Туре of Auditor Туре of Audit 1. Analyze proprietary schools' spending to train students for low-demand occupations. 2. Determine whether an advertising agency's financial statements are fairly presented in conformity with GAAP. 3. Study the effectiveness of the Department of Defense's expendable launch vehicle program. 4. Compare costs of municipal garbage pickup services to comparable services subcontracted to a private business. 5. Investigate financing terms of tax shelter partnerships. 6. Study a private aircraft manufacturer's test pilot performance in reporting on the results of test flights. 7. Conduct periodic examinations by the U.S. Comptroller of Currency of a national bank for solvency. 8. Evaluate the promptness of materials inspection in a manufacturer's receiving department. 9. Report on the need for the states to consider reporting requirements for chemical use data. 10. Render a public report on the assumptions and compilation of a revenue forecast by a sports stadium/racetrack complex.

Туре of Auditor Туре of Audit 1. Analyze proprietary schools' spending to train students for low-demand occupations. 2. Determine whether an advertising agency's financial statements are fairly presented in conformity with GAAP. 3. Study the effectiveness of the Department of Defense's expendable launch vehicle program. 4. Compare costs of municipal garbage pickup services to comparable services subcontracted to a private business. 5. Investigate financing terms of tax shelter partnerships. 6. Study a private aircraft manufacturer's test pilot performance in reporting on the results of test flights. 7. Conduct periodic examinations by the U.S. Comptroller of Currency of a national bank for solvency. 8. Evaluate the promptness of materials inspection in a manufacturer's receiving department. 9. Report on the need for the states to consider reporting requirements for chemical use data. 10. Render a public report on the assumptions and compilation of a revenue forecast by a sports stadium/racetrack complex.

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 6RP

Related questions

Question

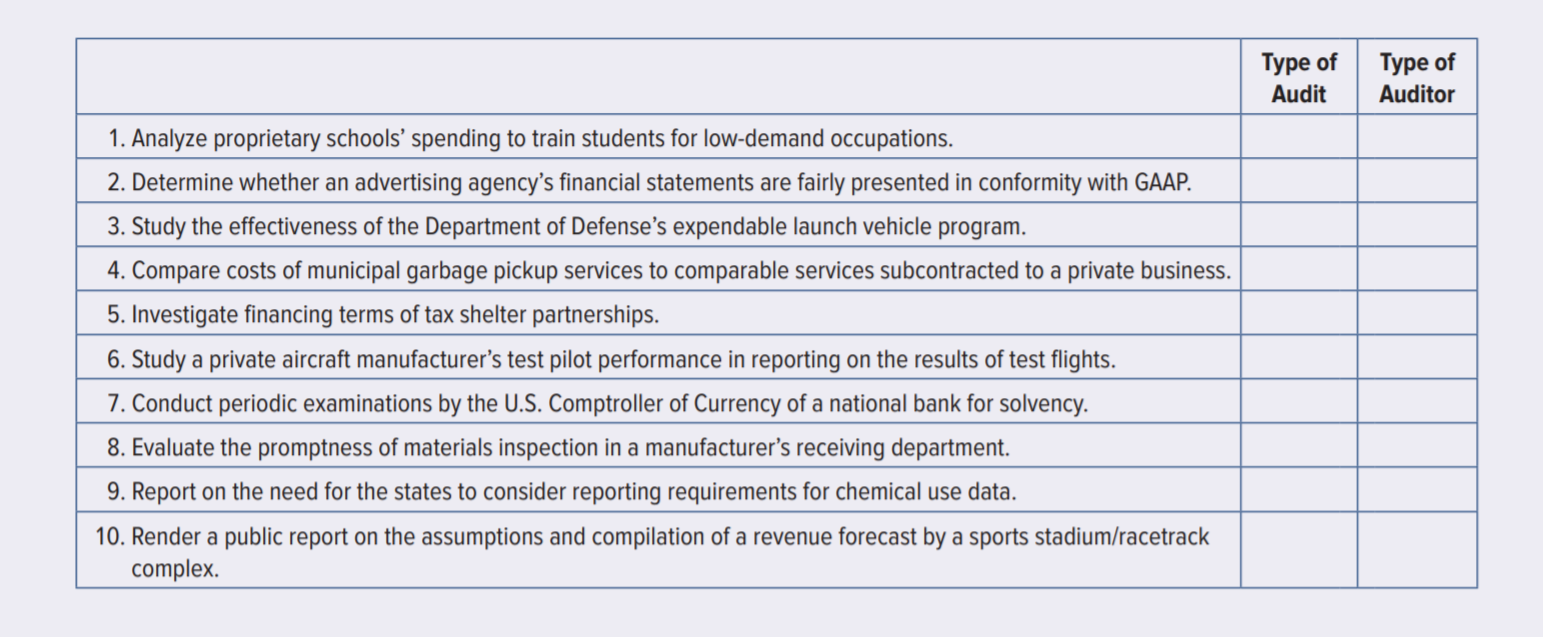

Audits may be characterized as (a) financial statement audits, (b) compliance audits, (c) economy and efficiency audits, and (d) program results audits. The work can be done by independent (external) auditors, internal auditors, or governmental auditors (including IRS auditors and federal bank examiners). Following is a list of the purposes or products of various audit engagements:

Check the below image for list of purposes-

Required:

For each of the engagements listed, indicate (1) the type of audit (financial statement, compliance, economy and efficiency, or program results) and (2) the type of auditors you would expect to be involved.

Transcribed Image Text:Туре of

Auditor

Туре of

Audit

1. Analyze proprietary schools' spending to train students for low-demand occupations.

2. Determine whether an advertising agency's financial statements are fairly presented in conformity with GAAP.

3. Study the effectiveness of the Department of Defense's expendable launch vehicle program.

4. Compare costs of municipal garbage pickup services to comparable services subcontracted to a private business.

5. Investigate financing terms of tax shelter partnerships.

6. Study a private aircraft manufacturer's test pilot performance in reporting on the results of test flights.

7. Conduct periodic examinations by the U.S. Comptroller of Currency of a national bank for solvency.

8. Evaluate the promptness of materials inspection in a manufacturer's receiving department.

9. Report on the need for the states to consider reporting requirements for chemical use data.

10. Render a public report on the assumptions and compilation of a revenue forecast by a sports stadium/racetrack

complex.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning