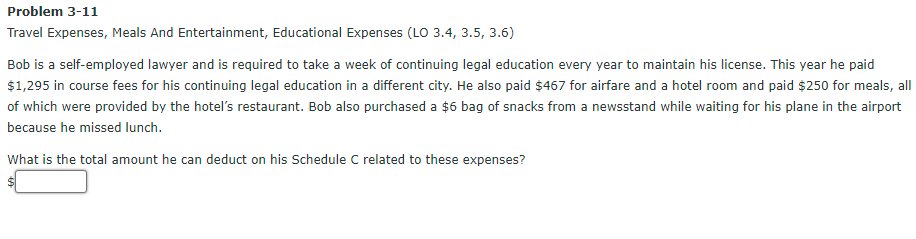

Travel Expenses, Meals And Entertainment, Educational Expenses (LO 3.4, 3.5, 3.6) Bob is a self-employed lawyer and is required to take a week of continuing legal education every year to mair $1,295 in course fees for his continuing legal education in a different city. He also paid $467 for airfare and a of which were provided by the hotel's restaurant. Bob also purchased a $6 bag of snacks from a newsstand w because he missed lunch. What is the total amount he can deduct on his Schedule C related to these expenses?

Q: olanda and her husband Chris each have a home office. This is a dedicated space for their work.…

A: Home Office Deduction is an income tax exemption payable on the proprietors whose principal place of…

Q: siness. While there, she spent 60% of the time on business and 40% on vacation. How much of the air…

A: Nicole can deduct the amount of airface that belongs to the business part only ,therefore in the…

Q: Peter operates a dental office in his home. The office occupies 250 square feet of his residence,…

A: Total expenses for a particular time are the sum of all gross cash expenditures plus any pending…

Q: Melissa recently paid $870 for round-trip airfare to San Francisco to attend a business conference…

A: Solution:- Calculation of the amount of these costs can Melissa deduct as business expenses as…

Q: Eli owns an insurance office, while Olivia operates a maintenance service that provides basic…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: Charlotte Braun is a realtor. She buys and sells properties on her own and she also earns commission…

A: Balance Sheet The purpose of preparing the balance sheet is to know the actual position of assets,…

Q: Melissa recently paid $640 for round-trip airfare to San Francisco to attend a business conference…

A: Given: - Registration for conference = $590 Miles drove = 107 miles Parking fees = $181

Q: Wilson Johnson, a childhood, friend has asked you to assist with his personal finances. Single and…

A: Personal Cash flow statement reflects the cash inflows and outflows of an individual in order to…

Q: James was a high school teacher earning a net salary of $4500 per month. After working for one year,…

A: Total Cost Particulars Amount ($) Tution Fees for 3 months 6000 Interest on Borrowing @8% of…

Q: Barry is a self-employed attorney who travels to New York on a business trip during the year.…

A: Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,…

Q: Joan is a self-employed attorney in New York City. Joan took a trip to San Diego, CA, primarily for…

A: Expenses:Expense is the cost borne by a company to produce and sell the goods and services to the…

Q: Assuming the Workmans file a joint tax return, determine their gross income minus expenses on the…

A: 1. Determination of Gross Income when Ryan's files joint return. S.NO PARTICULARS AMOUNT ($)…

Q: What amount of these investigation costs can Angel deduct if she opens the bookstore on August 1,…

A: For the first year start-up tax deduction oo $5000 for start-up cost ( legal expenses,advertising,…

Q: Paul broke his lease in Montreal, and purchased a condo in Toronto. He few from Vancouver to Toronto…

A: Total deductible moving expenses are the expenses which includes the cost of moving household goods…

Q: Freddie owns an electronics outlet in Houston. This year, he paid $600 to register for a four-day…

A: Business expense: Record expenses which are incurred only business purpose.

Q: Samantha, who is single and has MAGI of $48,600, recently was employed by an accounting firm. During…

A: SOLUTION- REIMBURSEMENT IS MONEY PAID TO AN EMPLOYEE OR CUSTOMER OR ANY OTHER PARTY , AS A…

Q: J is a self-employed interior decorator. Her business location is in New Brunswick NJ. In the…

A:

Q: Choy, after recelving her degree in Hotel and Restaurant Management began her own business called…

A: Acccounting equation is the basic principle of accounting which states that Asset = Liability +…

Q: Ryan is self-employed. This year Ryan used his personal auto for several long business trips. Ryan…

A: Please find the answer to the above question below:

Q: Compute the Wilsons’ moving expense deduction. Where is this amount reported on their return?

A: Reimbursement :- Any amount that is returned back or provided back by the employer after incurring a…

Q: Also, assume that, not counting the sole proprietorship, Rita’s AGI is $62,000. Rita itemizes…

A: Home office deduction of person R is $9,460. Home office deduction through actual expense method is…

Q: Josh is an employee of a large Accounting firm in the city earning $120,000 per year. On weekends,…

A: Definition: Income is the earnings of the individual or business entity by conducting the business…

Q: Kim works for a clothing manufacturer as a dress designer. During 2021, she travels to New York City…

A: a. The total deduction for K presuming for no reimbursement is calculated below: Airfare (full)…

Q: Joan is a self-employed attorney in New York City. Joan took a trip to San Diego, CA, primarily for…

A: Expenses: Expense is the cost borne by a company to produce and sell the goods and services to the…

Q: LO.3 Adelene, who lives in a winter resort area, rented her personal residence for 14 days while she…

A: The effect on the Adelene's AGI :

Q: Clark is a self-employed freelance news reporter. The Globe News Corp. hires him as an independent…

A: Deductible expenditures are those which can be deducted from a business's profit before it is taxed.

Q: Cindy, who is self-employed, maintains an office in her home that comprises 12% (260 square feet) of…

A: WORKING : 1. Business occupancy space= 260 Sq. ft. (12%) 2. Gross income= $ 45,650 3. Rent…

Q: Amanda is a self-employed newspaper columnist who does her work exclusively from a home office.…

A: Taxation-Taxation means imposing a tax on individuals and different types of organizations. Which…

Q: paid $250 for meals, all of which were provided by the hotel’s restaurant. Bob also purchased a $6…

A: Schedule C Schedule C is the most popular tax form used by sole proprietors. The title "Profit or…

Q: In October, Dave quit his job with employer I and in December found a new job with employer II in a…

A: Moving expenses Moving expenses is the expenses which was incurred at the time of shifting job from…

Q: Jordan took a business trip from New York to Denver. She spent two days in travel, conducted…

A: Business expenses for persons who are self-employed shall be deductible for AGI and is reported on…

Q: Cindy operates a computerized engineering drawing business from her home. Cindy maintains a home…

A: Definition: Expenses: Amount spent for running day to day business activities are called expenses.

Q: Based on your calculations of accounting profit and economic profit, would you advise James to…

A:

Q: Samantha moved from Regina to Winnipeg to work at Red River College. Her moving expenses included…

A: Moving allowances - It includes all such expenses which is incur for moving of household goods and…

Q: During the year, Scott went from Detroit, Michigan to San Jose, California. After six days of…

A: Given that : Scott goes for 6 days business meeting and after that he goes for 4 days vacation to…

Q: Milly operates a small business and incurs the following expenses: Annual dues Tampa Bay Golf Club…

A: Meals expenses under income tax are deductible either completely that is., 100% or partially as 50%.

Q: Rocky repairs TV sets in the basement of his personal residence. Rocky uses 450 square feet (20%)…

A: Deduction: A deduction is an expense that can be subtracted from an individual or married couple's…

Q: What amount of these costs can Melissa deduct as business expenses? (Use standard mileage rate of…

A: Particulars Amount in $ Round trip airfare 530 Conference registration fees 585 3 nights…

Q: CPA Jetter is a self-employed accountant and is required to take a week of continuing accounting and…

A: Education Expenses : Education which is required by law to meet standard beyond minimum requirements…

Q: Nadine is a self-employed attorney. Her expenses for continuing legal education are as follows:…

A: The term "educational expenses" refers to the costs associated with attending a postsecondary school…

Q: Ronald runs his own public relations business. During the year he incurred the following expenses:…

A: Taxable income is the income which states to the base on which the system of income tax impose the…

Q: During the current year, Harry, a self-employed accountant, travels from Kansas City to Miami for a…

A: A deduction is an out-of-pocket expense that can be deducted from taxable income to lower the amount…

Q: Jordan took a business trip from New York to Denver. She spent two days in travel, conducted…

A: SOLUTION SINCE THE TRIP IS PRIMARILY FOR BUSINESS (NO FOR FOREIGN TRAVEL) PURPOSE .100% OF TRAVEL…

Q: Jack is a lawyer who is a member at Ocean Spray Country Club where he spends $7,200 in dues, $4,000…

A: Business Expenses:- Expenses incurred for the running and operation of the business are known as…

Q: Bob took a business trip from Chicago to London. He was away 12 days of which he spent six days on…

A: Given that, He was away 12 days of which he spent six days on business (including two travel days)…

Schedule C

Schedule C is the most popular tax form used by sole proprietors. The title "Profit or Loss From Business" implies that it is used to record both income and losses. Schedule C filers are typically self-employed taxpayers who are just starting out in their businesses.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Problem 3-9 (Algorithmic)Travel Expenses (LO 3.4) Joan is a self-employed attorney in New York City. Joan took a trip to San Diego, CA, primarily for business, to consult with a client and take a short vacation. On the trip, Joan incurred the following expenses: Airfare to and from San Diego $ 750 Hotel charges while on business 600 Meals while on business 180 Car rental while on business 90 Hotel charges while on vacation 840 Meals while on vacation 198 Car rental while on vacation 180 Total $2,838 Calculate Joan's travel expense deduction for the trip, assuming the trip was made in 2018. $Problem 3-9Travel Expenses (LO 3.4) Joan is a self-employed attorney in New York City. Joan took a trip to San Diego, CA, primarily for business, to consult with a client and take a short vacation. On the trip, Joan incurred the following expenses: Airfare to and from San Diego $ 478 Hotel charges while on business 340 Meals while on business 260 Car rental while on business (she drove 240 miles) 110 Hotel charges while on vacation 460 Meals while on vacation 290 Car rental while on vacation 180 Total $2,118 Calculate Joan's travel expense deduction for the trip, assuming the trip was made in 2018.$Problem 6-47 (LO. 3) Adelene, who lives in a winter resort area, rented her personal residence for 14 days while she was visiting Brussels. Rent income was $5,000. Related expenses for the year were as follows: Real property taxes $3,800 Mortgage interest 7,500 Utilities 3,700 Insurance 2,500 Repairs 2,100 Depreciation 15,000 If an answer is zero, enter "0". a. Determine how much of the rental income is reportable. $fill in the blank 1 b. Determine whether the expenses are deductible. Select "Yes" if deductible otherwise select "No". Depreciation Real property taxes Repairs Utilities Mortgage interest Insurance c. Determine the effect the rental activity has on Adelene's AGI. $fill in the blank 8

- Required information Comprehensive Problem 5-88 (LO 5-1, LO 5-2, LO 5-3) (Algo) Skip to question [The following information applies to the questions displayed below.]Diana and Ryan Workman were married on January 1 of last year. Diana has an eight-year-old son, Jorge, from her previous marriage. Ryan works as a computer programmer at Datafile Incorporated (DI) earning a salary of $96,500. Diana is self-employed and runs a day care center. The Workmans reported the following financial information pertaining to their activities during the current year. Ryan earned a $96,500 salary for the year. Ryan borrowed $12,100 from DI to purchase a car. DI charged him 2 percent interest ($242) on the loan, which Ryan paid on December 31. DI would have charged Ryan $730 if interest had been calculated at the applicable federal interest rate. Assume that tax avoidance was not a motive for the loan. Diana received $2,050 in alimony and $4,600 in child support payments from her former husband. They…Exercise 3-43 Recognizing Expenses Treadway Dental Services gives each of its patients a toothbrush with the name and phone number of the dentist office and a logo imprinted on the brush. Treadway purchased 15,000 of the toothbrushes in October 2019 for $3,130. The toothbrushes were delivered in November and paid for in December 2019. Treadway began to give the patients the toothbrushes in February 2020. By the end of 2020, 4,500 of the toothbrushes remained in the supplies account. Required: How much expense should be recorded for the toothbrushes in 2019 and 2020 to properly match expenses with revenues? Describe how the 4,500 toothbrushes that remain in the supplies account will handled in 2021.Problem 3-62A Cash-Basis and Accrual-Basis Income George Hathaway, an electrician, entered into an agreement with a real estate management company to perform all maintenance of basic electrical systems and air-conditioning equipment in the apartment buildings under the companys management. The agreement, which is subject to annual renewal, provides for the payment of a fixed fee of S6,600 on January 1 of each year plus amounts for parts and materials billed separately at the end of each month. Amounts billed at the end of I month are collected in the next month. During the first 3 months of 2019, George makes the following additional billings and cash collections: Required: 1. Calculate the amount of cash-basis income reported for each of the first 3 months. 2. Calculate the amount of accrual-basis income reported for each of the first 3 months. 3. CONCEPTUAL CONNECTION Why do decision-makers prefer accrual-basis accounting?

- Exercise 3-40 Revenue and Expense Recognition Electronic Repair Company repaired a high-definition television for Sarah Merrifield in December 2019. Sarah paid $80 at the time of the repair and agreed to pay Electronic Repair $80 each month for 5 months beginning on January 15, 2020. Electronic Repair used $120 of supplies, which were purchased in November 2020, to repair the television. Assume that Electronic Repair uses accrual-basis accounting. Required: In what month or months should revenue from this service be recorded by Electronic Repaid? In what month or months should the expense related to the repair of the television be recorded by Electronic Repair? CONCEPTUAL CONNECTION Describe the accounting principles used to answer the above questions.Comprehensive Problem 3-1 Gordon Temper is a single taxpayer (birthdate July 1, 1986 and Social Security number 242-11-6767) who operates a food truck that specializes in food from South Africa. His business is named "Mobile Peri Peri" and although the truck moves around quite a bit, he generally parks it in an office park where he maintains an office and a supply of inventory. The business address is 150 Erie Street, Laramie, WY 82070. The principal business code is 722300. Gordon's food truck business is fairly new, so he also works part-time as a cook at a steak house restaurant in Laramie. His 2023 Form W-2 follows (see separate tab). Gordon provided the following financial information related to Mobile Peri Peri: Revenues $80,000 Beginning Inventory 5,600 Purchases 43,000 Ending inventory 5,800 Truck rental 24,000 Office rental 8,600 Advertising 700 Insurance 3,000 Food license 500 Uniforms 200 Dues 100 Travel 1,600 Office expense 400 Mobile Peri Peri uses the cash method of…D-3 You are working for a large firm that has asked you to attend a career fair at a university that is 185 miles from your office. You need to be there at 9:00 a.m. on a Monday morning. You can drive your personal car and be reimbursed $0.55 per mile, but you would need to leave home at 5:30 a.m. to get to the event and set up on time. Company policy allows you to spend the night if you must leave town before 6:00 a.m. The hotel across the street from campus charges $85 per night. Instead of driving, you could catch a 7:00 a.m. flight with a round-trip fare of $260. Flying would require you to rent a car for $29 per day, and you would have an airport parking fee of $20 for the day. The company pays a per diem of $40 for incidentals if you spend at least 66 hours out of town. (The per diem would be for one 24-hour period for either flying or driving.) As a manager, you are responsible for recruiting within a budget and want to determine which is more economical. Use the information…

- Problem #10Journalizing, Posting and Preparing a Trial Balance Leonila Generales won a concession to rent out bicycles in the Quezon Circle duringthe summer. During the month of April, Generales completed the following transactionsfor her bicycle rental business: Apr. 2 Began business by placing P120,000 in a business checking account.3 Purchased supplies on account for P 1,500.4 Purchased ten bicycles for P25,000, paying P12,000 down and agreed topay the balance in thirty days.5 Paid P29,000 in cash for a furnished container to store the bicycles anduse for other operations.6 Received P4,700 in cash for rentals during the first week of operation.8 Paid P4,000 in cash for shipping and installation costs (considered anaddition to the cost of the container) to place the container at the parkentrance.9 Hired a part-time assistant to help on weekends.10 Paid a maintenance person P750 to clean the grounds.13 Received P5,000 in cash for rentals during the second week of operation.16 Paid the…Exercise 9-15 (Algorithmic) (LO. 4) Samantha, who is single and has MAGI of $31,050, was recently employed by an accounting firm. During the year, she spends $3,450 for a CPA exam review course and begins working on a law degree in night school. Her law school expenses were $4,635 for tuition and $720 for books (which are not a requirement for enrollment in the course). Click here to access Concept Summary 9.2. If an amount is zero, enter "0". Assuming no reimbursement, how much of these expenses can Samantha deduct? $fill in the blank 1 8,805Problem 9-26 (LO. 1, 3, 5) Kim works for a clothing manufacturer as a dress designer. During 2020, she travels to New York City to attend five days of fashion shows and then spends three days sightseeing. Her expenses are as follows: Airfare $1,500 Lodging (8 nights) 1,920 Meals (8 days) 1,440 Airport transportation 120 Assume lodging/meals are the same amount for the business and personal portion of the trip ($240 per day for lodging and $180 per day for meals). If an amount is zero, enter "0". a. Determine Kim's business expenses, presuming no reimbursement. Airfare $fill in the blank 54c797fed034fc0_1 Lodging fill in the blank 54c797fed034fc0_2 Meals fill in the blank 54c797fed034fc0_3 Transportation fill in the blank 54c797fed034fc0_4 Total $fill in the blank 54c797fed034fc0_5 What amount may she deduct on her tax return?$fill in the blank 54c797fed034fc0_6 b. Would the tax treatment of Kim's deduction differ if she was…