Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his wife. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2021 for his daughters under each of the following alternative situations? Use Exhibit 8-8. c. His AGI is $425,600, and his daughters are ages 10 and 12.

Q: Toby and Nancy are engaged and plan to get married. During 2019, Toby is a full-time student and…

A: Gross income: Gross income is the sum of all forms of income of the taxpayer before claiming any…

Q: Joanna, age 44, defers $24,000 in a qualified Solo § 401(k) plan in 2020. a. What amount must be…

A: Concept used : The deferral limit for 2020 is $19,500.

Q: Denise is divorced and files a single tax return claiming her two children, ages 7 and 9, as…

A: Given, AGI = $ 81,500 Dependent children = 2 Age = 7& 9 Tax return TYPE = Single

Q: Trey has two dependents, his daughters, ages 14 and 17, at year-end. Trey files a joint return with…

A: To qualify for child tax credit (CTC) child’s age must be below 17 years (e.g. 16 or younger).2019,…

Q: osh is a MFJ taxpayer and decides to return to school to get a graduate degree at night school while…

A: Income tax: It is the amount a person is liable to pay on the earned amount in an accounting year.…

Q: Sandra and Nick, married taxpayers filing a joint return, have $180,000 in taxable income in 2019.…

A: For the 2019 the standard deduction for married filing jointly is $ 24,400.…

Q: Jacob, age 42, and Jane Brewster, age 44, are married and file a joint return in 2020. The Brewsters…

A: Alternative minimum tax (AMT) refers to the minimum amount of tax that an individual supposed after…

Q: Brian and Kim have a 12-year-old child, Stan. For 2019, Brian and Kim have taxable income of…

A: Tax: A tax is a compulsory charge or a levy imposed upon a taxpayer by a government organization…

Q: Charlie and Renee have two children who are 16 and 18. In addition, Rick's mother ives with them and…

A: According to US tax law, the child tax credit seems to be an income tax credit for up to $2,000 for…

Q: Clarita is a single taxpayer with two dependent children, ages 10 and 12. Clarita pays $3,000 in…

A: Given, Clarita is a single taxpayer Dependent children = 2 (below age 13) Qualified child care…

Q: Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with…

A: It is subject to phase outs when Married filing Jointly Adjusted Gross Income > $ 400,000 /- by…

Q: Denise's child tax credit for 2019 is

A: Tax credit is defined as the reduction in the tax liability of the taxpayer. It is known as tax…

Q: Norm and Linda are married, file a joint return, and have one 5 year old child. Their AGI is…

A: Total tax is the sum of all taxes owed by a taxpayer for the year in the context of personal income…

Q: ll of 2020 after having completed her junior year during the spring of that year. Both Devona and…

A: Calculation of American Opportunity credit available to Jerome and Kelly for 2020 American…

Q: withholdings. In addition to their other children, they adopted a 2-year old special needs child…

A: Tax Liability is the different company's taxable income as shown in the income statement and in…

Q: Ava and her husband, Leo, file a joint return and are in the 24% Federal income tax bracket in 2020.…

A: In case of b part, if Ava avails the plan then income tax savings will be 10% of reimbursement…

Q: Ian, 37, and Isabella, 36, are married and file a joint tax return. They have one child, Ingrid…

A: Income Tax - It is tax imposed by the government on company or individual with respect to their…

Q: Jim and Mary Jean are married and have two dependent children under the age of 13. Both parents are…

A: The portion of your total income used to calculate how much tax you owe in a given tax year is known…

Q: Clarita is a single taxpayer with two dependent children, ages 10 and 12. Clarita pays $3,000 in…

A: Standard deduction refers to the non-taxable portion of income. It is based on the age, filing…

Q: Harry and Carrie Franklin are married and choose to file Married Filing Jointly on their 2020 tax…

A: Eligible educators can subtract up to $250 in eligible expenditures from their wages under the…

Q: Brian and Kim have a 12-year-old child, Stan. For 2018, Brian and Kim have taxable income of…

A: Taxable Income:Taxable income refers to the base upon which an income tax system imposes tax.…

Q: Zack is single and has collected the following information for preparing his 2021 taxes: Gross…

A: According to the given question, we are required to compute the adjusted gross income and taxable…

Q: Ava and her husband, Leo, file a joint return and are in the 24% Federal income tax bracket in 2020.…

A: Particulars When they consider the option When they do not consider the option Income 75,000…

Q: Herb and Carol are married and file a joint tax return claiming their three children, ages 4, 5, and…

A: Solution:- Child tax credit (CTC) applies for child dependants below 17 years of age only. Hence…

Q: Ava and her husband, Leo, file a joint return and are in the 24% tax bracket in 2019. Ava’s employer…

A: Tax: Tax refers to a compulsory payment or a contribution to the state revenue, levied by the…

Q: Elijah and Anastasia are married and have six married children and eight minor grandchildren. For…

A: For 2020, the maximum amount of gift to an individual without having to pay gift tax is $15000 to…

Q: Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with…

A: 14-year child can get a child tax credit i.e $3,000 And 18 year old can be claimed as dependent i.e…

Q: Brian and Kim have a 12-year-old child, Stan. For 2018, Brian and Kim have taxable income of…

A: Stan has more than $2,100 unearned income, kiddle tax rates will be applicable on her income.

Q: Paul, age 40 and single, has an 8-year-old son, Larry. Larry resides with his mother, Susan, in her…

A: Answer:- Standard deduction:- Standard deduction is that portion of income which is not subject to…

Q: Rex and Dena are married and have two children, Michelle (age seven) and Nancy (age five). During…

A: Tax credits: Tax credit reduces the tax liability of the tax payer. Through tax credit an individual…

Q: Matt and Kate have an AGI of $200,000 and they file married filing jointly and claim two dependent…

A: For the tax year 2020, eligible taxpayers can claim a tax credit of $2,000 per qualifying dependent…

Q: Xialu is a single taxpayer who is under age 65 and in good health. For 2020, she has a salary of…

A: (a) The allowable standard deduction of $12,400 is higher than itemised deduction of $7,000…

Q: Harry is divorced from Kate. Pursuant to the divorce decree, they alternate years claiming their…

A: The Recovery Rebate Credit a part of Coronavirus Aid Relief and…

Q: Richard and Alice are divorced and under the terms of their written divorce agreement signed on…

A: Tax: Tax refers to a compulsory payment or a contribution to the state revenue, levied by the…

Q: Frankie lives in NJ, is divorced with one child, and made $80,000 last year. He qualified for…

A: Taxable income is the part of gross income which is taxable by the government, calculated by adding…

Q: 6,000 of tuition and $3,660 for room and board for Dante Dante, a full-time first-year student at…

A: The American Opportunity Tax Credit, which provides taxpayers with a credit of up to $2,500 per year…

Q: Brian and Kim have a 12-year-old child, Stan. For 2019, Brain and Kim have taxable income of…

A: Brian and Kim are minor kids their taxable income=$52000 Stan's Interest income=$4500

Q: Antonio and Maria deduct for state taxes?

A: a. Itemized deductions of $9,500 and deduct $5,600 for taxes on Antonio’s Schedule C for his…

Q: evelyn is 68 years old, her tax filing status is single, her adjusted gross income (AGI) is $16,000,…

A: Credit for the elderly or permanently and totally disabled is available subject to certain income…

Q: Sally and Jim are married and have taxable income in 2019 of $700,000. If they could file their…

A: You have the option to file either as single individual Filers or as married couples. So marriage…

Q: Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with…

A: It is subject to phase outs when Married filing Jointly Adjusted Gross Income > $ 400,000 /- by…

Q: In each of the following situations, determine whether the taxpayer(s) has/have a dependent and if…

A: Dependent: A dependent is a person who is financially reliant on another person, and this might…

Q: Elijah and Anastasia are husband and wife who have five married children and nine minor…

A: When a person transfer ownership of goods or property to another during his life at this time a tax…

Q: Sean, who is single, received social security benefits of $8,000, dividend income of $13,000, and…

A: Given information is: Social security benefits = $8000 Dividend Income = $13000 Interest Income =…

Q: Trey has two dependents, his daughters, ages 14 and 17, at year-end. Trey files a joint return with…

A: As per IRS, the maximum credit that per child under child tax credit is $2,000 if the age of the…

Q: Sheila and Joe Wells are married with no dependent children. During 2021, they have gross income of…

A: This question deals with the calculation of tax refund for year 2021. As per US tax code, First we…

Q: Trey has two dependents, his daughters, ages 14 and 17, at year-end. Trey files a joint return with…

A: Child Tax Credit = $2,000 per qualifying child (who are under age of 17 years) The child tax credit…

Q: Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with…

A: In order to qualify for the Child Tax Credit, the Child's age must be under 17 and Child Tax Credit…

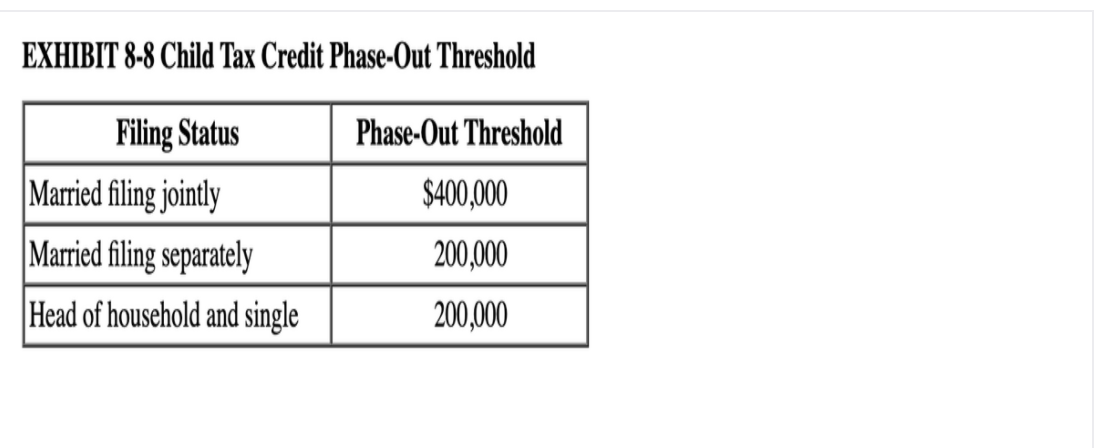

Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his wife.

What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2021 for his daughters under each of the following alternative situations? Use Exhibit 8-8.

c. His AGI is $425,600, and his daughters are ages 10 and 12.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Activity 5Answer the following questions below using the graduated tax table. Write your answer on the space provided after every questions.a. How much is the tax due on a taxable income of P150,000?Answer:b. How much is the tax due on a taxable income of P290,000?Answer:c. Ms. Carol earns compensation income of P3,230,000 during a taxable year. How much is the tax due of Ms. Carol? Answer:d. Mrs. Emily married earns compensation income of P460,000 during 2019. How much 1s the tax due of Mrs. Emily? Answer: Week 5 ACTIVITIES 5 29 Fundamentals of Accountancy, Business and Management 2e. The payslip of Mr. Budoy shows the following information:Basic salary P348,000SSS contribution 6,976PhilHealth contribution 4,500Pag-IBIG contribution 1,210How much is the tax due to Mr. Budoy?Answer:Question Content Area Victor and Maggie file a joint tax return for 2022 with adjusted gross income of $104,000. Victor and Maggie earned income of $30,000 and $74,000, respectively, during 2022. In order for both parents to be gainfully employed, they pay the following child care expenses for their 4-year-old son, J.J.: Union Day Care Center $6,700Wendy (Victor's mother) for babysitting 4,000 What is the amount of the child and dependent care credit they should report on their tax return for 2022 (assume no tax liability limitation)? a. $780 b. $3,745 c. $3,000 d. $2,899Chapter 3 Activity – Taxes Individual Income Tax Brackets (2021) Marginal Tax Rate Single, taxable income over: Joint, taxable income over: Head of Household, taxable income over: 10% $0 $0 $0 12% $9,950 $19,900 $14,200 22% $40,525 $81,050 $54,200 24% $86,375 $172,750 $86,350 32% $164,925 $329,850 $164,900 35% $209,425 $418,850 $209,400 37% $523,600 $628,300 $523,600 Standard Deduction Amounts (2021) Filing Status Deduction Amount Single $12,550 Married Filing Jointly $25,100 Head of Household $18,800 Long-term Capital Gains & Qualified Dividends (2021) Tax Rate Single Joint Head of Household 0% Under $40,000 Under $80,800 Under $54,100 15% $40,400 $80,800 $54,100 20% $445,850 $501,600 $473,750 Additional 3.8% Net Investment Income Tax for MAGI over $200,000 / $250,000 / $200,000 Calculate the federal income…

- Subject - Acounting Problem 7-6Earned Income Credit (LO 7.2) Diane is a single taxpayer who qualifies for the earned income credit. Diane has two qualifying children who are 3 and 5 years old. During 2022, Diane's wages are $19,800 and she receives dividend income of $1,200. Number of Qualifying Children Other than joint filers Joint filers Phaseout Begins Phaseout Ends Phaseout Begins Phaseout Ends None $11,610 $21,430 $17,560 $27,380 1 19,520 42,158 25,470 48,108 2 19,520 47,915 25,470 53,865 3 or more 19,520 51,464 25,470 57,414 Calculate Diane's earned income credit $ Would you kindly assist and explain:) I'm grateful for your help :)Required information Problem 8-50 (LO 8-1) (Static) [The following information applies to the questions displayed below.] Lacy is a single taxpayer. In 2021, her taxable income is $42,000. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Her $42,000 of taxable income includes $5,000 of qualified dividends.Question 1 (Marks - 10) Calculate Total Assessable Income, Taxable Income, Tax Liability, Student loan (HECS), Medicare Levy, and Medicare Levy Surcharge if applicable, for the taxpayer (Susanne) with the information below: • Susanne is a single and an Australian resident plans to lodge a tax return for the tax year 2020 - 2021. • Her total taxable income is $90,000 (Including tax withheld). • She does not have private health insurance. • Susanne has a student loan HECS outstanding for her previous study at Sydney University of $53,000. • Her employer pays superannuation guarantee charge of 9.5% on top of her salary to her nominated fund. • Susanne earned a passive income of $10,000 from the investments in shares in the same tax year.

- Example 6-4 Borden Company received a federal tax levy on John Kline. Kline is single, claims 2 personal allowances, and had a takehome pay of $621.00 this week. The amount of the tax levy (in 2020) would be: Take-home pay $621.00 Less: Exempt amount (from Figure 6.3). 403.84 Federal tax levy $217.16 Figure 6.32020 Table for Amount Exempt for Tax Levy (Single Person) Filing Status: Single PayPeriod Number of Exemptions Claimed on Statement 0 1 2 3 4 5 More Than 5 Daily 47.69 64.23 80.77 97.31 113.85 130.39 47.69 plus 16.54 foreach dependent Weekly 238.46 321.15 403.84 486.53 569.22 651.91 238.46 plus 82.69 foreach dependent Biweekly 476.92 642.30 807.68 973.06 1138.44 1303.82 476.92 plus 165.38 foreach dependent Semimonthly 516.67 695.84 875.01 1054.18 1233.35 1412.52 516.67 plus 179.17 foreach dependent Monthly 1033.33 1391.66 1749.99 2108.32 2466.65 2824.98 1033.33 plus 358.33 foreach dependent Source: Internal Revenue Service. Carson Holiday…CCH Federal Taxation-Comprehensive Topics 35. Beth, who is single, redeems her Series EE . bonds. She receives $12,000, consisting of $8,000 principal and $4,000 interest. Beth's qualified educational expenses total $16,500. Further, Beth's adjusted gross income for the year is $40,000. Determine what, if any, interest income Beth must include in her gross income.Proposed Regressive Plan (Regressive Tax) Calculate the tax for $95,000 . For example, $10,000x40%=$4,000 in tax. Show your work!! 40% on income up to $25,000 30% on income between $25,000 and $34,000 25% on income between $34,000 and $44,000 20% on income between $44,000 and $80,000 10% on taxable income over $80,000 TOTAL TAX PAID (sum of all rows):

- Presume business income as 20crores, apply the tax liability applicable as per new regime. Basic pay 22% Add surcharge 10% Add health & education cess 4%57. GRADUATED TAX TABLE UNDER TRAIN LAW (January 1, 2018 to December 31, 2022) Over But not over The tax shall be Plus Of excess over 250,000 0 0 - P 250,000 400,000 0 20% P 250,000 400,000 800,000 30,000 25% 400,000 800,000 2,000,000 130,000 30% 800,000 2,000,000 8,000,000 490,000 32% 2,000,000 8,000,000 2,410,000 35% 8,000,000 Nicanor, a Filipino Citizen residing in Manila, had the following data for the taxable year 2021: Gross income from rent of commercial spaces,net of P 60,000 withholding tax P 1,140,000 Dividend income From domestic corporation 50,000 From resident foreign corporation 60,000 From…Example 6-4 Borden Company received a federal tax levy on John Kline. Kline is single, claims 2 personal allowances, and had a takehome pay of $621.00 this week. The amount of the tax levy (in 2019) would be: Take-home pay $621.00 Less: Exempt amount (from Figure 6.3). 396.16 Federal tax levy $224.84 Figure 6.32019 Table for Amount Exempt for Tax Levy (Single Person) Filing Status: Single PayPeriod Number of Exemptions Claimed on Statement 0 1 2 3 4 5 More Than 5 Daily 46.92 63.07 79.22 95.37 111.52 127.67 46.92 plus 16.15 foreach dependent Weekly 234.62 315.39 396.16 476.93 557.70 638.47 234.62 plus 80.77 foreach dependent Biweekly 469.23 630.77 792.31 953.85 1115.39 1276.93 469.23 plus 161.54 foreach dependent Semimonthly 508.33 683.33 858.33 1033.33 1208.33 1383.33 508.33 plus 175 foreach dependent Monthly 1016.67 1366.67 1716.67 2066.67 2416.67 2766.67 1016.67 plus 350 foreach dependent Source: Internal Revenue Service. Carson Holiday has a…