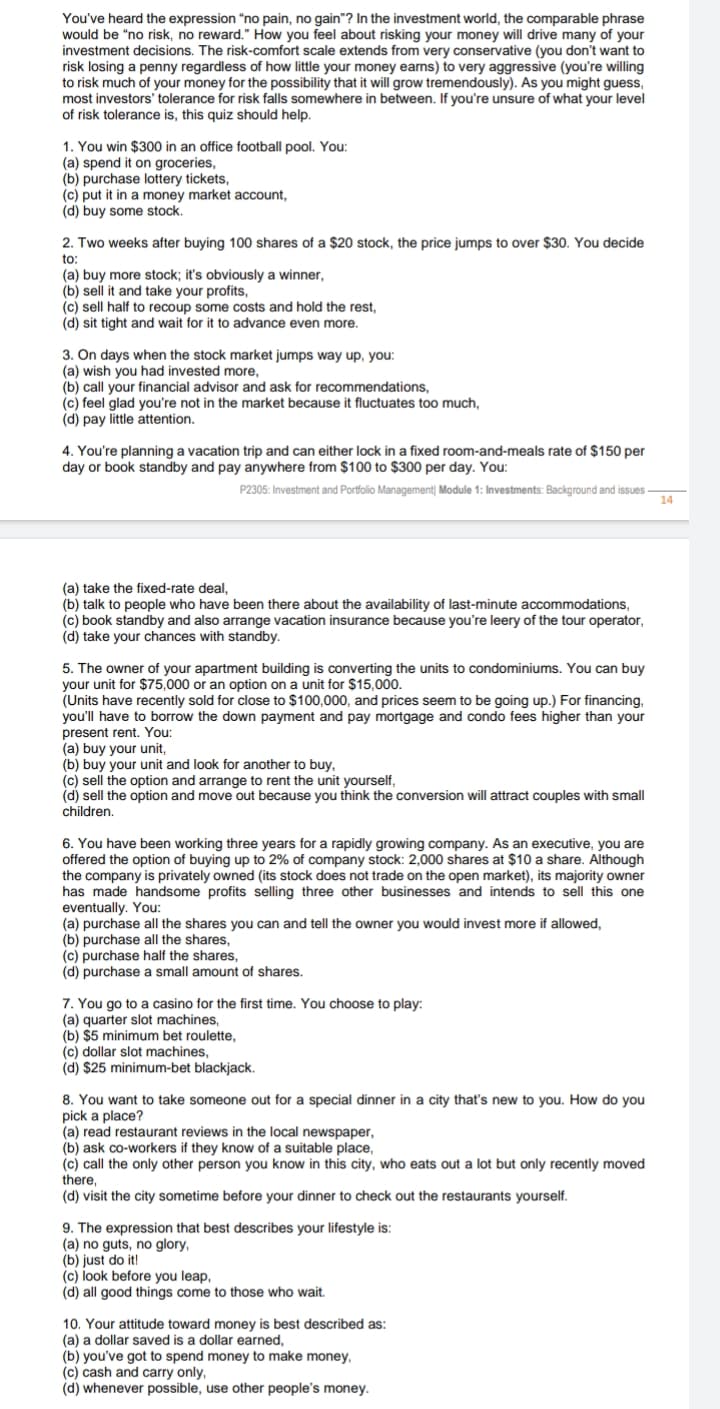

You've heard the expression "no pain, no gain"? In the investment world, the comparable phrase would be "no risk, no reward." How you feel about risking your money will drive many of your investment decisions. The risk-comfort scale extends from very conservative (you don't want to risk losing a penny regardless of how little your money earns) to very aggressive (you're willing to risk much of your money for the possibility that it will grow tremendously). As you might guess, most investors' tolerance for risk falls somewhere in between. If you're unsure of what your level of risk tolerance is, this quiz should help. 1. You win $300 in an office football pool. You: (a) spend it on groceries, (b) purchase lottery tickets, (c) put it in a money market account, (d) buy some stock. 2. Two weeks after buying 100 shares of a $20 stock, the price jumps to over $30. You decide to: (a) buy more stock; it's obviously a winner, (b) sell it and take your profits, (c) sell half to recoup some costs and hold the rest, (d) sit tight and wait for it to advance even more. 3. On days when the stock market jumps way up, you: (a) wish you had invested more, (b) call your financial advisor and ask for recommendations, (c) feel glad you're not in the market because it fluctuates too much, (d) pay little attention. 4. You're planning a vacation trip and can either lock in a fixed room-and-meals rate of $150 per day or book standby and pay anywhere from $100 to $300 per day. You:

You've heard the expression "no pain, no gain"? In the investment world, the comparable phrase would be "no risk, no reward." How you feel about risking your money will drive many of your investment decisions. The risk-comfort scale extends from very conservative (you don't want to risk losing a penny regardless of how little your money earns) to very aggressive (you're willing to risk much of your money for the possibility that it will grow tremendously). As you might guess, most investors' tolerance for risk falls somewhere in between. If you're unsure of what your level of risk tolerance is, this quiz should help. 1. You win $300 in an office football pool. You: (a) spend it on groceries, (b) purchase lottery tickets, (c) put it in a money market account, (d) buy some stock. 2. Two weeks after buying 100 shares of a $20 stock, the price jumps to over $30. You decide to: (a) buy more stock; it's obviously a winner, (b) sell it and take your profits, (c) sell half to recoup some costs and hold the rest, (d) sit tight and wait for it to advance even more. 3. On days when the stock market jumps way up, you: (a) wish you had invested more, (b) call your financial advisor and ask for recommendations, (c) feel glad you're not in the market because it fluctuates too much, (d) pay little attention. 4. You're planning a vacation trip and can either lock in a fixed room-and-meals rate of $150 per day or book standby and pay anywhere from $100 to $300 per day. You:

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter25: Portfolio Theory And Asset Pricing Models

Section: Chapter Questions

Problem 8MC: You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand...

Related questions

Question

Transcribed Image Text:You've heard the expression "no pain, no gain"? In the investment world, the comparable phrase

would be "no risk, no reward." How you feel about risking your money will drive many of your

investment decisions. The risk-comfort scale extends from very conservative (you don't want to

risk losing a penny regardless of how little your money eans) to very aggressive (you're willing

to risk much of your money for the possibility that it will grow tremendously). As you might guess,

most investors' tolerance for risk falls somewhere in between. If you're unsure of what your level

of risk tolerance is, this quiz should help.

1. You win $300 in an office football pool. You:

(a) spend it on groceries,

(b) purchase lottery tickets,

(c) put it in a money market account,

(d) buy some stock.

2. Two weeks after buying 100 shares of a $20 stock, the price jumps to over $30. You decide

to:

(a) buy more stock; it's obviously a winner,

(b) sell it and take your profits,

(c) sell half to recoup some costs and hold the rest,

(d) sit tight and wait for it to advance even more.

3. On days when the stock market jumps way up, you:

(a) wish you had invested more,

(b) call your financial advisor and ask for recommendations,

(c) feel glad you're not in the market because it fluctuates too much,

(d) pay little attention.

4. You're planning a vacation trip and can either lock in a fixed room-and-meals rate of $150 per

day or book standby and pay anywhere from $100 to $300 per day. You:

P2305: Investment and Portfolio Management| Module 1: Investments: Background and issues

14

(a) take the fixed-rate deal,

(b) talk to people who have been there about the availability of last-minute accommodations,

(c) book standby and also arrange vacation insurance because you're leery of the tour operator,

(d) take your chances with standby.

5. The owner of your apartment building is converting the units to condominiums. You can buy

your unit for $75,000 or an option on a unit for $15,000.

(Units have recently sold for close to $100,000, and prices seem to be going up.) For financing,

you'll have to borrow the down payment and pay mortgage and condo fees higher than your

present rent. You:

(a)

buy your

(b) buy your unit and look for another to buy,

(c) sell the option and arrange to rent the unit yourself,

(d) sell the option and move out because you think the conversion will attract couples with small

children.

unit,

6. You have been working three years for a rapidly growing company. As an executive, you are

offered the option of buying up to 2% of company stock: 2,000 shares at $10 a share. Although

the company is privately owned (its stock does not trade on the open market), its majority owner

has made handsome profits selling three other businesses and intends to sell this one

eventually. You:

(a) purchase all the shares you can and tell the owner you would invest more if allowed,

(b) purchase all the shares,

(c) purchase half the shares,

(d) purchase a small amount of shares.

7. You go to a casino for the first time. You choose to play:

(a) quarter slot machines,

(b) $5 minimum bet roulette,

(c) dollar slot machines,

(d) $25 minimum-bet blackjack.

8. You want to take someone out for a special dinner in a city that's new to you. How do you

pick a place?

(a) read restaurant reviews in the local newspaper,

(b) ask co-workers if they know of a suitable place,

(c) call the only other person you know in this city, who eats out a lot but only recently moved

there,

(d) visit the city sometime before your dinner to check out the restaurants yourself.

9. The expression that best describes your lifestyle is:

(a) no guts, no glory,

(b) just do it!

(c) look before you leap,

(d) all good things come to those who wait.

10. Your attitude toward money is best described as:

(a) a dollar saved is a dollar earned,

(b) you've got to spend money to make money,

(c) cash and carry only,

(d) whenever possible, use other people's money.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage