Total Liabilities - Php 9,000,000.0 ncome Statement Sales - Php 20,000,000.00

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 55E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

Transcribed Image Text:Nos. 8 to

following financial information:

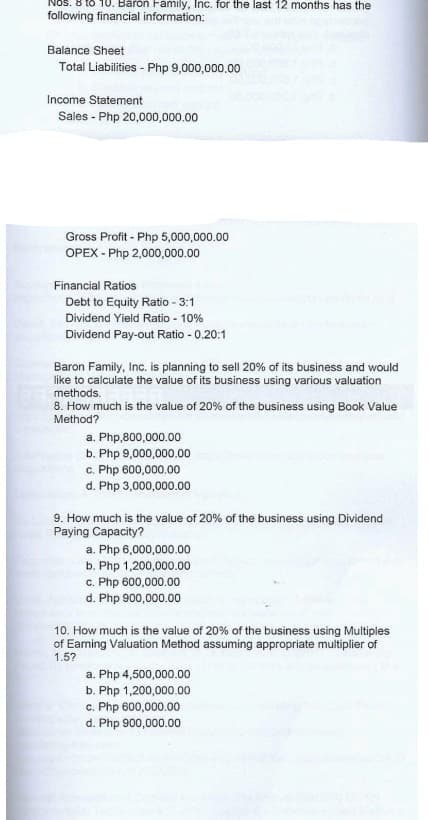

Baron Family, Inc. for the last 12 months has the

Balance Sheet

Total Liabilities - Php 9,000,000.00

Income Statement

Sales - Php 20,000,000.00

Gross Profit - Php 5,000,000.00

OPEX - Php 2,000,000.00

Financial Ratios

Debt to Equity Ratio - 3:1

Dividend Yield Ratio - 10%

Dividend Pay-out Ratio - 0.20:1

Baron Family, Inc. is planning to sell 20% of its business and would

like to calculate the value of its business using various valuation

methods.

8. How much is the value of 20% of the business using Book Value

Method?

a. Php,800,000.00

b. Php 9,000,000.00

c. Php 600,000.00

d. Php 3,000,000.00

9. How much is the value of 20% of the business using Dividend

Paying Capacity?

a. Php 6,000,000.00

b. Php 1,200,000.00

c. Php 600,000.00

d. Php 900,000.00

10. How much is the value of 20% of the business using Multiples

of Eaming Valuation Method assuming appropriate multiplier of

1.5?

a. Php 4,500,000.00

b. Php 1,200,000.00

c. Php 600,000.00

d. Php 900,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT