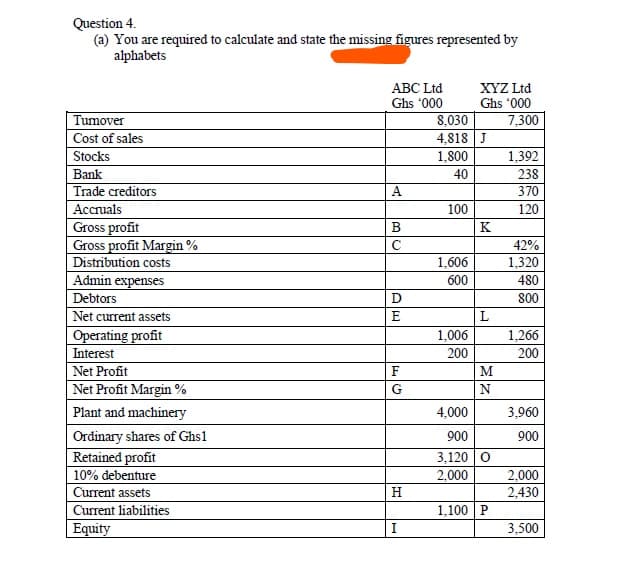

Turnover Cost of sales Stocks Bank Trade creditors Accruals Gross profit Gross profit Margin % Distribution costs Admin expenses Debtors Net current assets Operating profit Interest Net Profit Net Profit Margin % Plant and machinery Ordinary shares of Ghs1 Retained profit 10% debenture Current assets Current liabilities Equity ABC Ltd Ghs '000 A BU C DE F G H I XYZ Ltd Ghs '000 8,030 4,818 J 1,800 40 100 1,606 600 1,006 200 4,000 900 3,120 O 2,000 1,100 P K L M N 7,300 1.392 238 370 120 42% 1,320 480 800 1,266 200 3,960 900 2,000 2,430 3.500

Turnover Cost of sales Stocks Bank Trade creditors Accruals Gross profit Gross profit Margin % Distribution costs Admin expenses Debtors Net current assets Operating profit Interest Net Profit Net Profit Margin % Plant and machinery Ordinary shares of Ghs1 Retained profit 10% debenture Current assets Current liabilities Equity ABC Ltd Ghs '000 A BU C DE F G H I XYZ Ltd Ghs '000 8,030 4,818 J 1,800 40 100 1,606 600 1,006 200 4,000 900 3,120 O 2,000 1,100 P K L M N 7,300 1.392 238 370 120 42% 1,320 480 800 1,266 200 3,960 900 2,000 2,430 3.500

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter15: Financial Statements And Year-end Accounting For A Merchandising Business

Section: Chapter Questions

Problem 4CE

Related questions

Question

Transcribed Image Text:Question 4.

(a) You are required to calculate and state the missing figures represented by

alphabets

ABC Ltd

XYZ Ltd

Ghs '000

Ghs '000

7,300

1,392

A

B

с

D

E

F

G

H

I

Turnover

Cost of sales

Stocks

Bank

Trade creditors

Accruals

Gross profit

Gross profit Margin%

Distribution costs

Admin expenses

Debtors

Net current assets

Operating profit

Interest

Net Profit

Net Profit Margin %

Plant and machinery

Ordinary shares of Ghs1

Retained profit

10% debenture

Current assets

Current liabilities

Equity

8,030

4,818 J

1,800

40

100

1,606

600

1,006

K

L

200

4,000

900

3,120 O

2,000

1,100 P

M

N

238

370

120

42%

1,320

480

800

1,266

200

3,960

900

2,000

2,430

3,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning