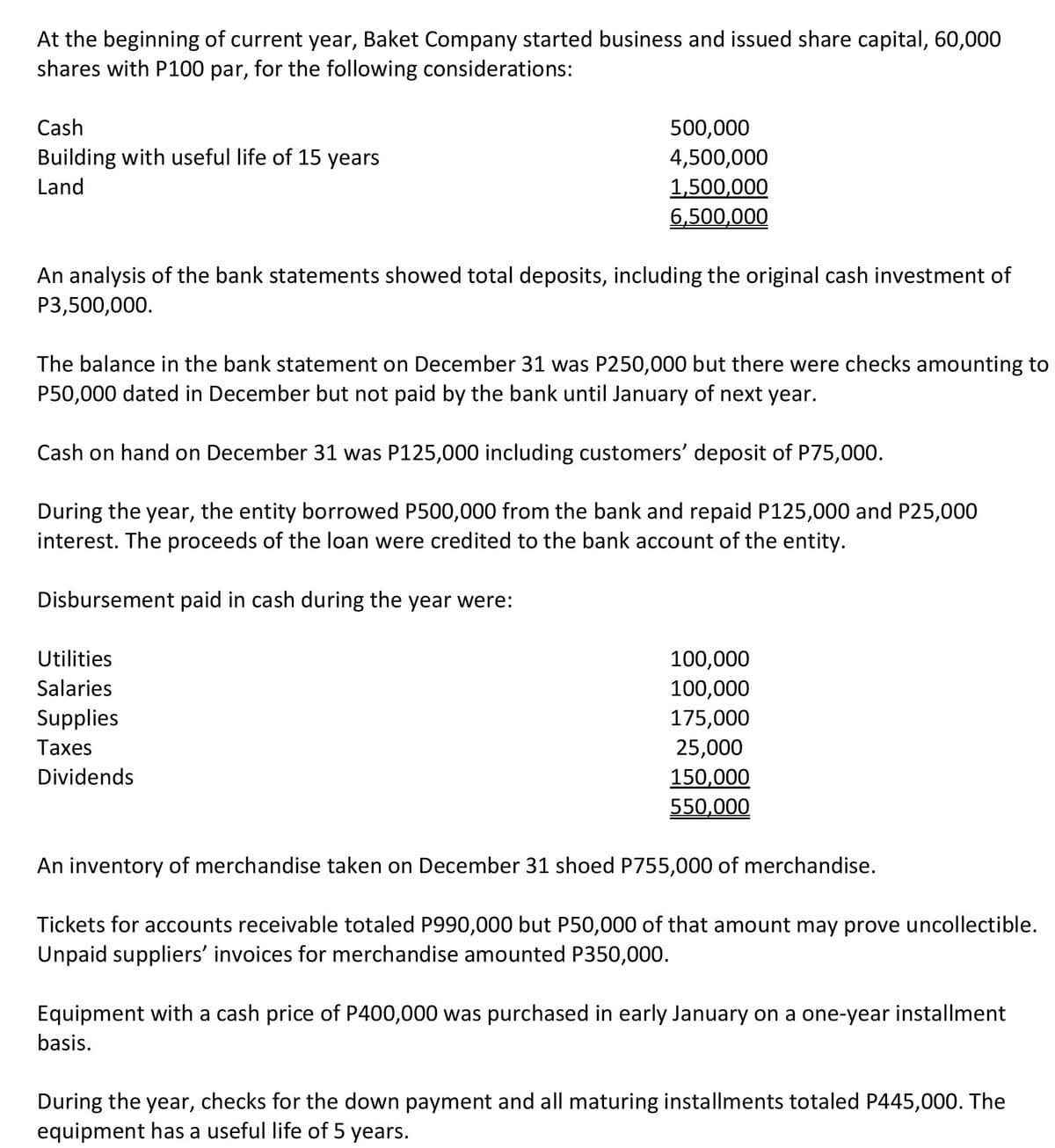

At the beginning of current year, Baket Company started business and issued share capital, 60,000 shares with P100 par, for the following considerations: Cash 500,000 4,500,000 Building with useful life of 15 years 1,500,000 6,500,000 Land An analysis of the bank statements showed total deposits, including the original cash investment of P3,500,000. The balance in the bank statement on December 31 was P250,000 but there were checks amounting P50,000 dated in December but not paid by the bank until January of next year. Cash on hand on December 31 was P125,000 including customers' deposit of P75,000. During the year, the entity borrowed P500,000 from the bank and repaid P125,000 and P25,000 interest. The proceeds of the loan were credited to the bank account of the entity. Disbursement paid in cash during the year were: 100,000 100,000 175,000 Utilities Salaries Supplies Taxes 25,000 Dividends 150,000 550,000 An inventory of merchandise taken on December 31 shoed P755,000 of merchandise. Tickets for accounts receivable totaled P990,000 but P50,000 of that amount may prove uncollectible Unpaid suppliers' invoices for merchandise amounted P350,000. Equipment with a cash price of P400,000 was purchased in early January on a one-year installment basis. During the year, checks for the down payment and all maturing installments totaled P445,000. The equipment has a useful life of 5 vears.

At the beginning of current year, Baket Company started business and issued share capital, 60,000 shares with P100 par, for the following considerations: Cash 500,000 4,500,000 Building with useful life of 15 years 1,500,000 6,500,000 Land An analysis of the bank statements showed total deposits, including the original cash investment of P3,500,000. The balance in the bank statement on December 31 was P250,000 but there were checks amounting P50,000 dated in December but not paid by the bank until January of next year. Cash on hand on December 31 was P125,000 including customers' deposit of P75,000. During the year, the entity borrowed P500,000 from the bank and repaid P125,000 and P25,000 interest. The proceeds of the loan were credited to the bank account of the entity. Disbursement paid in cash during the year were: 100,000 100,000 175,000 Utilities Salaries Supplies Taxes 25,000 Dividends 150,000 550,000 An inventory of merchandise taken on December 31 shoed P755,000 of merchandise. Tickets for accounts receivable totaled P990,000 but P50,000 of that amount may prove uncollectible Unpaid suppliers' invoices for merchandise amounted P350,000. Equipment with a cash price of P400,000 was purchased in early January on a one-year installment basis. During the year, checks for the down payment and all maturing installments totaled P445,000. The equipment has a useful life of 5 vears.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 32BEB: During 20X2, Evans Company had the following transactions: a. Cash dividends of 6,000 were paid. b....

Related questions

Topic Video

Question

1. What is the amount of sales for the year?

2. What is the amount of purchases for the year?

3. What is the net income for the year?

5. What is the amount of shareholders' equity on December 31?

Transcribed Image Text:At the beginning of current year, Baket Company started business and issued share capital, 60,000

shares with P100 par, for the following considerations:

Cash

500,000

Building with useful life of 15 years

4,500,000

Land

1,500,000

6,500,000

An analysis of the bank statements showed total deposits, including the original cash investment of

P3,500,000.

The balance in the bank statement on December 31 was P250,000 but there were checks amounting to

P50,000 dated in December but not paid by the bank until January of next year.

Cash on hand on December 31 was P125,000 including customers' deposit of P75,000.

During the year, the entity borrowed P500,000 from the bank and repaid P125,000 and P25,000

interest. The proceeds of the loan were credited to the bank account of the entity.

Disbursement paid in cash during the year were:

Utilities

100,000

Salaries

100,000

Supplies

175,000

Таxes

25,000

Dividends

150,000

550,000

An inventory of merchandise taken on December 31 shoed P755,000 of merchandise.

Tickets for accounts receivable totaled P990,000 but P50,000 of that amount may prove uncollectible.

Unpaid suppliers' invoices for merchandise amounted P350,000.

Equipment with a cash price of P400,000 was purchased in early January on a one-year installment

basis.

During the year, checks for the down payment and all maturing installments totaled P445,000. The

equipment has a useful life of 5 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning