[The following information applies to the questions displayed below.] The following transactions pertain to Smith Training Company for Year 1: Jan. 30 Established the business when it acquired $52,000 cash from the issue of common stock. 1 Paid rent for office space for two years, $33,000 cash. Feb. Apr. 10 Purchased $830 of supplies on account. July 1 Received $21,500 cash in advance for services to be provided over the next year. 20 Paid $623 of the accounts payable from April 10. Aug. 15 Billed a customer $9,400 for services provided during August. Sept.15 Completed a job and received $2,700 cash for services rendered. 1 Paid employee salaries of $34,000 cash. 15 Received $9,100 cash from accounts receivable. Nov. 16 Billed customers $31,500 for services rendered on account. 1 Paid a dividend of $1,500 cash to the stockholders. 31 Adjusted records to recognize the services provided on the contract of July 1. 31 Recorded $2,150 of accrued salaries as of December 31. 31 Recorded the rent expense for the year. (See February 1.) 31 Physically counted supplies; $80 was on hand at the end of the period. Oct. Dec.

[The following information applies to the questions displayed below.] The following transactions pertain to Smith Training Company for Year 1: Jan. 30 Established the business when it acquired $52,000 cash from the issue of common stock. 1 Paid rent for office space for two years, $33,000 cash. Feb. Apr. 10 Purchased $830 of supplies on account. July 1 Received $21,500 cash in advance for services to be provided over the next year. 20 Paid $623 of the accounts payable from April 10. Aug. 15 Billed a customer $9,400 for services provided during August. Sept.15 Completed a job and received $2,700 cash for services rendered. 1 Paid employee salaries of $34,000 cash. 15 Received $9,100 cash from accounts receivable. Nov. 16 Billed customers $31,500 for services rendered on account. 1 Paid a dividend of $1,500 cash to the stockholders. 31 Adjusted records to recognize the services provided on the contract of July 1. 31 Recorded $2,150 of accrued salaries as of December 31. 31 Recorded the rent expense for the year. (See February 1.) 31 Physically counted supplies; $80 was on hand at the end of the period. Oct. Dec.

Chapter4: Operating Activities: Sales And Cash Receipts

Section: Chapter Questions

Problem 4.14C

Related questions

Question

Practice

![[The following information applies to the questions displayed below.]

The following transactions pertain to Smith Training Company for Year 1:

Jan. 30 Established the business when it acquired $52,000 cash from the issue of common stock.

Feb.

1 Paid rent for office space for two years, $33,000 cash.

Apr. 10 Purchased $830 of supplies on account.

July

1 Received $21,500 cash in advance for services to be provided over the next year.

20 Paid $623 of the accounts payable from April 10.

Aug. 15 Billed a customer $9,400 for services provided during August.

Sept.15 Completed a job and received $2,700 cash for services rendered.

1 Paid employee salaries of $34,000 cash.

15 Received $9,100 cash from accounts receivable.

Oct.

Nov. 16 Billed customers $31,500 for services rendered on account.

1 Paid a dividend of $1,500 cash to the stockholders.

31 Adjusted records to recognize the services provided on the contract of July 1.

31 Recorded $2,150 of accrued salaries as of December 31.

31 Recorded the rent expense for the year. (See February 1.)

31 Physically counted supplies; $80 was on hand at the end of the period.

Dec.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fdf9c49b9-ebc3-4254-9011-25d5959a8511%2F2f7fe7ba-626a-4804-9d68-d972e15b3bf4%2F4adctnv_processed.png&w=3840&q=75)

Transcribed Image Text:[The following information applies to the questions displayed below.]

The following transactions pertain to Smith Training Company for Year 1:

Jan. 30 Established the business when it acquired $52,000 cash from the issue of common stock.

Feb.

1 Paid rent for office space for two years, $33,000 cash.

Apr. 10 Purchased $830 of supplies on account.

July

1 Received $21,500 cash in advance for services to be provided over the next year.

20 Paid $623 of the accounts payable from April 10.

Aug. 15 Billed a customer $9,400 for services provided during August.

Sept.15 Completed a job and received $2,700 cash for services rendered.

1 Paid employee salaries of $34,000 cash.

15 Received $9,100 cash from accounts receivable.

Oct.

Nov. 16 Billed customers $31,500 for services rendered on account.

1 Paid a dividend of $1,500 cash to the stockholders.

31 Adjusted records to recognize the services provided on the contract of July 1.

31 Recorded $2,150 of accrued salaries as of December 31.

31 Recorded the rent expense for the year. (See February 1.)

31 Physically counted supplies; $80 was on hand at the end of the period.

Dec.

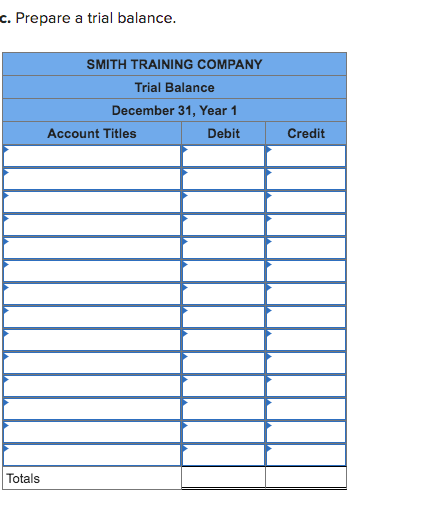

Transcribed Image Text:c. Prepare a trial balance.

SMITH TRAINING COMPANY

Trial Balance

December 31, Year 1

Account Titles

Debit

Credit

Totals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,