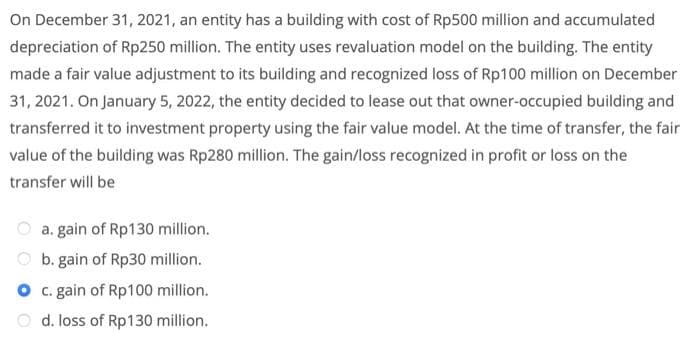

On December 31, 2021, an entity has a building with cost of Rp500 million and accumulated depreciation of Rp250 million. The entity uses revaluation model on the building. The entity made a fair value adjustment to its building and recognized loss of Rp100 million on December 31, 2021. On January 5, 2022, the entity decided to lease out that owner-occupied building and transferred it to investment property using the fair value model. At the time of transfer, the fair value of the building was Rp280 million. The gain/loss recognized in profit or loss on the transfer will be a. gain of Rp130 million. b. gain of Rp30 million. O c. gain of Rp100 million. O d. loss of Rp130 million.

On December 31, 2021, an entity has a building with cost of Rp500 million and accumulated depreciation of Rp250 million. The entity uses revaluation model on the building. The entity made a fair value adjustment to its building and recognized loss of Rp100 million on December 31, 2021. On January 5, 2022, the entity decided to lease out that owner-occupied building and transferred it to investment property using the fair value model. At the time of transfer, the fair value of the building was Rp280 million. The gain/loss recognized in profit or loss on the transfer will be a. gain of Rp130 million. b. gain of Rp30 million. O c. gain of Rp100 million. O d. loss of Rp130 million.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 6RE

Related questions

Question

Transcribed Image Text:On December 31, 2021, an entity has a building with cost of Rp500 million and accumulated

depreciation of Rp250 million. The entity uses revaluation model on the building. The entity

made a fair value adjustment to its building and recognized loss of Rp100 million on December

31, 2021. On January 5, 2022, the entity decided to lease out that owner-occupied building and

transferred it to investment property using the fair value model. At the time of transfer, the fair

value of the building was Rp280 million. The gain/loss recognized in profit or loss on the

transfer will be

a. gain of Rp130 million.

O b. gain of Rp30 million.

O .gain of Rp100 million.

O d. loss of Rp130 million.

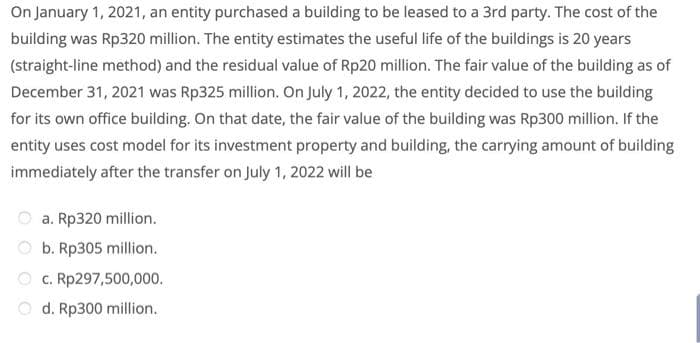

Transcribed Image Text:On January 1, 2021, an entity purchased a building to be leased to a 3rd party. The cost of the

building was Rp320 million. The entity estimates the useful life of the buildings is 20 years

(straight-line method) and the residual value of Rp20 million. The fair value of the building as of

December 31, 2021 was Rp325 million. On July 1, 2022, the entity decided to use the building

for its own office building. On that date, the fair value of the building was Rp300 million. If the

entity uses cost model for its investment property and building, the carrying amount of building

immediately after the transfer on July 1, 2022 will be

O a. Rp320 million.

O b. Rp305 million.

c. Rp297,500,000.

O d. Rp300 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College