Traded in old office equipment with book value of $55,000 (cost of $127,000 and accumulated depreciation of $72,000) for new equipment. Mora also paid $70,000 in cash. Fair value of new equipment is $133,000. Assume the exchange had commercial substance. Jan. 1 Apr. 1 Sold equipment that cost $18,000 (accumulated depreciation of $8,000 through December 31 of the preceding year). Mora received $6, 100 cash from the sale of the equipment. Depreciation is computed on a straight- line basis. The equipment has a five-year useful life and a residual value of $0. Dec. 31 Recorded depreciation as follows: Office equipment is depreciated using the double-declining-balance method over four years with a $9,000 residual value.

Traded in old office equipment with book value of $55,000 (cost of $127,000 and accumulated depreciation of $72,000) for new equipment. Mora also paid $70,000 in cash. Fair value of new equipment is $133,000. Assume the exchange had commercial substance. Jan. 1 Apr. 1 Sold equipment that cost $18,000 (accumulated depreciation of $8,000 through December 31 of the preceding year). Mora received $6, 100 cash from the sale of the equipment. Depreciation is computed on a straight- line basis. The equipment has a five-year useful life and a residual value of $0. Dec. 31 Recorded depreciation as follows: Office equipment is depreciated using the double-declining-balance method over four years with a $9,000 residual value.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 3RE: Albany Corporation purchased equipment at the beginning of Year 1 for 75,000. The asset does not...

Related questions

Question

100%

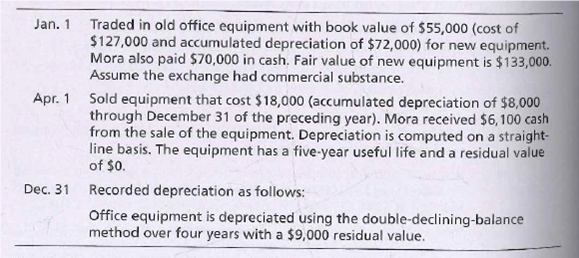

Journalizing partial-year

During 2018, Mora Corporation completed the following transactions:

Record the transactions in the journal of Mora Corporation.

Transcribed Image Text:Traded in old office equipment with book value of $55,000 (cost of

$127,000 and accumulated depreciation of $72,000) for new equipment.

Mora also paid $70,000 in cash. Fair value of new equipment is $133,000.

Assume the exchange had commercial substance.

Jan. 1

Apr. 1 Sold equipment that cost $18,000 (accumulated depreciation of $8,000

through December 31 of the preceding year). Mora received $6, 100 cash

from the sale of the equipment. Depreciation is computed on a straight-

line basis. The equipment has a five-year useful life and a residual value

of $0.

Dec. 31 Recorded depreciation as follows:

Office equipment is depreciated using the double-declining-balance

method over four years with a $9,000 residual value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning