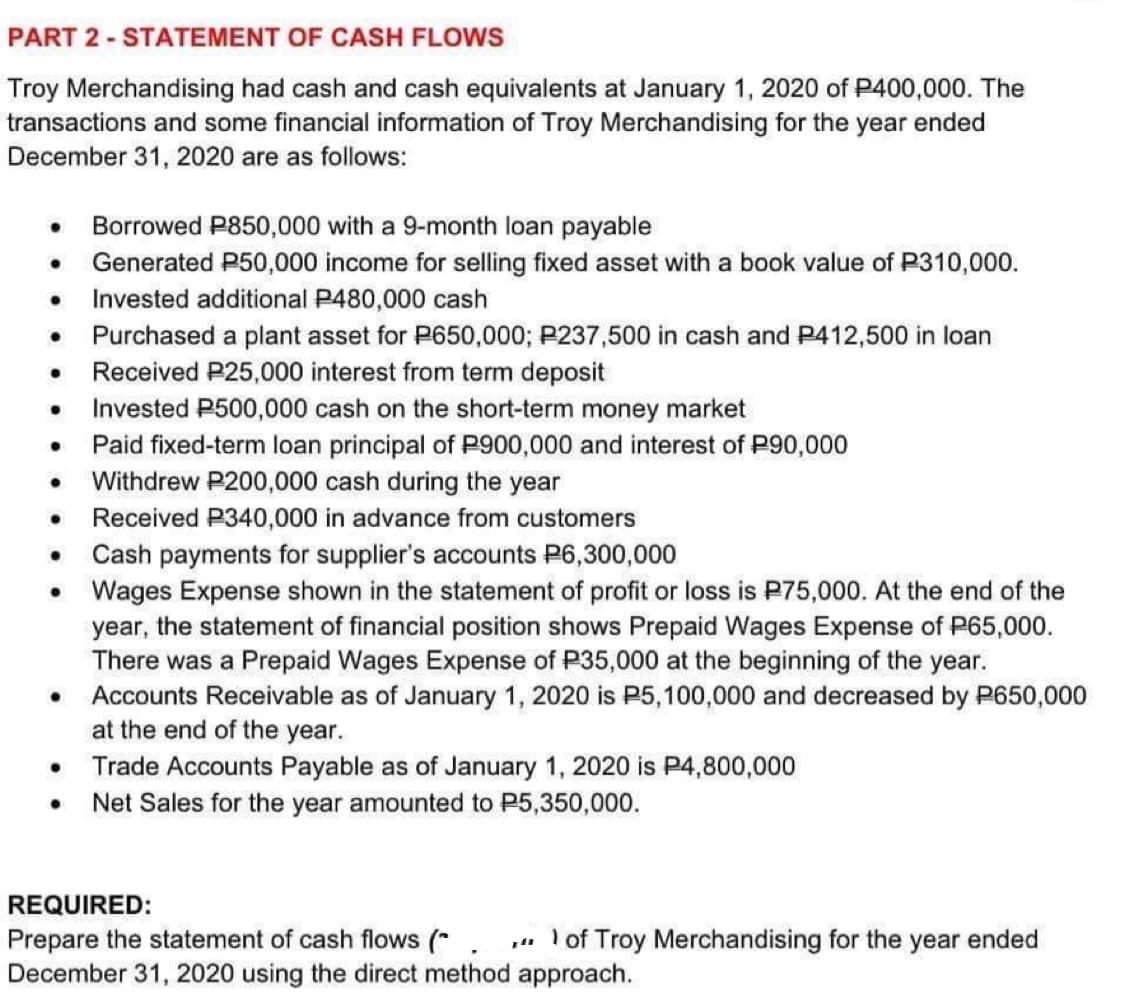

Troy Merchandising had cash and cash equivalents at January 1, 2020 of P400,000. The transactions and some financial information of Troy Merchandising for the year ended December 31, 2020 are as follows: Borrowed P850,000 with a 9-month loan payable Generated P50,000 income for selling fixed asset with a book value of P310,000. ● Invested additional P480,000 cash ● ● ● ● ● ● ● Cash payments for supplier's accounts P6,300,000 Wages Expense shown in the statement of profit or loss is P75,000. At the end of the year, the statement of financial position shows Prepaid Wages Expense of P65,000. There was a Prepaid Wages Expense of P35,000 at the beginning of the year. Accounts Receivable as of January 1, 2020 is P5,100,000 and decreased by P650,000 at the end of the year. • • Purchased a plant asset for P650,000; P237,500 in cash and P412,500 in loan Received P25,000 interest from term deposit Invested P500,000 cash on the short-term money market Paid fixed-term loan principal of P900,000 and interest of P90,000 Withdrew P200,000 cash during the year Received P340,000 in advance from customers ● Trade Accounts Payable as of January 1, 2020 is P4,800,000 Net Sales for the year amounted to P5,350,000. REQUIRED: Prepare the statement of cash flows ( of Troy Merchandising for the year ended December 31, 2020 using the direct method approach.

Troy Merchandising had cash and cash equivalents at January 1, 2020 of P400,000. The transactions and some financial information of Troy Merchandising for the year ended December 31, 2020 are as follows: Borrowed P850,000 with a 9-month loan payable Generated P50,000 income for selling fixed asset with a book value of P310,000. ● Invested additional P480,000 cash ● ● ● ● ● ● ● Cash payments for supplier's accounts P6,300,000 Wages Expense shown in the statement of profit or loss is P75,000. At the end of the year, the statement of financial position shows Prepaid Wages Expense of P65,000. There was a Prepaid Wages Expense of P35,000 at the beginning of the year. Accounts Receivable as of January 1, 2020 is P5,100,000 and decreased by P650,000 at the end of the year. • • Purchased a plant asset for P650,000; P237,500 in cash and P412,500 in loan Received P25,000 interest from term deposit Invested P500,000 cash on the short-term money market Paid fixed-term loan principal of P900,000 and interest of P90,000 Withdrew P200,000 cash during the year Received P340,000 in advance from customers ● Trade Accounts Payable as of January 1, 2020 is P4,800,000 Net Sales for the year amounted to P5,350,000. REQUIRED: Prepare the statement of cash flows ( of Troy Merchandising for the year ended December 31, 2020 using the direct method approach.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 12P

Related questions

Question

Please do it in excel. Thank you

Transcribed Image Text:PART 2-STATEMENT OF CASH FLOWS

Troy Merchandising had cash and cash equivalents at January 1, 2020 of P400,000. The

transactions and some financial information of Troy Merchandising for the year ended

December 31, 2020 are as follows:

Borrowed P850,000 with a 9-month loan payable

Generated P50,000 income for selling fixed asset with a book value of P310,000.

● Invested additional P480,000 cash

●

●

●

●

●

●

●

●

●

Purchased a plant asset for P650,000; P237,500 in cash and P412,500 in loan

Received P25,000 interest from term deposit

Invested P500,000 cash on the short-term money market

Paid fixed-term loan principal of P900,000 and interest of P90,000

Withdrew P200,000 cash during the year

Received P340,000 in advance from customers

Cash payments for supplier's accounts P6,300,000

Wages Expense shown in the statement of profit or loss is P75,000. At the end of the

year, the statement of financial position shows Prepaid Wages Expense of P65,000.

There was a Prepaid Wages Expense of P35,000 at the beginning of the year.

Accounts Receivable as of January 1, 2020 is P5,100,000 and decreased by P650,000

at the end of the year.

Trade Accounts Payable as of January 1, 2020 is P4,800,000

Net Sales for the year amounted to P5,350,000.

REQUIRED:

Prepare the statement of cash flows (*.

December 31, 2020 using the direct method approach.

of Troy Merchandising for the year ended

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT