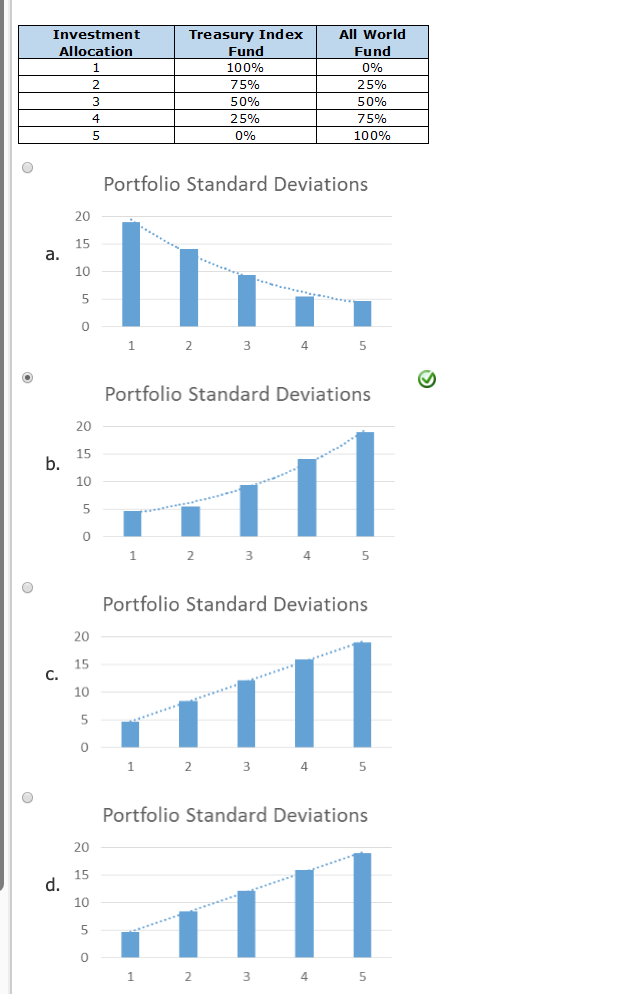

Treasury Index Fund All World Investment Allocation Fund 100% 0% 75% 25% 3 50% 50% 75% 4 25% 0% 100% Portfolio Standard Deviations 20 15 a. 10 1 2 3 4 5 Portfolio Standard Deviations 20 15 b. 10 2 3 4 5 Portfolio Standard Deviations 20 15 C. 10 *..... 1. 2 3 4 5 Portfolio Standard Deviations 20 15 d. 10 3 2 4 5

How do I/What is the process for solving this problem:

|

You are an investment manager for Simple Asset Management, a company that specializes in developing simple investment portfolios consisting of no more than three assets such as stocks, bonds, etc., for investors who like to keep things simple. One of your more popular investments is called the All World Fund and is composed of global stocks with good dividend yields. A client is interested in constructing a portfolio that consists of the All World Fund and the Treasury Index Fund, which consists of U.S. Treasury securities (government bonds). You calculate a 7.8% expected return on the All World Fund with a return standard deviation (a measure of risk) of 18.90%. The expected return of the Treasury Index Fund is 5.50% with a return standard deviation of 4.6%. To analyze the relationship between the two investments, you also calculate the covariance between the two of –12.4. |

Expected return on a portfolio of investments, while helpful, does not offer a complete picture of an investment’s characteristics. The risk associated with the portfolio must also be calculated to make sure the portfolio fits the customer’s risk profile. The standard deviation of the returns offers an adequate measure of portfolio risk.

Which graph below best represents the expected standard deviation for the same investment allocations used in Question 1?

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 10 images