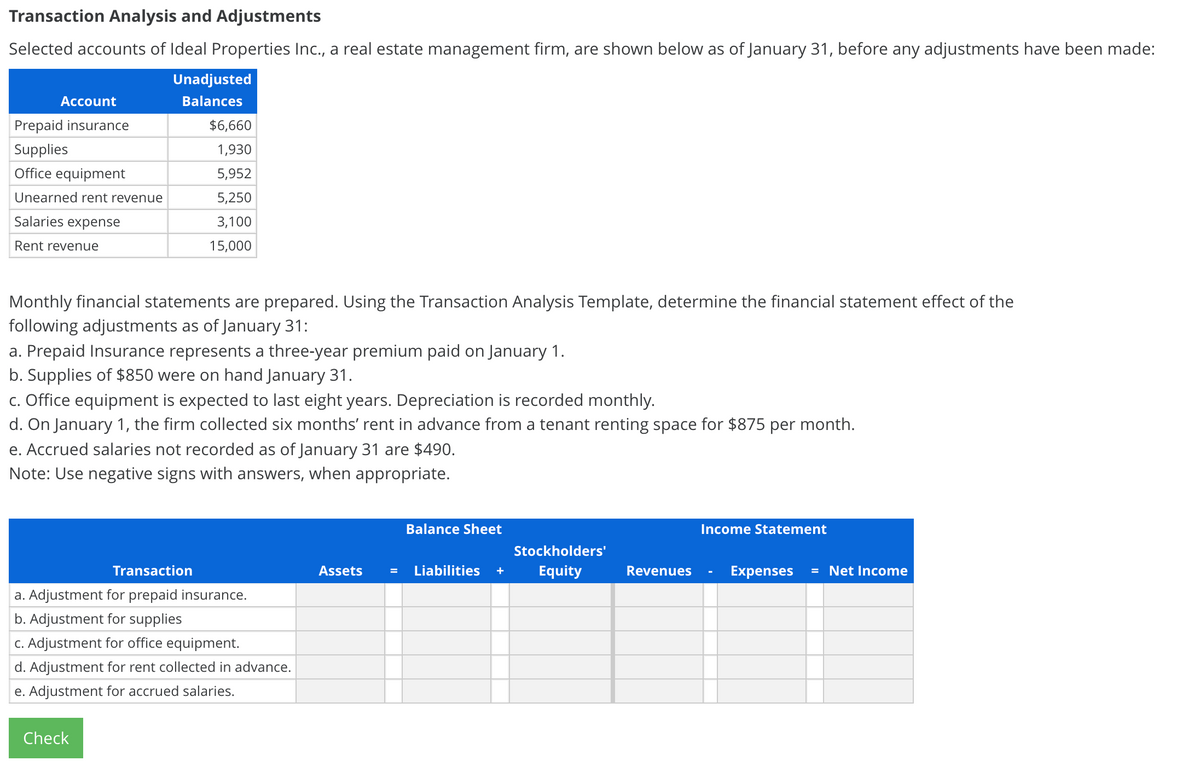

Transaction Analysis and Adjustments Selected accounts of Ideal Properties Inc., a real estate management firm, are shown below as of January 31, before any adjustments have been made: Unadjusted Account Balances Prepaid insurance $6,660 Supplies 1,930 Office equipment 5,952 Unearned rent revenue 5,250 Salaries expense 3,100 Rent revenue 15,000 Monthly financial statements are prepared. Using the Transaction Analysis Template, determine the financial statement effect of the following adjustments as of January 31: a. Prepaid Insurance represents a three-year premium paid on January 1. b. Supplies of $850 were on hand January 31. c. Office equipment is expected to last eight years. Depreciation is recorded monthly. d. On January 1, the firm collected six months' rent in advance from a tenant renting space for $875 per month. e. Accrued salaries not recorded as of January 31 are $490. Note: Use negative signs with answers, when appropriate. Balance Sheet Income Statement Stockholders' Transaction Assets Liabilities Equity Expenses = Net Income Revenues a. Adjustment for prepaid insurance. b. Adjustment for supplies C. Adjustment for office equipment. d. Adjustment for rent collected in advance. e. Adjustment for accrued salaries.

Transaction Analysis and Adjustments Selected accounts of Ideal Properties Inc., a real estate management firm, are shown below as of January 31, before any adjustments have been made: Unadjusted Account Balances Prepaid insurance $6,660 Supplies 1,930 Office equipment 5,952 Unearned rent revenue 5,250 Salaries expense 3,100 Rent revenue 15,000 Monthly financial statements are prepared. Using the Transaction Analysis Template, determine the financial statement effect of the following adjustments as of January 31: a. Prepaid Insurance represents a three-year premium paid on January 1. b. Supplies of $850 were on hand January 31. c. Office equipment is expected to last eight years. Depreciation is recorded monthly. d. On January 1, the firm collected six months' rent in advance from a tenant renting space for $875 per month. e. Accrued salaries not recorded as of January 31 are $490. Note: Use negative signs with answers, when appropriate. Balance Sheet Income Statement Stockholders' Transaction Assets Liabilities Equity Expenses = Net Income Revenues a. Adjustment for prepaid insurance. b. Adjustment for supplies C. Adjustment for office equipment. d. Adjustment for rent collected in advance. e. Adjustment for accrued salaries.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.6.1P: Adjustment process and financial statements Adjustment data for Ms. Ellen’s Laundry Inc. for the...

Related questions

Question

I'm having difficulty with this question, by getting the rest of the values from the given prices, as well as understanding where to place some of the prices.

Transcribed Image Text:Transaction Analysis and Adjustments

Selected accounts of Ideal Properties Inc., a real estate management firm, are shown below as of January 31, before any adjustments have been made:

Unadjusted

Асcount

Balances

Prepaid insurance

$6,660

Supplies

1,930

Office equipment

5,952

Unearned rent revenue

5,250

Salaries expense

3,100

Rent revenue

15,000

Monthly financial statements are prepared. Using the Transaction Analysis Template, determine the financial statement effect of the

following adjustments as of January 31:

a. Prepaid Insurance represents a three-year premium paid on January 1.

b. Supplies of $850 were on hand January 31.

c. Office equipment is expected to last eight years. Depreciation is recorded monthly.

d. On January 1, the firm collected six months' rent in advance from a tenant renting space for $875 per month.

e. Accrued salaries not recorded as of January 31 are $490.

Note: Use negative signs with answers, when appropriate.

Balance Sheet

Income Statement

Stockholders'

Transaction

Assets

Liabilities

Equity

Revenues

Expenses

= Net Income

+

a. Adjustment for prepaid insurance.

b. Adjustment for supplies

c. Adjustment for office equipment.

d. Adjustment for rent collected in advance.

e. Adjustment for accrued salaries.

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning