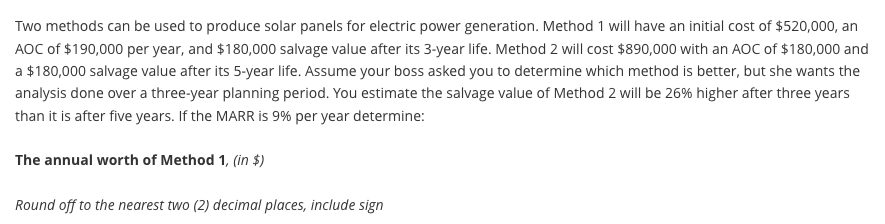

Two methods can be used to produce solar panels for electric power generation. Method 1 will have an initial cost of $520,000, an AOC of $190,000 per year, and $180,000 salvage value after its 3-year life. Method 2 will cost $890,000 with an AOC of $180,000 and a $180,000 salvage value after its 5-year life. Assume your boss asked you to determine which method is better, but she wants the analysis done over a three-year planning period. You estimate the salvage value of Method 2 will be 26% higher after three years than it is after five years. If the MARR is 9% per year determine: The annual worth of Method 1, (in $) Round off to the nearest two (2) decimal places, include sign

Q: Use a logical way to provide an extended range of detailed factual information about the principles…

A: ANSWER : The principles of subsystems in a production machine, mixer machine, and packing machine…

Q: Dispersing particular value chain activities across many countries rather than concentrating them in…

A: Value chains play a crucial role in many firms' strategic planning processes nowadays. The whole…

Q: -2 20 1,0 1,0 The above is the graph of a system of linear inequality constraints. The corner points…

A: Given- The corner points (x, y) of the graph are:(5,18), (13,20), (15,12), (9,2)

Q: hello, can someone help me with this question?: if a company regularly holds 50 units of safety…

A: A safety stock would be an extra amount of a product kept in the inventories to lower the…

Q: Calculate the unconstrained order quantities Are these values optimal? If not, determine the optimal…

A:

Q: Can I have 2 other rules please?

A: Rules for ascertaining intention Rule A.—Where there is a contract for the sale of specific goods…

Q: Maximize z = 2x₁ - 1x₂ + 3x3 Subject to: 1x₁ - 5x₂ + x₂ ≤ 10 2x₁ - 1x₂1x₂ + < 40 X₁, X₂, X3 ²0…

A: Find the given details below: Objective Function: Maximize Z = 2x1 - x2 + 3x3…

Q: Manually apply the Hungarian algorithm to solve the following problem. Task 2 26 P Assignee Q R S 1…

A: If the number of column are not equal to number of rows in assignment problem before starting the…

Q: Office Depot has almost 1,000 office superstores and giant catalog of office supplies that it offers…

A: Based on the information provided, it seems that Office Depot has a strong online presence that…

Q: Calculate the average number of orders per month and order quantity for each component. In addition,…

A:

Q: (a) Determine the cost of each subplan that is possible in this problem (i.e., g(s, t) for s = 1, 2,…

A:

Q: 1) What was the most important decision made by the management of Caravan Engineering to meet…

A: Decision making is a process of selecting a wise option among the given list.

Q: What is the difference between a feasibility study and a business plan?

A: As per Bartleby guidelines, references or sources can not be provided. Rest complete solution is…

Q: ou have been assigned as the team leader for a group project to update the current HR vacation and…

A: 1. Introduction : The purpose of this team project is to update the current HR vacation and sick…

Q: Complete the table below and to predict the demand for Period 5 (See image).…

A: Here, First, I would apply the method-exponential smoothing with the trend adjustment, next, I would…

Q: Solve the following LP problems: 1. Maximize z = 1x₁ + 2x₂ + 3x3 Subject to: 1x₁ - 2x₂ + 3x₂ ≤ 10 x₂…

A: Given LP- Maximize Z = x1 + 2x2 + 3x3Subject to-x1 - 2x2 + 3x3 ≤ 10x1 + 2x2 ≤ 5x1 ≤ 1x1, x2, x3≥0

Q: Sales of PQR-Cool air conditioners have grown steadily during the past 5 years: The sales manager…

A: Ans) Explanation of how forecast will be calculated using exponential Smoothing and 3 period moving…

Q: An NC winery makes 4 types (1-4) of wine measured in gallons per year. Maximize profit. Formulate…

A:

Q: Which of the following is an example of a "back room" operation for an airline company? O…

A: Backroom operations: Backroom operations is defined as, it is a part of business…

Q: What is the importance of project organizational chart? How is this related to project controlling…

A: Project management is an important part of any business. It involves the planning, organizing, and…

Q: Under Armour • Segmented social media plan: Consider 2 or 3 customer segments that are interesting…

A: Company: Under Armour Segmented Social Media Plan: 1. Customer Segment: Athletes and Fitness…

Q: Why should one do a technical analysis in the first place? Explain how technicians use it, why they…

A: ANSWER : Technical analysis is a method used by traders and investors to evaluate securities by…

Q: Discuss the external analysis of Amazon related to how the company is using Blue Ocean Strategy.

A: Blue ocean strategy can be defined as a simultaneous pursuit of high product differentiation and low…

Q: Just-in-time inventory is one of the major developments in operations management. Identify a company…

A: ANSWER : One company that is currently using JIT is Toyota Motor Corporation. Toyota is known for…

Q: i) Define and calculate the marginal costs and throughput costs for each unit of GC and EX…

A: Costing is most important step to calculate profitability. Marginal Cost:- here variable costs…

Q: 1. The following are the activities and the time durations towards completion of a project. Compute…

A: Find the Duration and Variance calculations below:

Q: efine absolute advantage for Russia and Argentina

A: Absolute advantage is a concept that refers to the ability of a country to produce goods and…

Q: If project participant 'ST' had completed all of the Scoping work themselves and had also delivered…

A:

Q: 1) The manufacturer only has 10lbs of each type of meat left and wants to maximize the number of…

A:

Q: A catering company must have the following number of clean napkins available at the beginning of…

A: CONCEPT- The minimum-cost method endeavours to decrease the costs of conveyance by focusing on the…

Q: Consider the following statement "All four dimensions of the 'four V's framework' have different…

A: The implications of all four dimensions of the four V's framework for the cost of creating products…

Q: How do I Calculate the total cost of ownership for each supplier? Image of the table is available…

A: Given-

Q: The following table lists all costs of quality incurred by Sam's Surf Shop last year. Annual…

A: The formula for Appraisal cost Appraisal cost = Annual inspection costs + Annual testing cost

Q: K. 1. In this case, the company adopted five operating objectives: 1) safety, 2) quality, 3)…

A: Brad Hirsch who stood on the gaming floor at Harrah's Metropolis Casino and Hotel in Metropolis,…

Q: Hello, I was wondering if anyone can help me out with calculating safety stock with the information…

A: Given the data stated below, The average customer demand=100 units The standard deviation of…

Q: Solve this LP problem: 1. Maximize z = 3x₂ + 3x₂ + 3x3 Subject to: 2x₁ + x₂ + x₂ ≤ 2 3x₂ + 4x₂ + 3x₂…

A: By introducing slack variables, we must first convert the inequality constraints into equality…

Q: Complete the following: Target Based Situation: Produce products within 30 days Objective: Limiting…

A: Target Based Situation: Produce products within 30 days. Objective: Maximizing sales revenues.…

Q: Within each of the five process categories, what are some of the most often encountered challenges…

A: Teamwork makes the fantasy work, yet once in a while, it tends to be a test. Particularly when great…

Q: a) calculate the overall capacity for the system in units/hour

A:

Q: In London stock exchange company with some of its assets are under lease contracts. Examine…

A: IFRS 16 is the specification of how an IFRS reporter may recognize, measure and disclose leases. To…

Q: Organization (organizational structures) of the EPS as a whole and of its elements: TPP, NPP, HPP,…

A: Enterprise Project Structure means a hierarchy which represents the breakdown of projects in an…

Q: For the four basic configurations that follow, assume that the market is demanding product that must…

A: Find the Given details below: Given details: Production time of resource X 40 minutes…

Q: CU, Incorporated (CUI), produces copper contacts that it uses in switches and relays. CUI needs to…

A: Economic Order Quantity is a technique which helps to identify the optimal order quantity using…

Q: You are reuqired to prepare a Training Need Analysis form and discuss how should TNA be conducted to…

A: Training Needs Analysis (TNA) can be defined as a method of determining training need exists and…

Q: sne a. What price should she charge for a hot dog to break even? b. What factors might occur during…

A: Given: Vendor's fee = $3000 Cost of equipment = $4500 Cost of each hotdog = 0.35 Sales = 2000 units

Q: Formulate this as a covering problem and solve it with the Excel solver.

A:

Q: Formulate the LP and then use the graphical 2D method to solve Corner points of the feasible region:…

A: I would formulate the LP, then, I would solve this LP using the graphical method, The LP…

Q: What sort of demand management techniques would an exclusive restaurant use when demand exceeds its…

A: An exclusive restaurant differs from a fast food chain restaurant like McDonald as customers expect…

Q: What does logistics mean?

A: To explain: The term logistics. Concept used: Logistics: The process of managing and supplying…

Q: The liability for special assessment bonds for which the city is not obligated in any manner should…

A: The detailed solution of the question is given in Step 2.

11. Solve the given question and give the correct answer.

Step by step

Solved in 2 steps

- It costs a pharmaceutical company 75,000 to produce a 1000-pound batch of a drug. The average yield from a batch is unknown but the best case is 90% yield (that is, 900 pounds of good drug will be produced), the most likely case is 85% yield, and the worst case is 70% yield. The annual demand for the drug is unknown, with the best case being 20,000 pounds, the most likely case 17,500 pounds, and the worst case 10,000 pounds. The drug sells for 125 per pound and leftover amounts of the drug can be sold for 30 per pound. To maximize annual expected profit, how many batches of the drug should the company produce? You can assume that it will produce the batches only once, before demand for the drug is known.The Tinkan Company produces one-pound cans for the Canadian salmon industry. Each year the salmon spawn during a 24-hour period and must be canned immediately. Tinkan has the following agreement with the salmon industry. The company can deliver as many cans as it chooses. Then the salmon are caught. For each can by which Tinkan falls short of the salmon industrys needs, the company pays the industry a 2 penalty. Cans cost Tinkan 1 to produce and are sold by Tinkan for 2 per can. If any cans are left over, they are returned to Tinkan and the company reimburses the industry 2 for each extra can. These extra cans are put in storage for next year. Each year a can is held in storage, a carrying cost equal to 20% of the cans production cost is incurred. It is well known that the number of salmon harvested during a year is strongly related to the number of salmon harvested the previous year. In fact, using past data, Tinkan estimates that the harvest size in year t, Ht (measured in the number of cans required), is related to the harvest size in the previous year, Ht1, by the equation Ht = Ht1et where et is normally distributed with mean 1.02 and standard deviation 0.10. Tinkan plans to use the following production strategy. For some value of x, it produces enough cans at the beginning of year t to bring its inventory up to x+Ht, where Ht is the predicted harvest size in year t. Then it delivers these cans to the salmon industry. For example, if it uses x = 100,000, the predicted harvest size is 500,000 cans, and 80,000 cans are already in inventory, then Tinkan produces and delivers 520,000 cans. Given that the harvest size for the previous year was 550,000 cans, use simulation to help Tinkan develop a production strategy that maximizes its expected profit over the next 20 years. Assume that the company begins year 1 with an initial inventory of 300,000 cans.Seas Beginning sells clothing by mail order. An important question is when to strike a customer from the companys mailing list. At present, the company strikes a customer from its mailing list if a customer fails to order from six consecutive catalogs. The company wants to know whether striking a customer from its list after a customer fails to order from four consecutive catalogs results in a higher profit per customer. The following data are available: If a customer placed an order the last time she received a catalog, then there is a 20% chance she will order from the next catalog. If a customer last placed an order one catalog ago, there is a 16% chance she will order from the next catalog she receives. If a customer last placed an order two catalogs ago, there is a 12% chance she will order from the next catalog she receives. If a customer last placed an order three catalogs ago, there is an 8% chance she will order from the next catalog she receives. If a customer last placed an order four catalogs ago, there is a 4% chance she will order from the next catalog she receives. If a customer last placed an order five catalogs ago, there is a 2% chance she will order from the next catalog she receives. It costs 2 to send a catalog, and the average profit per order is 30. Assume a customer has just placed an order. To maximize expected profit per customer, would Seas Beginning make more money canceling such a customer after six nonorders or four nonorders?

- Assume the demand for a companys drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. If the company builds a plant that can produce x units of Wozac per year, it will cost 16x. Each unit of Wozac is sold for 3. Each unit of Wozac produced incurs a variable production cost of 0.20. It costs 0.40 per year to operate a unit of capacity. Determine how large a Wozac plant the company should build to maximize its expected profit over the next 10 years.If a monopolist produces q units, she can charge 400 4q dollars per unit. The variable cost is 60 per unit. a. How can the monopolist maximize her profit? b. If the monopolist must pay a sales tax of 5% of the selling price per unit, will she increase or decrease production (relative to the situation with no sales tax)? c. Continuing part b, use SolverTable to see how a change in the sales tax affects the optimal solution. Let the sales tax vary from 0% to 8% in increments of 0.5%.Global Logistics needs to rent space for storing product for the next three years. The following information regarding the demand and spot price is available. Current demand for the product is 150,000. Historically, Global Logistics has required 1500 square feet to store 1500 units of the product. Demand for the product can go up by 20% with a probability of 0.7 or down by 20% with a probability of 0.3. Global Logistics can sign a three-year fixed lease to rent 150,000 square feet of space at $1.00 per square foot per year. The firm may also choose to obtain warehousing space on the spot market. The current spot market price is $1.20 per square foot per year. The spot price can go up by 10% with a probability of 0.8 and can decrease by 10% with a probability of 0.2. The firm receives a revenue of $1.22 for each unit of demand. a) Create a decision tree showing period 0, 1 and 2 for the scenario described above. b) Calculate the NPV for the option when the firm decides to sign a…

- The Sloan Corporation is trying to choose between the following two mutually exclusive design projects. If the required return is 10 percent, what is the profitability index for each project? What is the NPV for each project? Complete the following analysis. Do not hard code values in your calculations. You must use the built-in excel function to answer this question. Annual Cash Flows I II 0 $ (51,000.00) $ (14,000.00) 1 $ 24,800.00 $ 7,800.00 2 $ 24,800.00 $ 7,800.00 3 $ 24,800.00 $ 7,800.00 Required Return 10% Profitability index (I)_________________ Profitability index(II)_________________ NPV (I) ______________ NPV (II) ______________The lease cost for a specialized highway design software package is estimated to be $13,000 for each of years 1, 2, and 3 (future dollars). (a) Calculate the CV amount today (year 0) of each future cost estimate at the inflation rate of 6% per year. (b) Develop a spreadsheet and graph for inflation rates of 3%, 6%, and 8% per year that show the CV today.A firm that plans to expand its product line must decide whether to build a small or a large facilityto produce the new products. If it builds a small facility and demand is low, the net present valueafter deducting for building costs will be $400,000. If demand is high, the firm can either maintainthe small facility or expand it. Expansion would have a net present value of $450,000, and maintaining the small facility would have a net present value of $50,000.If a large facility is built and demand is high, the estimated net present value is $800,000. If demandturns out to be low, the net present value will be – $10,000.The probability that demand will be high is estimated to be .60, and the probability of low demandis estimated to be .40.a. Analyze using a tree diagram.

- A firm that plans to expand its product line must decide whether to build a small or a large facilityto produce the new products. If it builds a small facility and demand is low, the net present valueafter deducting for building costs will be $400,000. If demand is high, the firm can either maintainthe small facility or expand it. Expansion would have a net present value of $450,000, and maintaining the small facility would have a net present value of $50,000.If a large facility is built and demand is high, the estimated net present value is $800,000. If demandturns out to be low, the net present value will be – $10,000.The probability that demand will be high is estimated to be .60, and the probability of low demandis estimated to be .40. 1- Compute the EVPI 2- Determine the range over which each alternative would be best in terms of the value of P ( low demand )The Rio Credit Union has $250,000 available to invest in a 12-month commitment and wants to invest all of it. The money can be placed in Brazilian treasury notes yielding an 8% return or in riskier high-yield bonds at an average rate of return of 9%. Credit union regulations require diversification to the extent that at least 50% of the investment be placed in Treasury notes. It is also decided that no more than 40% of the investment be placed in bonds. The aim of the objective function for Rio Credit Union should be to Maximize the objective value. Decision variables: X = $ invested in Treasury notes Y = $ invested in Bonds Objective function (in decimals, eg., .07, NOT 7%): The optimal ROI occurs when: X = Y = (enter your response as a whole number). Optimal ROI value 'Z' = (enter your response as a whole number)The manager of a small firm is considering whether to produce a new product that would require leasing some special equipment at a cost of$20,000 per month. In addition to this leasing cost, a production cost of$10 would be incurred for the first 1000 units (including the 1000th unit). After that, a production cost of$15 would be incurred for the rest. Each unit sold generates$20 in revenue. Determine how many units should be produced each month to make it profitable to produce this product.