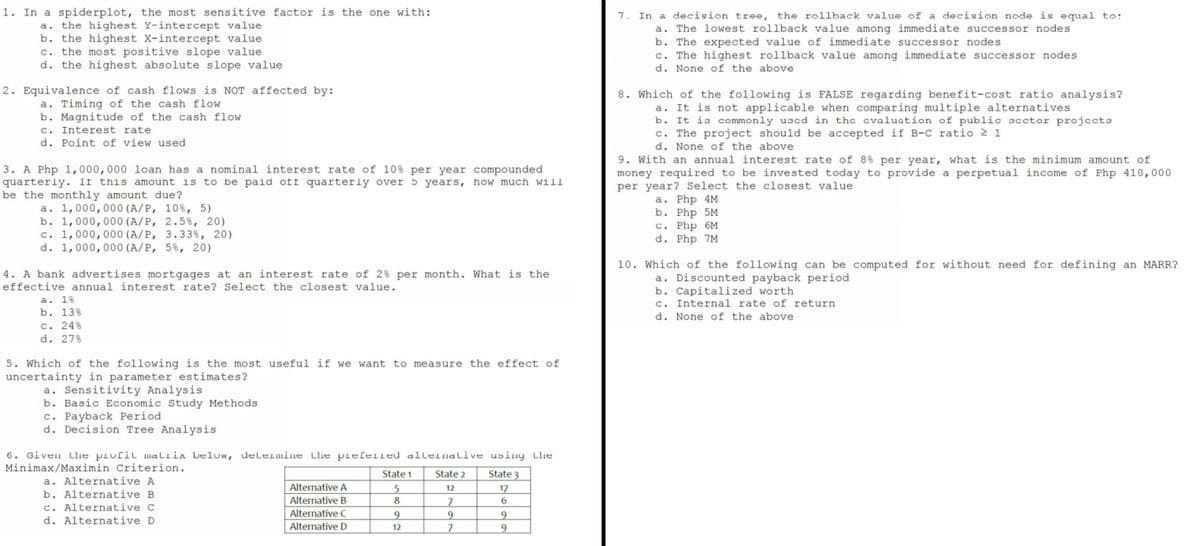

1. In a spiderplot, the most sensitive factor is the one with: a. the highest Y-intercept value b. the highest X-intercept value c. the most positive slope value d. the highest absolute slope value 2. Equivalence of cash flows is NOT affected by: a. Timing of the cash flow b. Magnitude of the cash flow c. Interest rate. d. Point of view used 3. A Php 1,000,000 loan has a nominal interest rate of 10% per year compounded quarterly. If this amount is to be paid ott quarterly over 5 years, how much will be the monthly amount due? a. 1,000,000 (A/P, 10%, 5) b. 1,000,000 (A/P, 2.5%, 20) c. 1,000,000 (A/P, 3.33%, 20) d. 1,000,000 (A/P, 5%, 20)

1. In a spiderplot, the most sensitive factor is the one with: a. the highest Y-intercept value b. the highest X-intercept value c. the most positive slope value d. the highest absolute slope value 2. Equivalence of cash flows is NOT affected by: a. Timing of the cash flow b. Magnitude of the cash flow c. Interest rate. d. Point of view used 3. A Php 1,000,000 loan has a nominal interest rate of 10% per year compounded quarterly. If this amount is to be paid ott quarterly over 5 years, how much will be the monthly amount due? a. 1,000,000 (A/P, 10%, 5) b. 1,000,000 (A/P, 2.5%, 20) c. 1,000,000 (A/P, 3.33%, 20) d. 1,000,000 (A/P, 5%, 20)

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 16MC: When using the NPV method for a particular investment decision, if the present value of all cash...

Related questions

Question

Transcribed Image Text:1. In a spiderplot, the most sensitive factor is the one with:

a. the highest Y-intercept value

b. the highest X-intercept value

c. the most positive slope value.

d. the highest absolute slope value

2. Equivalence of cash flows is NOT affected by:

a. Timing of the cash flow

b. Magnitude of the cash flow

c. Interest rate.

d. Point of view used

3. A Php 1,000,000 loan has a nominal interest rate of 10% per year compounded.

quarterly. If this amount is to be paid oft quarterly over 5 years, how much will

be the monthly amount due?

a. 1,000,000 (A/P, 10%, 5)

b. 1,000,000 (A/P, 2.5%, 20)

c. 1,000,000 (A/P, 3.33%, 20)

d. 1,000,000 (A/P, 5%, 20)

4. A bank advertises mortgages at an interest rate of 2% per month. What is the

effective annual interest rate? Select the closest value.

a. 1%

b. 13%

c. 24%

d. 27%

5. Which of the following is the most useful if we want to measure the effect of

uncertainty in parameter estimates?

a. Sensitivity Analysis

b. Basic Economic Study Methods

c. Payback Period.

d. Decision Tree Analysis.

6. Given the profil maliix below, determine the preferred alternative

Minimax/Maximin Criterion.

using the

State 3

State 2

a. Alternative A

State 1

5

12

17

b. Alternative B

Alternative A

Alternative B

8

7

6

c. Alternative C

Alternative C

9

9

9

d. Alternative D.

Alternative D

12

7

9

7. In a decision tree, the rollback value of a decision node is equal to:

a. The lowest rollback value among immediate successor nodes

b. The expected value of immediate successor nodes

c. The highest rollback value among immediate successor nodes.

d. None of the above

8. Which of the following is FALSE regarding benefit-cost ratio analysis?

a. It is not applicable when comparing multiple alternatives

b. It is commonly used in the evaluation of public sector projects

c. The project should be accepted if B-C ratio 2 1

d. None of the above

9. With an annual interest rate of 8% per year, what is the minimum amount of

money required to be invested today to provide a perpetual income of Php 418,000

per year? Select the closest value

a. Php 4M

b. Php 5M

C. Php 6M

d. Php 7M

10. Which of the following can be computed for without need for defining an MARR?

a. Discounted payback period

b. Capitalized worth

c. Internal rate of return.

d. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning