TPW, a calendar year taxpayer, sold land with a $535,000 tax basis for $750,000 in February. The purchaser paid $75,000 cash at closing and gave TPW an interest-bearing note for the $675,000 remaining price. In August, TPW received a $55,950 payment from the purchaser consisting of a $33,750 principal payment and a $22,200 interest payment. * I only need Requirement C (box 2) to be solved. Required: c. Compute gain recognized in the year of sale if TPW uses the installment sale method of accounting. Compute TPW’s tax basis in the note at the end of the year.

TPW, a calendar year taxpayer, sold land with a $535,000 tax basis for $750,000 in February. The purchaser paid $75,000 cash at closing and gave TPW an interest-bearing note for the $675,000 remaining price. In August, TPW received a $55,950 payment from the purchaser consisting of a $33,750 principal payment and a $22,200 interest payment. * I only need Requirement C (box 2) to be solved. Required: c. Compute gain recognized in the year of sale if TPW uses the installment sale method of accounting. Compute TPW’s tax basis in the note at the end of the year.

Chapter11: Invest Or Losses

Section: Chapter Questions

Problem 64P

Related questions

Question

100%

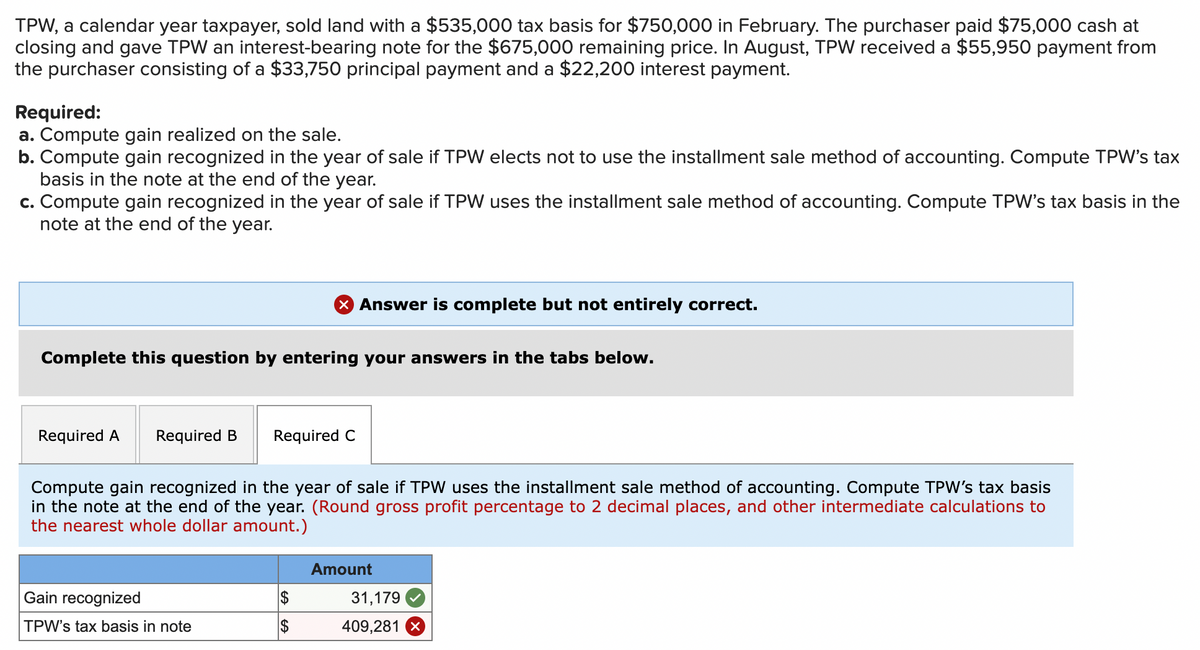

TPW, a calendar year taxpayer, sold land with a $535,000 tax basis for $750,000 in February. The purchaser paid $75,000 cash at closing and gave TPW an interest-bearing note for the $675,000 remaining price. In August, TPW received a $55,950 payment from the purchaser consisting of a $33,750 principal payment and a $22,200 interest payment.

* I only need Requirement C (box 2) to be solved.

Required:

c. Compute gain recognized in the year of sale if TPW uses the installment sale method of accounting. Compute TPW’s tax basis in the note at the end of the year.

Transcribed Image Text:TPW, a calendar year taxpayer, sold land with a $535,000 tax basis for $750,000 in February. The purchaser paid $75,000 cash at

closing and gave TPW an interest-bearing note for the $675,000 remaining price. In August, TPW received a $55,950 payment from

the purchaser consisting of a $33,750 principal payment and a $22,200 interest payment.

Required:

a. Compute gain realized on the sale.

b. Compute gain recognized in the year of sale if TPW elects not to use the installment sale method of accounting. Compute TPW's tax

basis in the note at the end of the year.

c. Compute gain recognized in the year of sale if TPW uses the installment sale method of accounting. Compute TPW's tax basis in the

note at the end of the year.

X Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Compute gain recognized in the year of sale if TPW uses the installment sale method of accounting. Compute TPW's tax basis

in the note at the end of the year. (Round gross profit percentage to 2 decimal places, and other intermediate calculations to

the nearest whole dollar amount.)

Amount

Gain recognized

$

TPW's tax basis in note

$

31,179

409,281 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you