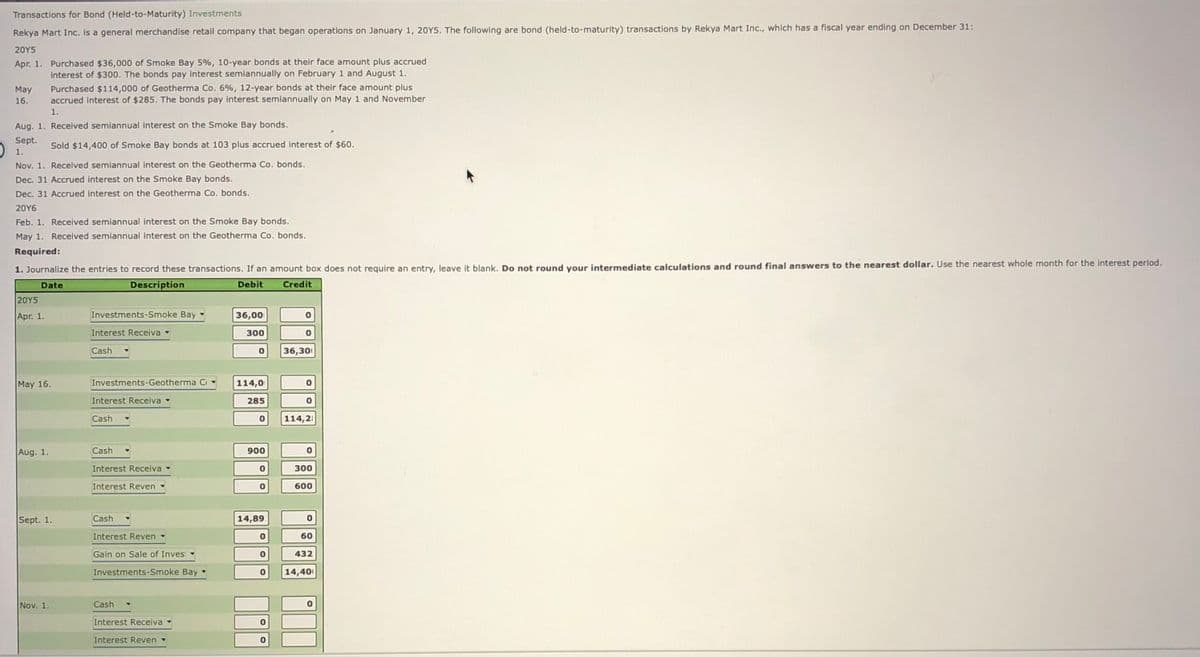

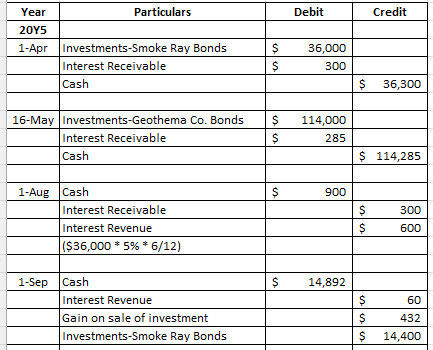

Transactions for Bond (Held-to-Maturity) Investments Rekya Mart Inc. is a general merchandise retail company that began operations on January 1, 20Y5. The following are bond (held-to-maturity) transactions by Rekya Mart Inc., which has a fiscal year ending on December 31: 20YS Purchased $36,000 of Smoke Bay 5%, 10-year bonds at their face amount plus accrued Interest of $300. The bonds pay interest semiannually on February 1 and August 1. Purchased $114,000 of Geotherma Co. 6%, 12-year bonds at their face amount plus accrued interest of $285. The bonds pay interest semiannually on May 1 and November Apr. 1 May 16. Aug. 1. Received semiannual interest on the Smoke Bay bonds. Sept. Sold $14,400 of Smoke Bay bonds at 103 plus accrued interest of $60. 1. Nov. 1. Recelved semiannual Interest on the Geotherma Co. bonds. Dec. 31 Accrued interest on the Smoke Bay bonds. Dec. 31 Accrued interest on the Geotherma Co. bonds. 20Y6 Feb. 1. Received semiannual interest on the Smoke Bay bonds. May 1. Received semiannual interest on the Geotherma Co. bonds. Required: 1. Journalize the entries to record these transactions. If an amount box does not require an entry, leave it blank. Do not round your intermediate calculations and round final answers to the nearest dollar. Use the nearest whole month for the interest period.

Transactions for Bond (Held-to-Maturity) Investments Rekya Mart Inc. is a general merchandise retail company that began operations on January 1, 20Y5. The following are bond (held-to-maturity) transactions by Rekya Mart Inc., which has a fiscal year ending on December 31: 20YS Purchased $36,000 of Smoke Bay 5%, 10-year bonds at their face amount plus accrued Interest of $300. The bonds pay interest semiannually on February 1 and August 1. Purchased $114,000 of Geotherma Co. 6%, 12-year bonds at their face amount plus accrued interest of $285. The bonds pay interest semiannually on May 1 and November Apr. 1 May 16. Aug. 1. Received semiannual interest on the Smoke Bay bonds. Sept. Sold $14,400 of Smoke Bay bonds at 103 plus accrued interest of $60. 1. Nov. 1. Recelved semiannual Interest on the Geotherma Co. bonds. Dec. 31 Accrued interest on the Smoke Bay bonds. Dec. 31 Accrued interest on the Geotherma Co. bonds. 20Y6 Feb. 1. Received semiannual interest on the Smoke Bay bonds. May 1. Received semiannual interest on the Geotherma Co. bonds. Required: 1. Journalize the entries to record these transactions. If an amount box does not require an entry, leave it blank. Do not round your intermediate calculations and round final answers to the nearest dollar. Use the nearest whole month for the interest period.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 13E

Related questions

Question

100%

Transcribed Image Text:Transactions for Bond (Held-to-Maturity) Investments

Rekya Mart Inc. is a general merchandise retail company that began operations on January 1, 2OY5. The following are bond (held-to-maturity) transactions by Rekya Mart Inc., which has a fiscal year ending on December 31:

20Y5

Apr. 1. Purchased $36,000 of Smoke Bay 5%, 10-year bonds at their face amount plus accrued

interest of $300. The bonds pay interest semiannually on February 1 and August 1.

Purchased $114,000 of Geotherma Co. 6%, 12-year bonds at their face amount plus

accrued interest of $285. The bonds pay interest semiannually on May 1 and November

May

16.

1.

Aug. 1. Received semiannual interest on the Smoke Bay bonds.

Sept.

Sold $14,400 of Smoke Bay bonds at 103 plus accrued interest of $60.

1.

Nov. 1. Received semiannual interest on the Geotherma Co. bonds.

Dec. 31 Accrued interest on the Smoke Bay bonds.

Dec. 31 Accrued interest on the Geotherma Co. bonds.

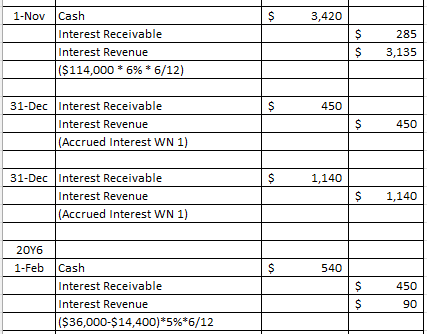

20Y6

Feb. 1. Received semiannual interest on the Smoke Bay bonds.

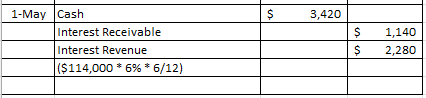

May 1. Received semiannual interest on the Geotherma Co. bonds.

Required:

1. Journalize the entries to record these transactions. If an amount box does not require an entry, leave it blank. Do not round your intermediate calculations and round final answers to the nearest dollar. Use the nearest whole month for the interest period.

Date

Description

Debit

Credit

20Y5

Apr. 1.

Investments-Smoke Bay

36,00

Interest Receiva -

300

Cash

36,300

May 16.

Investments-Geotherma Cr

114,0

Interest Receiva -

285

Cash

114,2

Aug. 1.

Cash

900

Interest Receiva

300

Interest Reven -

600

Sept. 1.

Cash

14,89

Interest Reven -

60

Gain on Sale of Invest

432

Investments-Smoke Bay -

14,400

Nov. 1.

Cash

Interest Receiva

Interest Reven

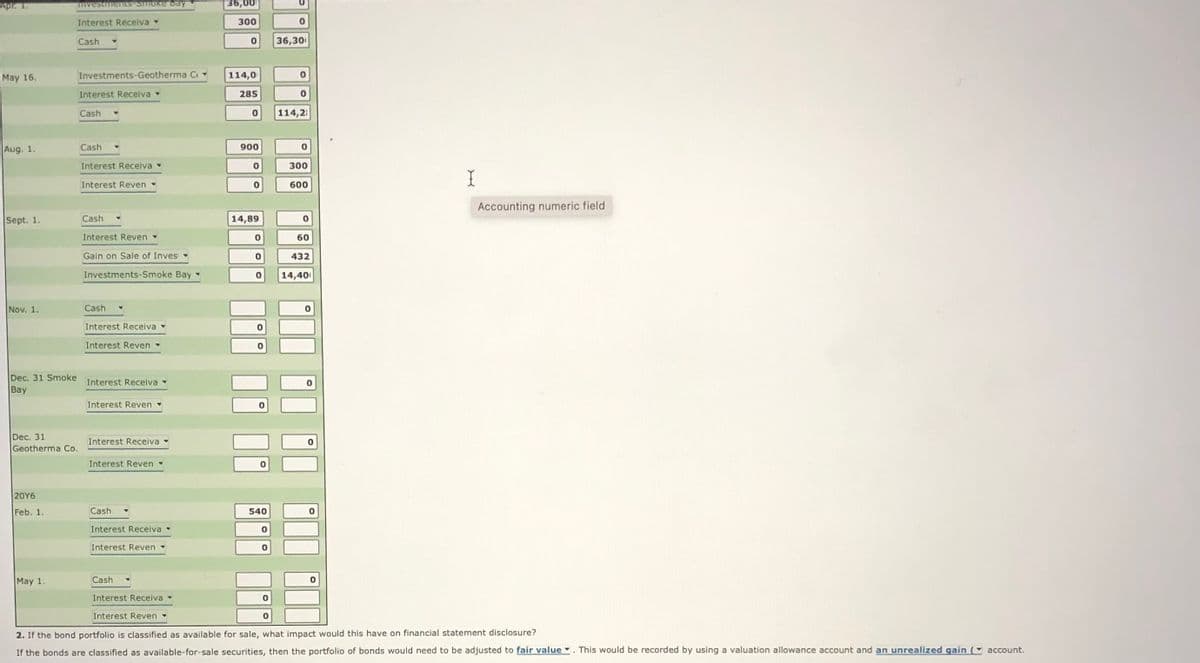

Transcribed Image Text:Apr. 1.

mvestmeILS STORE bay

36,00

Interest Receiva

300

Cash

36,30

May 16.

Investments-Geotherma C

114,0

Interest Receiva

285

Cash

114,21

Aug. 1.

Cash

900

Interest Receiva

300

Interest Reven

600

Accounting numeric field

Sept. 1.

Cash

14,89

Interest Reven •

60

Gain on Sale of Inves -

432

Investments-Smoke Bay

14,40

Nov. 1.

Cash

Interest Receiva

Interest Reven

Dec. 31 Smoke

Bay

Interest Receiva

Interest Reven •

Dec. 31

Geotherma Co.

Interest Receiva

Interest Reven

20Y6

Feb. 1.

Cash

540

Interest Receiva

Interest Reven

May 1.

Cash

Interest Receiva -

Interest Reven

2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?

If the bonds are classified as available-for-sale securities, then the portfolio of bonds would need to be adjusted to fair value - . This would be recorded by using a valuation allowance account and an unrealized gain ( account.

Expert Solution

Step 1

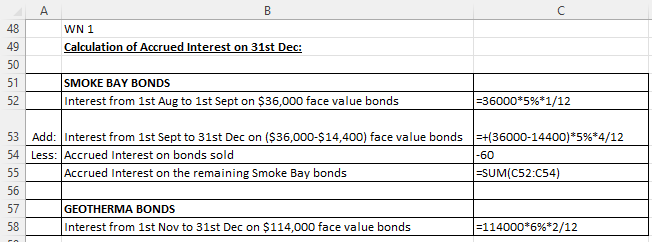

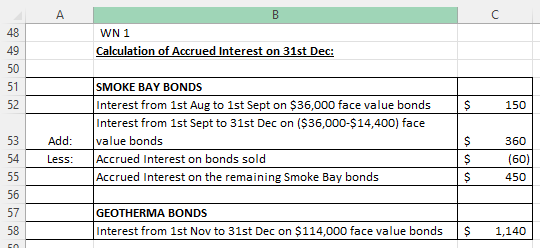

Working Notes:

Journal Entries:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College