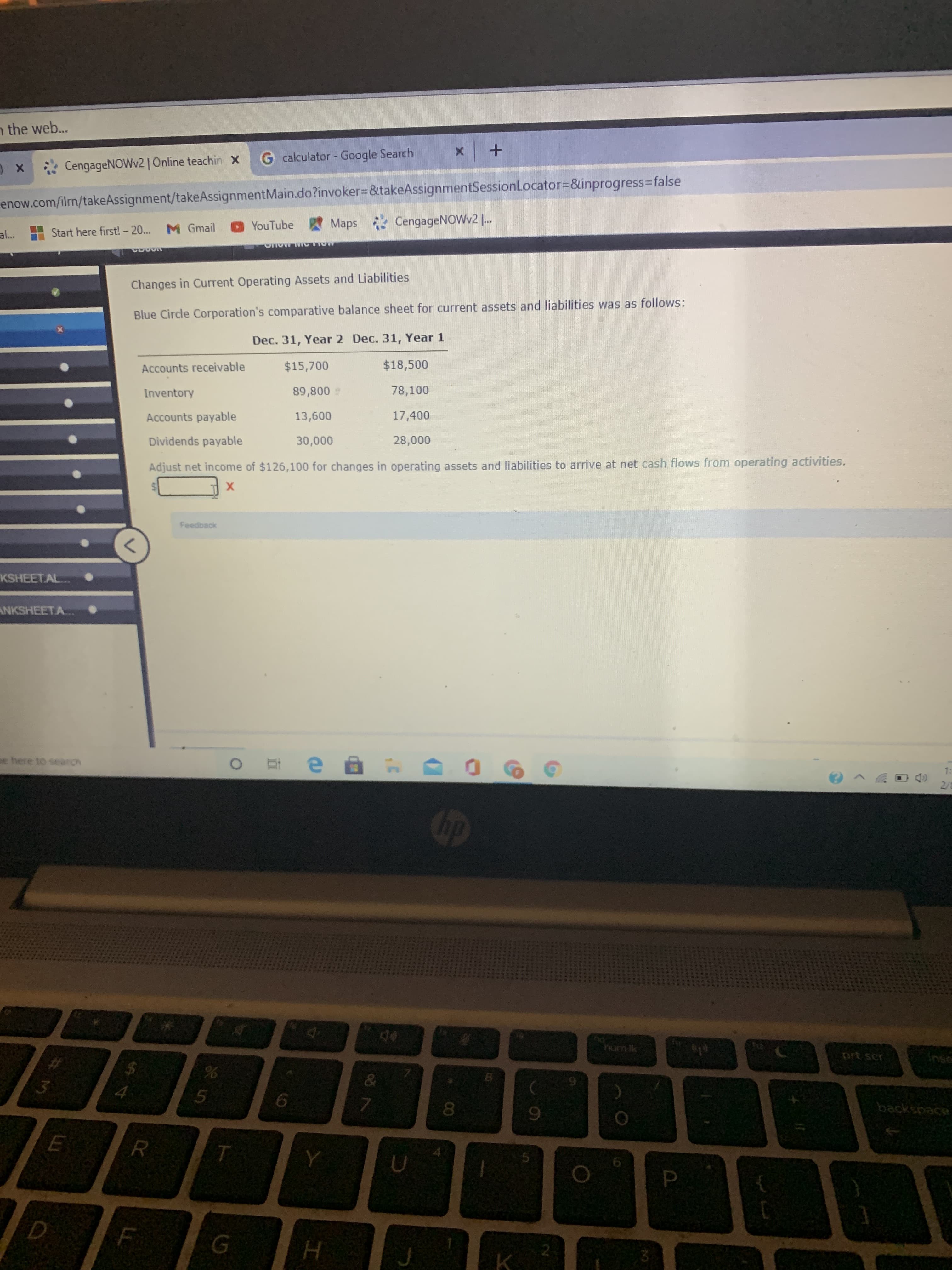

Changes in Current Operating Assets and Liabilities Blue Cirde Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, Year 2 Dec. 31, Year 1 Accounts receivable $15,700 $18,500 Inventory 89,800 78,100 Accounts payable 13,600 17,400 Dividends payable 30,000 28,000 Adjust net income of $126,100 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.

Changes in Current Operating Assets and Liabilities Blue Cirde Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, Year 2 Dec. 31, Year 1 Accounts receivable $15,700 $18,500 Inventory 89,800 78,100 Accounts payable 13,600 17,400 Dividends payable 30,000 28,000 Adjust net income of $126,100 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.3BE

Related questions

Question

Transcribed Image Text:Changes in Current Operating Assets and Liabilities

Blue Cirde Corporation's comparative balance sheet for current assets and liabilities was as follows:

Dec. 31, Year 2 Dec. 31, Year 1

Accounts receivable

$15,700

$18,500

Inventory

89,800

78,100

Accounts payable

13,600

17,400

Dividends payable

30,000

28,000

Adjust net income of $126,100 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.

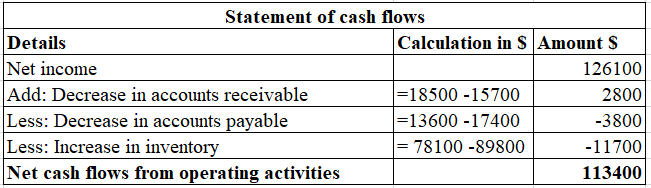

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning