TRUE OR FALSE? (Based on the book.) The effect of a lender agreeing to give the borrowing entity a grace period within the reporting period will make a liability noncurrent.

TRUE OR FALSE? (Based on the book.) The effect of a lender agreeing to give the borrowing entity a grace period within the reporting period will make a liability noncurrent.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

TRUE OR FALSE? (Based on the book.)

The effect of a lender agreeing to give the borrowing entity a grace period within the reporting period will make a liability noncurrent.

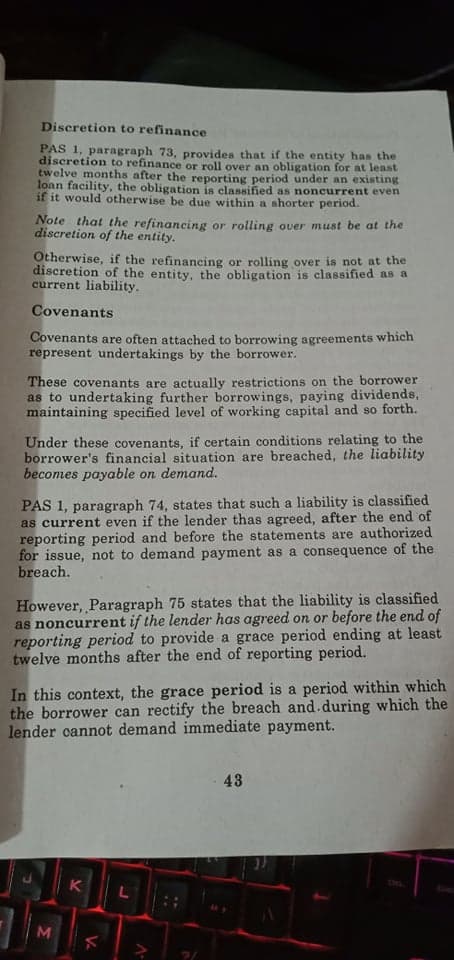

Transcribed Image Text:Discretion to refinance

PAS 1, paragraph 73, provides that if the entity has the

discretion to refinance or roll over an obligation for at least

twelve months after the reporting period under an existing

loan facility, the obligation is classifed as noncurrent even

if it would otherwise be due within a shorter period.

Note that the refinancing or rolling over must be at the

discretion of the entity.

Otherwise, if the refinancing or rolling over is not at the

discretion of the entity, the obligation is classified as a

current liability.

Covenants

Covenants are often attached to borrowing agreements which

represent undertakings by the borrower.

These covenants are actually restrictions on the borrower

as to undertaking further borrowings, paying dividends,

maintaining specified level of working capital and so forth.

Under these covenants, if certain conditions relating to the

borrower's financial situation are breached, the liability

becomes payable on demand.

PAS 1, paragraph 74, states that such a liability is classified

as current even if the lender thas agreed, after the end of

reporting period and before the statements are authorized

for issue, not to demand payment as a consequence of the

breach.

However, Paragraph 75 states that the liability is classified

as noncurrent if the lender has agreed on or before the end of

reporting period to provide a grace period ending at least

twelve months after the end of reporting period.

In this context, the grace period is a period within which

the borrower can rectify the breach and.during which the

lender cannot demand immediate payment.

43

K

M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education