tout below are the financial statements of Emma, a limited liability company. ATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED 31 DECEMBER 20X2 les revenue st of sales oss profit stribution costs ministrative expenses nance costs fit before tax

tout below are the financial statements of Emma, a limited liability company. ATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED 31 DECEMBER 20X2 les revenue st of sales oss profit stribution costs ministrative expenses nance costs fit before tax

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 46E: OBJECTIVE 6 Exercise 1-46 Income Statement ERS Inc. maintains and repairs office equipment. ERS had...

Related questions

Question

please help me to solve this problem

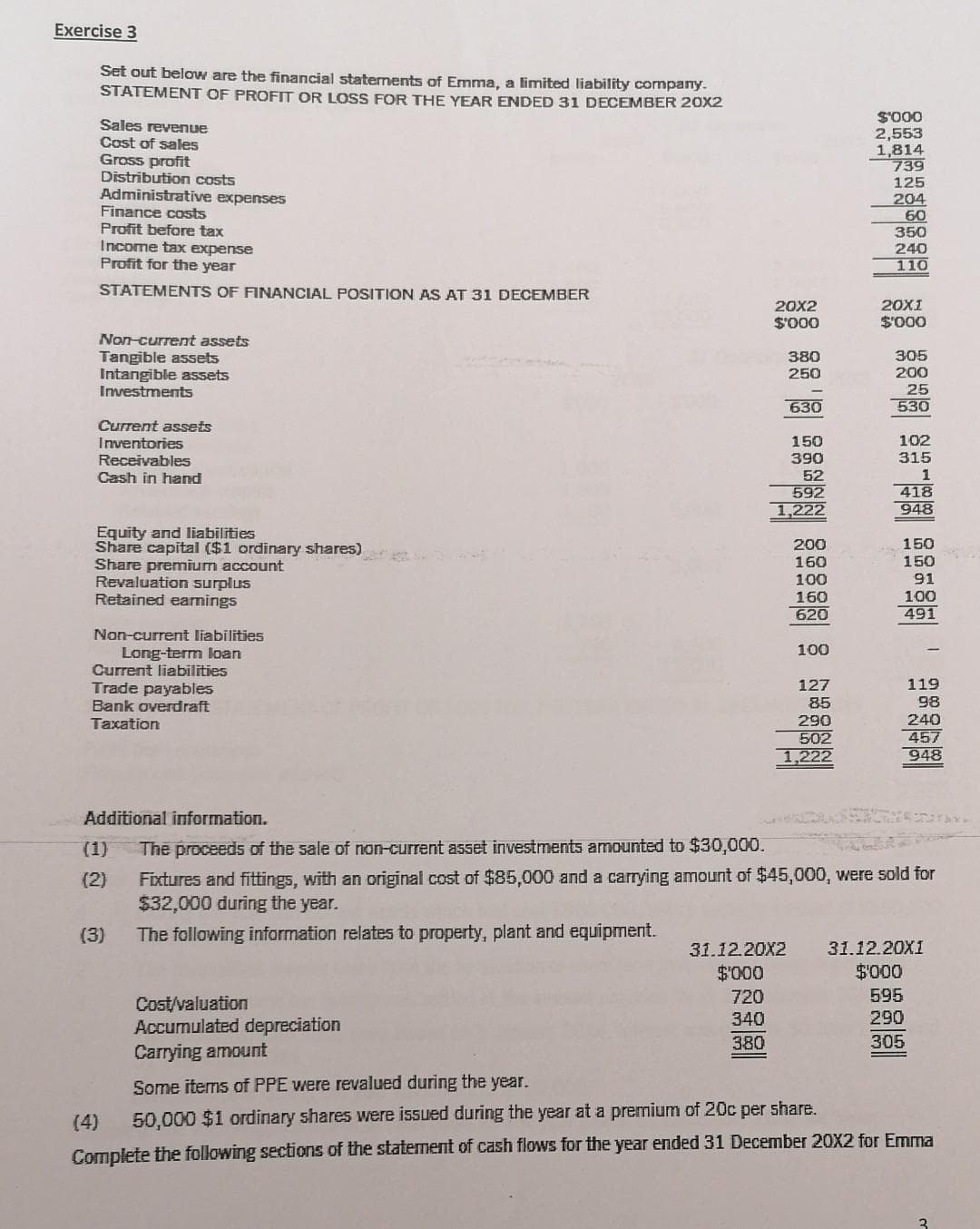

Transcribed Image Text:Exercise 3

Set out below are the financial statements of Emma, a limited liability company.

STATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED 31 DECEMBER 20X2

Sales revenue

Cost of sales

Gross profit

Distribution costs

Administrative expenses

Finance costs

Profit before tax

Income tax expense

Profit for the year

STATEMENTS OF FINANCIAL POSITION AS AT 31 DECEMBER

Non-current assets

Tangible assets

Intangible assets

Investments

Current assets

Inventories

Receivables

Cash in hand

Equity and liabilities

Share capital ($1 ordinary shares)

Share premium account

Revaluation surplus

Retained earnings

Non-current liabilities

Long-term loan

Current liabilities

Trade payables

Bank overdraft

Taxation

(3)

20X2

$'000

Cost/valuation

Accumulated depreciation

Carrying amount

380

250

630

150

390

52

592

1,222

200

160

100

160

620

100

127

85

290

502

1,222

Additional information.

(1) The proceeds of the sale of non-current asset investments amounted to $30,000.

(2)

Fixtures and fittings, with an original cost of $85,000 and a carrying amount of $45,000, were sold for

$32,000 during the year.

The following information relates to property, plant and equipment.

********** *888*8 02-88| 88586| ' 98393|

31.12.20X2 31.12.20X1

$'000

$'000

720

595

340

290

380

305

Some items of PPE were revalued during the year.

(4) 50,000 $1 ordinary shares were issued during the year at a premium of 20c per share.

Complete the following sections of the statement of cash flows for the year ended 31 December 20X2 for Emma

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning