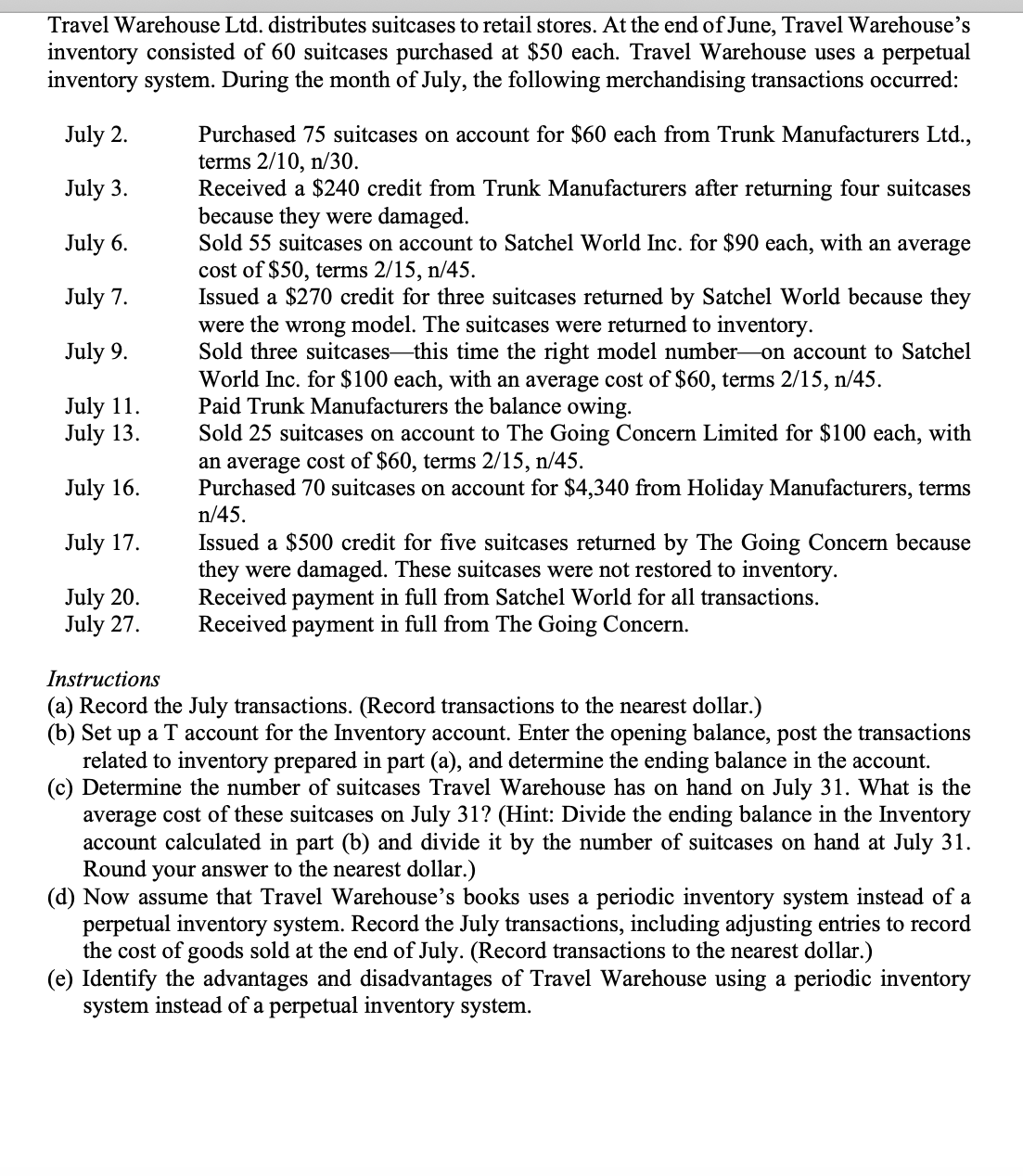

Travel Warehouse Ltd. distributes suitcases to retail stores. At the end of June, Travel Warehouse's inventory consisted of 60 suitcases purchased at $50 each. Travel Warehouse uses a perpetual inventory system. During the month of July, the following merchandising transactions occurred: July 2. July 3. July 6. July 7. July 9. July 11. July 13. July 16. July 17. July 20. July 27. Purchased 75 suitcases on account for $60 each from Trunk Manufacturers Ltd., terms 2/10, n/30. Received a $240 credit from Trunk Manufacturers after returning four suitcases because they were damaged. Sold 55 suitcases on account to Satchel World Inc. for $90 each, with an average cost of $50, terms 2/15, n/45. Issued a $270 credit for three suitcases returned by Satchel World because they were the wrong model. The suitcases were returned to inventory. Sold three suitcases this time the right model number on account to Satchel World Inc. for $100 each, with an average cost of $60, terms 2/15, n/45. Paid Trunk Manufacturers the balance owing. Sold 25 suitcases on account to The Going Concern Limited for $100 each, with an average cost of $60, terms 2/15, n/45. Purchased 70 suitcases on account for $4,340 from Holiday Manufacturers, terms n/45. Issued a $500 credit for five suitcases returned by The Going Concern because they were damaged. These suitcases were not restored to inventory. Received payment in full from Satchel World for all transactions. Received payment in full from The Going Concern. Instructions (a) Record the July transactions. (Record transactions to the nearest dollar.) (b) Set up a T account for the Inventory account. Enter the opening balance, post the transactions related to inventory prepared in part (a), and determine the ending balance in the account. (c) Determine the number of suitcases Travel Warehouse has on hand on July 31. What is the average cost of these suitcases on July 31? (Hint: Divide the ending balance in the Inventory account calculated in part (b) and divide it by the number of suitcases on hand at July 31. Round your answer to the nearest dollar.)

Travel Warehouse Ltd. distributes suitcases to retail stores. At the end of June, Travel Warehouse's inventory consisted of 60 suitcases purchased at $50 each. Travel Warehouse uses a perpetual inventory system. During the month of July, the following merchandising transactions occurred: July 2. July 3. July 6. July 7. July 9. July 11. July 13. July 16. July 17. July 20. July 27. Purchased 75 suitcases on account for $60 each from Trunk Manufacturers Ltd., terms 2/10, n/30. Received a $240 credit from Trunk Manufacturers after returning four suitcases because they were damaged. Sold 55 suitcases on account to Satchel World Inc. for $90 each, with an average cost of $50, terms 2/15, n/45. Issued a $270 credit for three suitcases returned by Satchel World because they were the wrong model. The suitcases were returned to inventory. Sold three suitcases this time the right model number on account to Satchel World Inc. for $100 each, with an average cost of $60, terms 2/15, n/45. Paid Trunk Manufacturers the balance owing. Sold 25 suitcases on account to The Going Concern Limited for $100 each, with an average cost of $60, terms 2/15, n/45. Purchased 70 suitcases on account for $4,340 from Holiday Manufacturers, terms n/45. Issued a $500 credit for five suitcases returned by The Going Concern because they were damaged. These suitcases were not restored to inventory. Received payment in full from Satchel World for all transactions. Received payment in full from The Going Concern. Instructions (a) Record the July transactions. (Record transactions to the nearest dollar.) (b) Set up a T account for the Inventory account. Enter the opening balance, post the transactions related to inventory prepared in part (a), and determine the ending balance in the account. (c) Determine the number of suitcases Travel Warehouse has on hand on July 31. What is the average cost of these suitcases on July 31? (Hint: Divide the ending balance in the Inventory account calculated in part (b) and divide it by the number of suitcases on hand at July 31. Round your answer to the nearest dollar.)

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter9: Sales And Purchases

Section: Chapter Questions

Problem 4PA: The following transactions relate to Hawkins, Inc., an office store wholesaler, during June of this...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

Transcribed Image Text:Travel Warehouse Ltd. distributes suitcases to retail stores. At the end of June, Travel Warehouse's

inventory consisted of 60 suitcases purchased at $50 each. Travel Warehouse uses a perpetual

inventory system. During the month of July, the following merchandising transactions occurred:

July 2.

July 3.

July 6.

July 7.

July 9.

July 11.

July 13.

July 16.

July 17.

July 20.

July 27.

Purchased 75 suitcases on account for $60 each from Trunk Manufacturers Ltd.,

terms 2/10, n/30.

Received a $240 credit from Trunk Manufacturers after returning four suitcases

because they were damaged.

Sold 55 suitcases on account to Satchel World Inc. for $90 each, with an average

cost of $50, terms 2/15, n/45.

Issued a $270 credit for three suitcases returned by Satchel World because they

were the wrong model. The suitcases were returned to inventory.

Sold three suitcases this time the right model number on account to Satchel

World Inc. for $100 each, with an average cost of $60, terms 2/15, n/45.

Paid Trunk Manufacturers the balance owing.

Sold 25 suitcases on account to The Going Concern Limited for $100 each, with

an average cost of $60, terms 2/15, n/45.

Purchased 70 suitcases on account for $4,340 from Holiday Manufacturers, terms

n/45.

Issued a $500 credit for five suitcases returned by The Going Concern because

they were damaged. These suitcases were not restored to inventory.

Received payment in full from Satchel World for all transactions.

Received payment in full from The Going Concern.

Instructions

(a) Record the July transactions. (Record transactions to the nearest dollar.)

(b) Set up a T account for the Inventory account. Enter the opening balance, post the transactions

related to inventory prepared in part (a), and determine the ending balance in the account.

(c) Determine the number of suitcases Travel Warehouse has on hand on July 31. What is the

average cost of these suitcases on July 31? (Hint: Divide the ending balance in the Inventory

account calculated in part (b) and divide it by the number of suitcases on hand at July 31.

Round your answer to the nearest dollar.)

(d) Now assume that Travel Warehouse's books uses a periodic inventory system instead of a

perpetual inventory system. Record the July transactions, including adjusting entries to record

the cost of goods sold at the end of July. (Record transactions to the nearest dollar.)

(e) Identify the advantages and disadvantages of Travel Warehouse using a periodic inventory

system instead of a perpetual inventory system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning