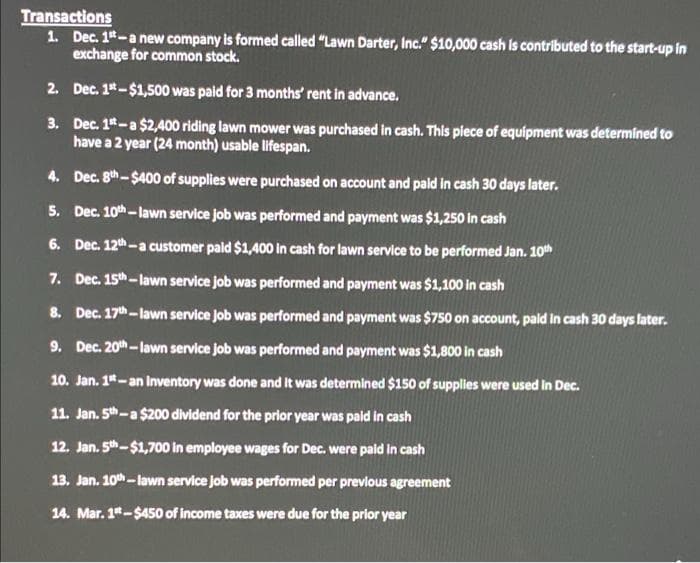

Transactions 1. Dec. 1"-a new company is formed called "Lawn Darter, Inc." $10,000 cash is contributed to the start-up In exchange for common stock. 2. Dec. 1-$1,500 was paid for 3 months' rent in advance. 3. Dec. 1"-a $2,400 riding lawn mower was purchased in cash. This plece of equipment was determined to have a 2 year (24 month) usable lifespan. 4. Dec. 8th-$400 of supplies were purchased on account and pald in cash 30 days later. 5. Dec. 10th - lawn service Job was performed and payment was $1,250 in cash 6. Dec. 12th-a customer pald $1,400 in cash for lawn service to be performed Jan. 10th 7. Dec. 15h -lawn service job was performed and payment was $1,100 in cash 8. Dec. 17th -lawn service Job was performed and payment was $750 on account, pald in cash 30 days later. 9. Dec. 20h -lawn service Job was performed and payment was $1,800 in cash 10. Jan. 14-an Inventory was done and It was determined $150 of supplies were used in Dec. 11. Jan. 5th-a $200 dividend for the prior year was pald in cash 12. Jan. 5th-$1,700 in employee wages for Dec. were pald in cash 13. Jan. 10th - lawn service Job was performed per prevlous agreement 14. Mar. 1"-$450 of income taxes were due for the prior year

Transactions 1. Dec. 1"-a new company is formed called "Lawn Darter, Inc." $10,000 cash is contributed to the start-up In exchange for common stock. 2. Dec. 1-$1,500 was paid for 3 months' rent in advance. 3. Dec. 1"-a $2,400 riding lawn mower was purchased in cash. This plece of equipment was determined to have a 2 year (24 month) usable lifespan. 4. Dec. 8th-$400 of supplies were purchased on account and pald in cash 30 days later. 5. Dec. 10th - lawn service Job was performed and payment was $1,250 in cash 6. Dec. 12th-a customer pald $1,400 in cash for lawn service to be performed Jan. 10th 7. Dec. 15h -lawn service job was performed and payment was $1,100 in cash 8. Dec. 17th -lawn service Job was performed and payment was $750 on account, pald in cash 30 days later. 9. Dec. 20h -lawn service Job was performed and payment was $1,800 in cash 10. Jan. 14-an Inventory was done and It was determined $150 of supplies were used in Dec. 11. Jan. 5th-a $200 dividend for the prior year was pald in cash 12. Jan. 5th-$1,700 in employee wages for Dec. were pald in cash 13. Jan. 10th - lawn service Job was performed per prevlous agreement 14. Mar. 1"-$450 of income taxes were due for the prior year

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Question

Q6: statement for

Note: do it on Excel please

Transcribed Image Text:Transactions

1. Dec. 1-a new company is formed called "Lawn Darter, Inc." $10,000 cash is contributed to the start-up in

exchange for common stock.

2. Dec. 1*-$1,500 was paid for 3 months' rent in advance.

3. Dec. 1*-a $2,400 riding lawn mower was purchased in cash. This piece of equipment was determined to

have a 2 year (24 month) usable lifespan.

4. Dec. 8th-$400 of supplies were purchased on account and paid in cash 30 days later.

5. Dec. 10th-lawn service job was performed and payment was $1,250 in cash

6. Dec. 12th-a customer paid $1,400 in cash for lawn service to be performed Jan. 10th

7. Dec. 15 - lawn service job was performed and payment was $1,100 in cash

8. Dec. 17th -lawn service Job was performed and payment was $750 on account, pald in cash 30 days later.

9. Dec. 20th - lawn service Job was performed and payment was $1,800 in cash

10. Jan. 14-an Inventory was done and It was determined $150 of supplies were used in Dec.

11. Jan. 5th-a $200 dividend for the prior year was paid in cash

12. Jan. 5th-$1,700 in employee wages for Dec. were pald in cash

13. Jan. 10th - lawn service Job was performed per prevlous agreement

14. Mar. 14-$450 of income taxes were due for the prior year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning