Two years ago, Kimberly became a 30 percent partner in the KST Partnership with a contribution of investment land with a $10,750 basis and a $17,050 fair market value. On January 2 of this year, Kimberly has a $15,900 basis in her partnership interest, and none of her pre-contribution gain has been recognized. On January 2 Kimberly receives an operating distribution of a tract of land (not the contributed land) with a Š12,975 basis and an $19,275 fair market value. Problem 21-44 Part b (Algo) b. What is Kimberly's remaining basis in KST after the distribution? Basis Problem 21-44 Part c (Algo) c. What is KST's basis in the land Kimberly contributed after Kimberly receives this distribution?

Two years ago, Kimberly became a 30 percent partner in the KST Partnership with a contribution of investment land with a $10,750 basis and a $17,050 fair market value. On January 2 of this year, Kimberly has a $15,900 basis in her partnership interest, and none of her pre-contribution gain has been recognized. On January 2 Kimberly receives an operating distribution of a tract of land (not the contributed land) with a Š12,975 basis and an $19,275 fair market value. Problem 21-44 Part b (Algo) b. What is Kimberly's remaining basis in KST after the distribution? Basis Problem 21-44 Part c (Algo) c. What is KST's basis in the land Kimberly contributed after Kimberly receives this distribution?

Chapter21: Partnerships

Section: Chapter Questions

Problem 25CE

Related questions

Question

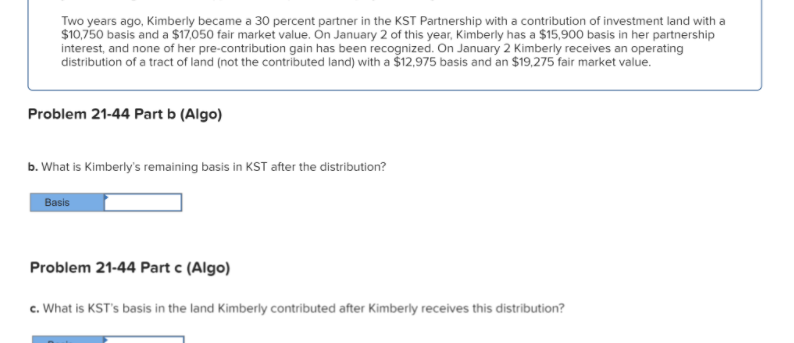

Transcribed Image Text:Two years ago, Kimberly became a 30 percent partner in the KST Partnership with a contribution of investment land with a

$10,750 basis and a $17,050 fair market value. On January 2 of this year, Kimberly has a $15,900 basis in her partnership

interest, and none of her pre-contribution gain has been recognized. On January 2 Kimberly receives an operating

distribution of a tract of land (not the contributed land) with a Š12,975 basis and an $19,275 fair market value.

Problem 21-44 Part b (Algo)

b. What is Kimberly's remaining basis in KST after the distribution?

Basis

Problem 21-44 Part c (Algo)

c. What is KST's basis in the land Kimberly contributed after Kimberly receives this distribution?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you