Turner (cable networks and digital media) Home Box Office (pay television) Warner Bros. (films, television, and videos) Turner Home Box Office Warner Bros. Segment Revenues (in millions) Assume that the variable costs as a percent of sales for each segment are as follows: Revenues Variable costs $94,300 79,200 29,300 a. Determine the contribution margin and contribution margin ratio for each segment from the information given. When required, round to the nearest whole millionth (for example, round 5,688.7 to 5,689). Round contribution margin ratio to whole percents for each segment from the information given. Contribution margin. Contribution margin ratio (as a percent) 40% 51% 37% Turner % Home Box Offic b. Does your answer to (a) mean that the other segments are more profitable businesses? The higher contribution margin ratio of a segment should not be interpreted as being the profitable segment. If the volume of business is not sufficient to exceed the break-even point, then the segments would be . In the final analysis, the fixed costs also should be considered in determining the overall profitability of the segments. The Ishows how sensitive

Turner (cable networks and digital media) Home Box Office (pay television) Warner Bros. (films, television, and videos) Turner Home Box Office Warner Bros. Segment Revenues (in millions) Assume that the variable costs as a percent of sales for each segment are as follows: Revenues Variable costs $94,300 79,200 29,300 a. Determine the contribution margin and contribution margin ratio for each segment from the information given. When required, round to the nearest whole millionth (for example, round 5,688.7 to 5,689). Round contribution margin ratio to whole percents for each segment from the information given. Contribution margin. Contribution margin ratio (as a percent) 40% 51% 37% Turner % Home Box Offic b. Does your answer to (a) mean that the other segments are more profitable businesses? The higher contribution margin ratio of a segment should not be interpreted as being the profitable segment. If the volume of business is not sufficient to exceed the break-even point, then the segments would be . In the final analysis, the fixed costs also should be considered in determining the overall profitability of the segments. The Ishows how sensitive

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 16E

Related questions

Question

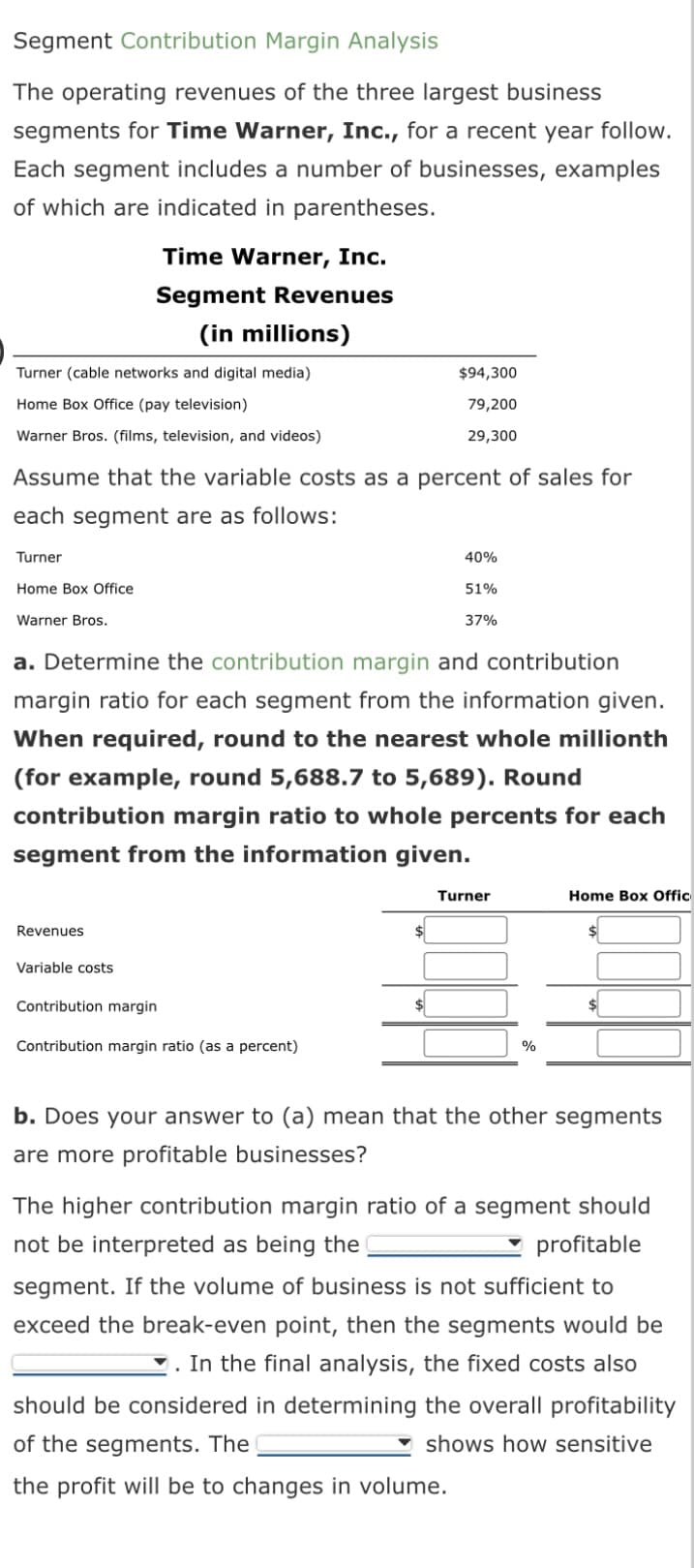

Transcribed Image Text:Segment Contribution Margin Analysis

The operating revenues of the three largest business

segments for Time Warner, Inc., for a recent year follow.

Each segment includes a number of businesses, examples

of which are indicated in parentheses.

Turner (cable networks and digital media)

Home Box Office (pay television)

Warner Bros. (films, television, and videos)

Turner

Home Box Office

Warner Bros.

Time Warner, Inc.

Segment Revenues

(in millions)

Assume that the variable costs as a percent of sales for

each segment are as follows:

Revenues

Variable costs

$94,300

79,200

29,300

a. Determine the contribution margin and contribution

margin ratio for each segment from the information given.

When required, round to the nearest whole millionth

(for example, round 5,688.7 to 5,689). Round

contribution margin ratio to whole percents for each

segment from the information given.

Contribution margin

Contribution margin ratio (as a percent)

40%

51%

37%

Turner

%

Home Box Offic

b. Does your answer to (a) mean that the other segments

are more profitable businesses?

The higher contribution margin ratio of a segment should

not be interpreted as being the

profitable

segment. If the volume of business is not sufficient to

exceed the break-even point, then the segments would be

. In the final analysis, the fixed costs also

should be considered in determining the overall profitability

of the segments. The

Ishows how sensitive

the profit will be to changes in volume.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning