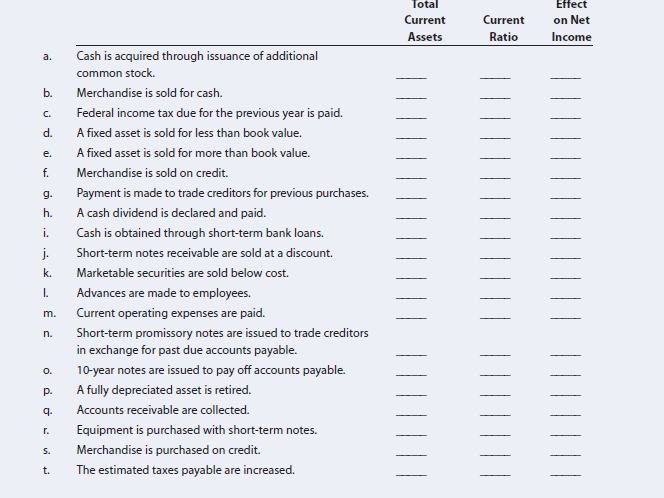

Indicate the effects of the transactions listed in the following table on total current assets,

and (0) to indicate either no effect or an indeterminate effect. Be prepared to state any

necessary assumptions and assume an initial current ratio of more than 1.0. (Note: A good

accounting background is necessary to answer some of these questions; if yours is not

strong, answer the questions you can.)

Transcribed Image Text:Total

Effect

Current

Current

on Net

Assets

Ratio

Income

a.

Cash is acquired through issuance of additional

common stock.

b.

Merchandise is sold for cash.

C.

Federal income tax due for the previous year is paid.

d.

A fixed asset is sold for less than book value.

e.

A fixed asset is sold for more than book value.

f.

Merchandise is sold on credit.

g.

Payment is made to trade creditors for previous purchases.

h.

A cash dividend is declared and paid.

i.

Cash is obtained through short-term bank loans.

j.

Short-term notes receivable are sold at a discount.

k.

Marketable securities are sold below cost.

I.

Advances are made to employees.

m.

Current operating expenses are paid.

Short-term promissory notes are issued to trade creditors

in exchange for past due accounts payable.

n.

10-year notes are issued to pay off accounts payable.

O.

A fully depreciated asset is retired.

p.

q.

Accounts receivable are collected.

r.

Equipment is purchased with short-term notes.

S.

Merchandise is purchased on credit.

t.

The estimated taxes payable are increased.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning