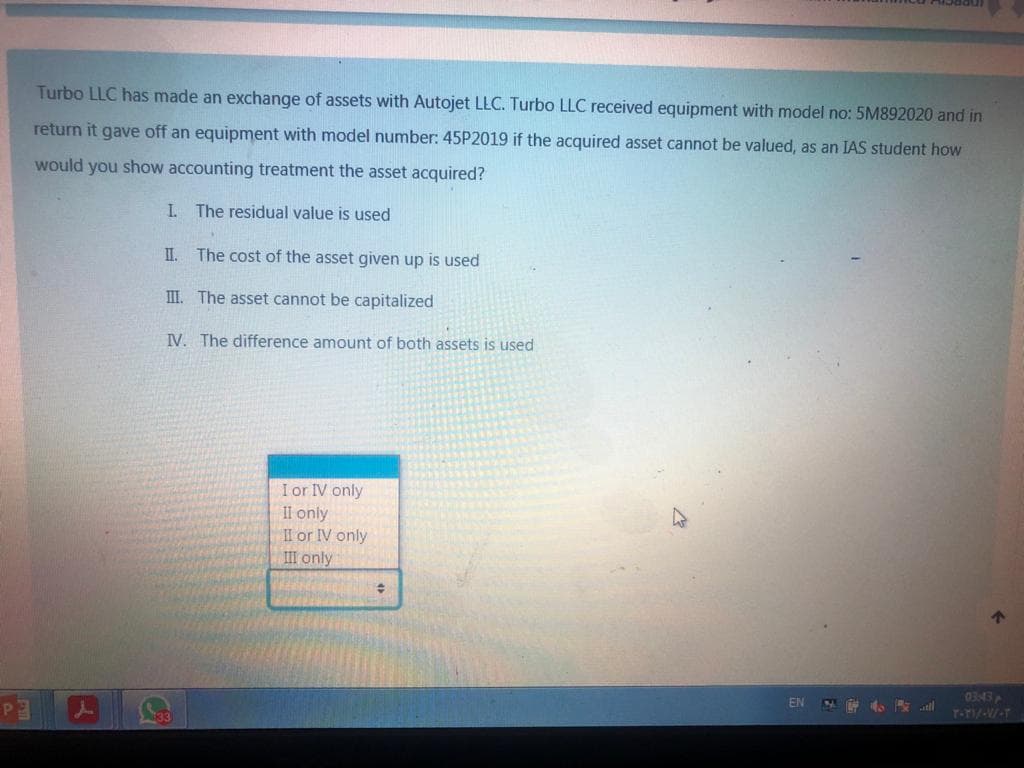

Turbo LLC has made an exchange of assets with Autojet LLC. Turbo LLC received equipment with model no: 5M892020 and in return it gave off an equipment with model number: 45P2019 if the acquired asset cannot be valued, as an IAS student how would you show accounting treatment the asset acquired? I The residual value is used II. The cost of the asset given up is used III. The asset cannot be capitalized IV. The difference amount of both assets is used

Turbo LLC has made an exchange of assets with Autojet LLC. Turbo LLC received equipment with model no: 5M892020 and in return it gave off an equipment with model number: 45P2019 if the acquired asset cannot be valued, as an IAS student how would you show accounting treatment the asset acquired? I The residual value is used II. The cost of the asset given up is used III. The asset cannot be capitalized IV. The difference amount of both assets is used

Chapter17: Property Transactions: §1231 And Recapture Provisions

Section: Chapter Questions

Problem 55P: Jay sold three items of business equipment for a total of 300,000. None of the equipment was...

Related questions

Question

Transcribed Image Text:Turbo LLC has made an exchange of assets with Autojet LLC. Turbo LLC received equipment with model no: 5M892020 and in

return it gave off an equipment with model number: 45P2019 if the acquired asset cannot be valued, as an IAS student how

would you show accounting treatment the asset acquired?

I The residual value is used

I.

The cost of the asset given up is used

III. The asset cannot be capitalized

IV. The difference amount of both assets is used

I or IV only

Il only

II or IV only

III only

0343P

T-TI/-W-T

EN

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT