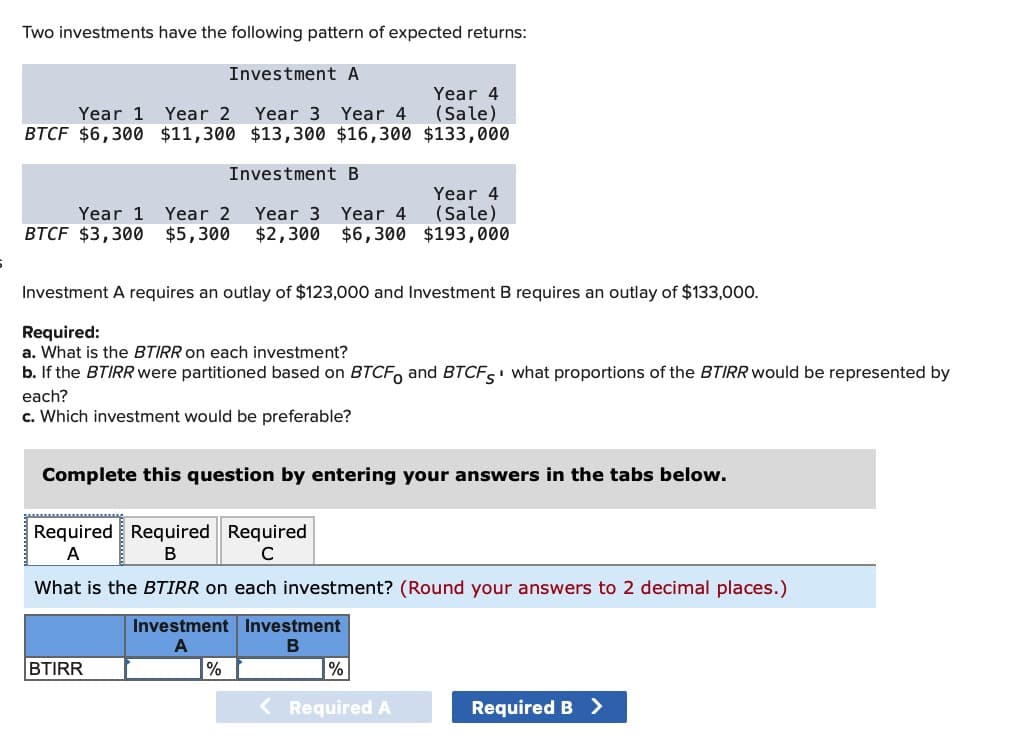

Two investments have the following pattern of expected returns: Investment A Year 1 Year 2 Year 3 Year 4 Year 4 (Sale) BTCF $6,300 $11,300 $13,300 $16,300 $133,000 Investment B Year 1 Year 2 Year 3 Year 4 BTCF $3,300 $5,300 $2,300 Year 4 $6,300 (Sale) $193,000 Investment A requires an outlay of $123,000 and Investment B requires an outlay of $133,000. Required: a. What is the BTIRR on each investment? b. If the BTIRR were partitioned based on BTCFO and BTCFS what proportions of the BTIRR would be represented by each? c. Which investment would be preferable? Complete this question by entering your answers in the tabs below. Required Required Required A B C What is the BTIRR on each investment? (Round your answers to 2 decimal places.) Investment Investment A B BTIRR % % < Required A Required B >

Two investments have the following pattern of expected returns: Investment A Year 1 Year 2 Year 3 Year 4 Year 4 (Sale) BTCF $6,300 $11,300 $13,300 $16,300 $133,000 Investment B Year 1 Year 2 Year 3 Year 4 BTCF $3,300 $5,300 $2,300 Year 4 $6,300 (Sale) $193,000 Investment A requires an outlay of $123,000 and Investment B requires an outlay of $133,000. Required: a. What is the BTIRR on each investment? b. If the BTIRR were partitioned based on BTCFO and BTCFS what proportions of the BTIRR would be represented by each? c. Which investment would be preferable? Complete this question by entering your answers in the tabs below. Required Required Required A B C What is the BTIRR on each investment? (Round your answers to 2 decimal places.) Investment Investment A B BTIRR % % < Required A Required B >

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 3CMA

Related questions

Question

Nikulbhai

Transcribed Image Text:Two investments have the following pattern of expected returns:

Investment A

Year 1 Year 2

Year 3 Year 4

Year 4

(Sale)

BTCF $6,300 $11,300 $13,300 $16,300 $133,000

Investment B

Year 1 Year 2 Year 3 Year 4

BTCF $3,300

$5,300

$2,300

Year 4

$6,300

(Sale)

$193,000

Investment A requires an outlay of $123,000 and Investment B requires an outlay of $133,000.

Required:

a. What is the BTIRR on each investment?

b. If the BTIRR were partitioned based on BTCFO and BTCFS what proportions of the BTIRR would be represented by

each?

c. Which investment would be preferable?

Complete this question by entering your answers in the tabs below.

Required Required Required

A

B

C

What is the BTIRR on each investment? (Round your answers to 2 decimal places.)

Investment Investment

A

B

BTIRR

%

%

< Required A

Required B >

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT