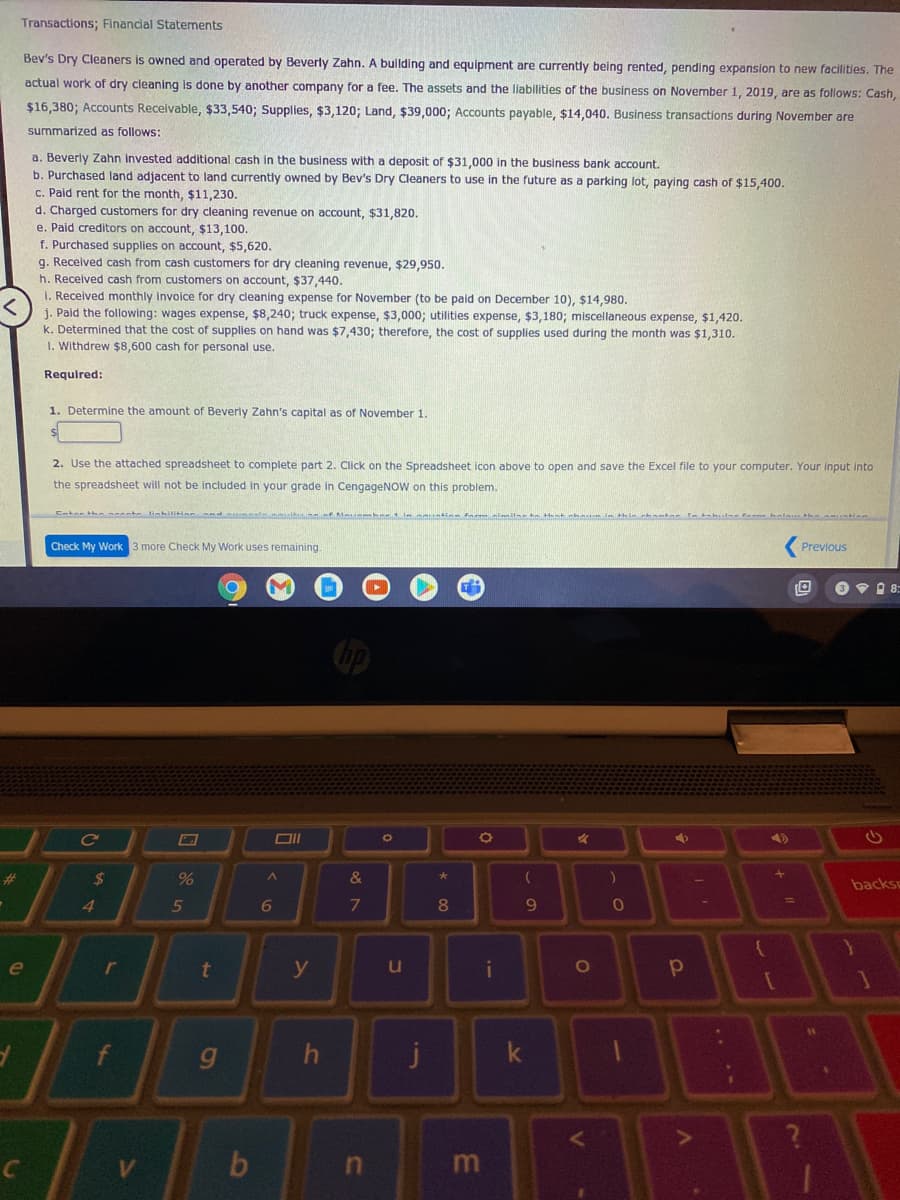

Transactions; Financial Statements Bev's Dry Cleaners is owned and operated by Beverly Zahn. A bullding and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company for a fee. The assets and the liabilities of the business on November 1, 2019, are as follows: Cash $16,380; Accounts Receivable, $33,540; Supplies, $3,120; Land, $39,000; Accounts payable, $14,040. Business transactions during November are summarized as follows: a. Beverly Zahn invested additional cash in the business with a deposit of $31,000 in the business bank account. b. Purchased land adjacent to land currently owned by Bev's Dry Cleaners to use in the future as a parking lot, paying cash of $15,400. c. Paid rent for the month, $11,230. d. Charged customers for dry cleaning revenue on account, $31,820. e. Paid creditors on account, $13,100. f. Purchased supplies on account, $5,620. g. Received cash from cash customers for dry cleaning revenue, $29,950. h. Received cash from customers on account, $37,440. I. Received monthly invoice for dry cleaning expense for November (to be paid on December 10), $14,980. j. Paid the following: wages expense, $8,240; truck expense, $3,000; utilities expense, $3,180; miscellaneous expense, $1,420. k. Determined that the cost of supplies on hand was $7,430; therefore, the cost of supplies used during the month was $1,310. I. Withdrew $8,600 cash for personal use. Required: 1. Determine the amount of Beverly Zahn's capital as of November 1. 2. Use the attached spreadsheet to complete part 2. Click on the Spreadsheet icon above to open and save the Excel file to your computer. Your input into the spreadsheet will not be included in your grade in CengageNOW on this problem.

Transactions; Financial Statements Bev's Dry Cleaners is owned and operated by Beverly Zahn. A bullding and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company for a fee. The assets and the liabilities of the business on November 1, 2019, are as follows: Cash $16,380; Accounts Receivable, $33,540; Supplies, $3,120; Land, $39,000; Accounts payable, $14,040. Business transactions during November are summarized as follows: a. Beverly Zahn invested additional cash in the business with a deposit of $31,000 in the business bank account. b. Purchased land adjacent to land currently owned by Bev's Dry Cleaners to use in the future as a parking lot, paying cash of $15,400. c. Paid rent for the month, $11,230. d. Charged customers for dry cleaning revenue on account, $31,820. e. Paid creditors on account, $13,100. f. Purchased supplies on account, $5,620. g. Received cash from cash customers for dry cleaning revenue, $29,950. h. Received cash from customers on account, $37,440. I. Received monthly invoice for dry cleaning expense for November (to be paid on December 10), $14,980. j. Paid the following: wages expense, $8,240; truck expense, $3,000; utilities expense, $3,180; miscellaneous expense, $1,420. k. Determined that the cost of supplies on hand was $7,430; therefore, the cost of supplies used during the month was $1,310. I. Withdrew $8,600 cash for personal use. Required: 1. Determine the amount of Beverly Zahn's capital as of November 1. 2. Use the attached spreadsheet to complete part 2. Click on the Spreadsheet icon above to open and save the Excel file to your computer. Your input into the spreadsheet will not be included in your grade in CengageNOW on this problem.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 10E: Spreadsheet The following 2019 information is available for Payne Company: Partial additional...

Related questions

Topic Video

Question

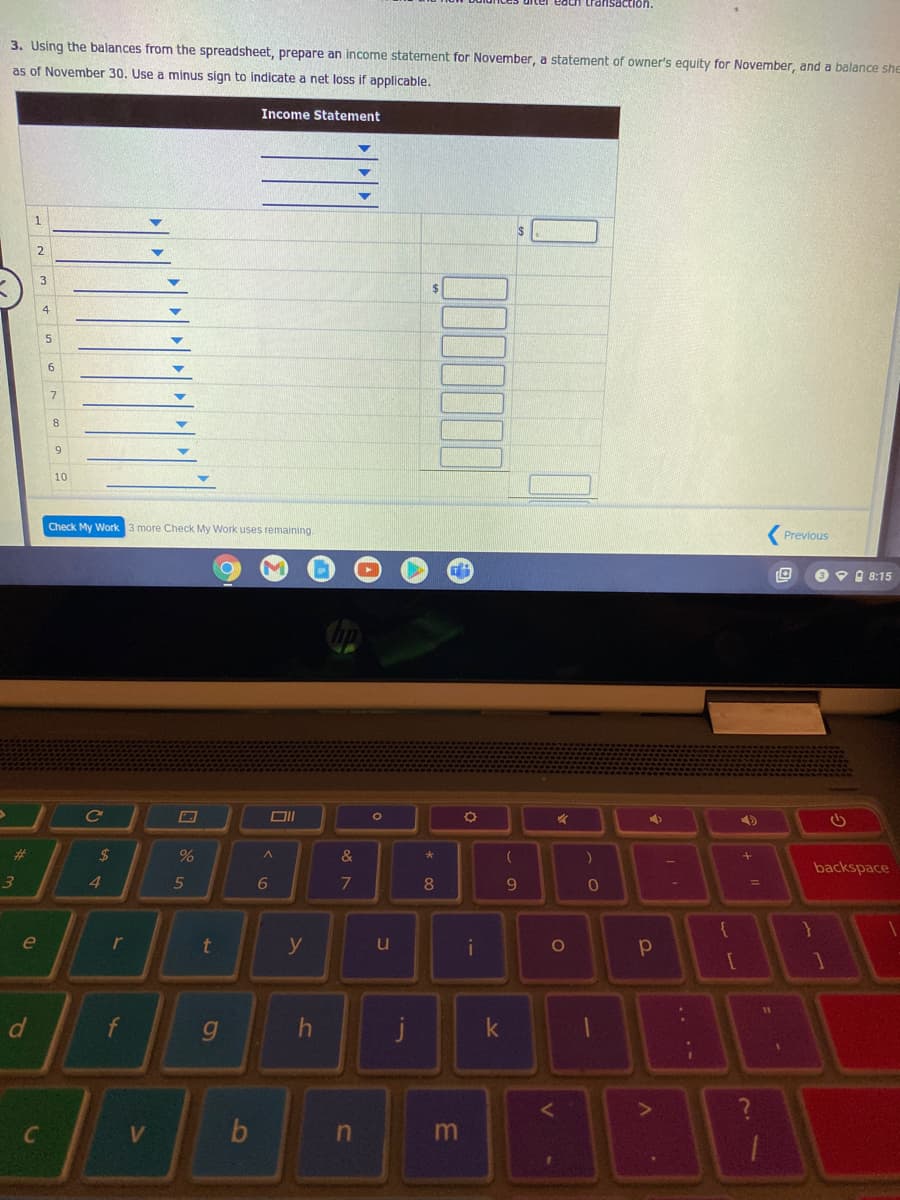

Still apart of number 3. Statement of owner equity.

Transcribed Image Text:Transactions; Financial Statements

Bev's Dry Cleaners is owned and operated by Beverly Zahn. A building and equipment are currently being rented, pending expansion to new facilities. The

actual work of dry cleaning is done by another company for a fee. The assets and the liabilities of the business on November 1, 2019, are as follows: Cash,

$16,380; Accounts Receivable, $33,540; Supplies, $3,120; Land, $39,000; Accounts payable, $14,040. Business transactions during November are

summarized as follows:

a. Beverly Zahn invested additional cash in the business with a deposit of $31,000 in the business bank account.

b. Purchased land adjacent to land currently owned by Bev's Dry Cleaners to use in the future as a parking lot, paying cash of $15,400.

c. Paid rent for the month, $11,230.

d. Charged customers for dry cleaning revenue on account, $31,820.

e. Paid creditors on account, $13,100.

f. Purchased supplies on account, $5,620.

g. Recelved cash from cash customers for dry cleaning revenue, $29,950.

h. Received cash from customers on account, $37,440.

I. Received monthly invoice for dry cleaning expense for November (to be paid on December 10), $14,980.

j. Paid the following: wages expense, $8,240; truck expense, $3,000; utilities expense, $3,180; miscellaneous expense, $1,420.

k. Determined that the cost of supplies on hand was $7,430; therefore, the cost of supplies used during the month was $1,310.

I. Withdrew $8,600 cash for personal use.

Required:

1. Determine the amount of Beverly Zahn's capital as of November 1.

2. Use the attached spreadsheet to complete part 2. Click on the Spreadsheet icon above to open and save the Excel file to your computer. Your input into

the spreadsheet will not be included in your grade in CengageNOW on this problem.

Check My Work 3 more Check My Work uses remaining

Previous

O v I 8-

hp

%23

24

&

backsr

4.

9.

r

t

y

j

k

b

m

Transcribed Image Text:each transaction.

3. Using the balances from the spreadsheet, prepare an income statement for November, a statement of owner's equity for November, and a balance she

as of November 30. Use

minus sign to indicate a net loss if applicable.

Income Statement

3

4

5

6.

7

8

9.

10

Check My Work 3 more Check My Work uses remaining.

Previous

O9 0 8:15

Ce

%23

2$

&

backspace

3.

4

6

8

9.

e

r

y

d

f

j

k

V

b

to

96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,