As regards antichresis, which of the following is not correct? * a. The amount of the principal and of the interest shall be specified in writing, otherwise the contract of anti chresis shall be void b. The debtor, unless there is stipulation to the contrary is obliged to pay the taxes ar charges upon the estate c. The debtor cannot reacquire the enjoyment of the immovable without first having totally paid what he owes the creditor d. The creditor is bound to bear the expenses necessary for the preservation and repair of the immovable

As regards antichresis, which of the following is not correct? * a. The amount of the principal and of the interest shall be specified in writing, otherwise the contract of anti chresis shall be void b. The debtor, unless there is stipulation to the contrary is obliged to pay the taxes ar charges upon the estate c. The debtor cannot reacquire the enjoyment of the immovable without first having totally paid what he owes the creditor d. The creditor is bound to bear the expenses necessary for the preservation and repair of the immovable

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 1DQ

Related questions

Question

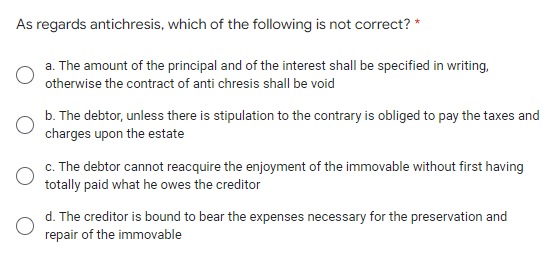

Transcribed Image Text:As regards antichresis, which of the following is not correct? *

a. The amount of the principal and of the interest shall be specified in writing,

otherwise the contract of anti chresis shall be void

b. The debtor, unless there is stipulation to the contrary is obliged to pay the taxes and

charges upon the estate

c. The debtor cannot reacquire the enjoyment of the immovable without first having

totally paid what he owes the creditor

d. The creditor is bound to bear the expenses necessary for the preservation and

repair of the immovable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT