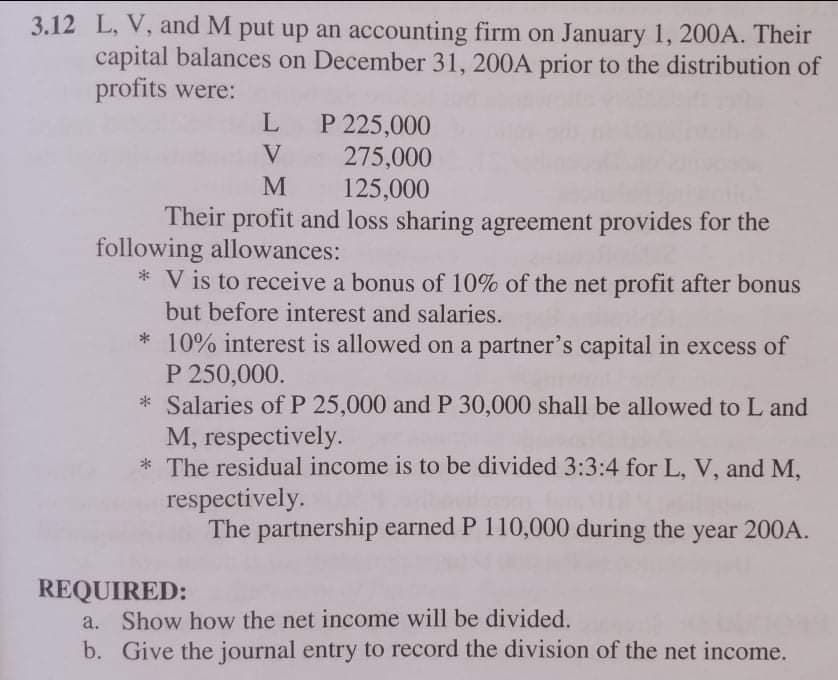

3.12 L, V, and M put up an accounting firm on January 1, 200A. Their capital balances on December 31, 200A prior to the distribution of profits were:

Q: In 2020, Frost Company, which began operations in 2018, decided to change from LIFO to FIFO because ...

A: Inventory Analysis: Inventory analysis is one of the parts of operation research which bargains in c...

Q: Percent of capacity 90% 100% 110% Direct labor hours 3,600 4,000 4,400 Units of output 900 1,000 1,1...

A: Preparation of flexible budget are as follows

Q: (Political Motivations for Policies) Ever since the unethical actions of some employees of Enron Cor...

A: Accounting policies refers to the rules and regulations which is implemented on the management of th...

Q: A).What is the inventory for zooey corporation B).what is the notes payable for zooey corporation in...

A: Calculation of Inventory. Inventory Turnover = Cost of goods sold/ Inventory. Cost of goods sold= Sa...

Q: Working capital is an indication of the firm’s ________.A. asset utilizationB. amount of noncurrent ...

A: Working capital (WC) seems to be a financial statistic that indicates the operating liquidity access...

Q: Paragon Properties built a shopping center at a cost of $50M in year 2010. The company started leasi...

A: The Modified Accelerated Cost Recovery System is the current tax depreciation system in the United S...

Q: 7...e1 Sage Industries and Pronghorn Inc. enter into an agreement that requires Pronghorn Inc. to b...

A: Amortization Schedule is the statement that shows the payment of rentals at certain period and charg...

Q: What is the impact on the accounting equation when a current month’s utility expense is paid?A. both...

A: Accounting equation is one of the important concept used in accounting. Three elements of accounting...

Q: Sample Cat. ref. Sales Unit Description Last 12 mo. Inventory as Reorder sales (units) at last year ...

A:

Q: Required: 1) Prepare a schedule of total standard manufacturing costs for the 24000 production of bl...

A: Standard costing is one of the important tool of management accounting, under which standard or budg...

Q: Statement 1: Cost of inventories or supplies are deducted from gross income when purchased or acquir...

A: Inventories form a part of assets of the entity and represent the stock of raw material, work in pro...

Q: acius Corporationis conducting a TDABC study in its Customer Service Department. The company has pro...

A: Cost of employee per week (39780*11)/50 = 8751.6 Practical capacity of total employees = 2400*11*85%...

Q: Iρng Corporation is a fabric manufacturing company. On January 20, Long made sales to Lyndsay’s Lace...

A: Gross Price method is the recording of transaction on gross basis and not availing the discount at t...

Q: The following is the accounts found in the trial balance of Lei, Inc., an SME: 2020 2019 Lease li...

A: The correct answer for the above mentioned question is given in the following steps.

Q: On July 1, Blue Spruce Corporation purchases 460 shares of its $5 par value common stock for the tre...

A: Treasury shares means the share which has been buy back by the company . It will be shown as deducti...

Q: 4. Compute gross profit earned by the company for each of the four costing methods. For specific ide...

A: Under FIFO Method, units which comes in first will be sold first and the inventory will be out of th...

Q: Sage Industries and Pronghorn Inc. enter into an agreement that requires Pronghorn Inc. to build thr...

A: The question is based on the concept of Lease Accounting. As per the Bartleby guidelines we are allo...

Q: Why is the power to tax is sometimes called sometimes the power to destroy?

A: Note: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered o...

Q: balance because of a number of errors: Debit Credit Cash P 13,000 Accounts receivable 30,840 Supplie...

A: In this question trial balance is wrong and some values are missing , so we make a new trial balance...

Q: Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur i...

A: Cash budget means expected cash receipts and expected cash payment with opening and closing cash bal...

Q: Dos Enterprises has historically reported bad debt expense of 5% of sales in each quarter. The entit...

A: Bad debt expense for the fourth quarter = Bad debt expense for the entire year - Bad debt expense re...

Q: What are subsidiary ledgers and control accounts,and why are they used? Describe how they work.

A: An accounting ledger is an accounting account or record that keeps track of activities on the balanc...

Q: Accounting The Concord Hat Shop Limited counted the entire inventory in its store on August 31 and a...

A: Consignment is a way of selling goods in which goods are kept with a third party. The party with who...

Q: provide complete solution

A: The formulas needed for the upper limit and tolerance limit are:- The formula for prediction interva...

Q: 1. What is the primary purpose of taxation?

A: Note: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered o...

Q: Which donut is giving the most profit on each one sold . On average, which donut brings in the most ...

A: When all the expenses incurred for production and sales are deducted from the revenue we get the pro...

Q: Initially, the amount of currency was 500 and the amount of deposits was zero. The required reserve ...

A: Here discuss about the money creation process which are incurred in the commercial banking system wh...

Q: You need to have $15,000 in five years to pay-off a home equity loan. You can invest in an account t...

A: We use the formula: A=P(1+r/4)4n where A=future valueP=present value r=rate of interestn=time pe...

Q: Uno Company reported income before tax for the first six months ended June 30, 2021 at P5,000,000. H...

A: Interim financial statements are those financial statements which are prepared in between two financ...

Q: 12. Manny's adjusted gross income on his federal tax return was $45,231. He claimed a standard deduc...

A: In the given question, Manny's gross income on his federal tax return = $45,231 Standard Deduction c...

Q: Sodas Inc. and Tom’s Bottling Plant have a manufacturing franchise arrangement. This involves the tr...

A: Manufacturing Franchise Arrangement:- It is such a type of arrangement where a franchisor (manufactu...

Q: Qestion 1 a) Many loan agreements have financial covenants that rely on: Multiple Choice A. float...

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: On September 30, 2022 World Company borrowed P1, 000, 000 on a 9% note payable. The entity paid the ...

A: >Note Payables are the liabilities. >It can be issued in case of: --when goods are pur...

Q: Why is the power to tax is something called something the power destroy

A: The Government run but it is the people who pay the Taxes and who elect the government to run the c...

Q: Helsinki Inc. produces premium bottled water. Helsinki purchases artesian water, stores the water in...

A: The question asks to compute the ending WIP on December 31 : where , ending WIP = Ending work in pro...

Q: Reviewing insurance policies revealed that a single policy was purchased on August 1, for oneyear’s ...

A: Prepaid insurance is one of the current asset of the business, which means insurance expenses for fu...

Q: Sonya Jared opened a law office on July 1, 2022. On July 31, the balance sheet showed Cash $5.000, A...

A: Income statement: It is one of the financial statement that is prepared by the business to show its ...

Q: There are 2 types of residents in town. 20% are financially stable who can pay back the loan they bo...

A: Breakeven means a point of balance making neither profit nor loss. If amount is below point then it...

Q: Preparing a Corrected Trial Balance The following trial balance of Splendid Household Services as of...

A: Trial Balance - Trial Balance is the statement prepare after posting all the general into ledgers of...

Q: Which of the following is the primary source of revenue for a manufacturing business?A. the producti...

A: Manufacturing business are those type of business which are indulged in production of goods in the b...

Q: Saved Help Save & Exit Submi Boone Company allocates overhead based on direct labor hours. It alloca...

A: Given, Overhead cost = $4600 Job 1 (11 hours)= $2300 Job 2 (11 hours)= $2300 Overhead increased = $6...

Q: Novak Company at December 31 has cash $44,500, noncash assets $214,000, liabilities $120,000, and th...

A: Preparation of the schedule of cash payment is as follows:

Q: Heinz Company’s post-closing trial balance as of December 31, 2018, and the adjusted trial balance a...

A: Cash flow statement- The movement of cash or cash equivalents in a firm is represented by a cash flo...

Q: business bank account 2016 1 Started in business with £10,500 cash. Jan 2. Put £9,000 of the cash in...

A: Journal entries, Closing of accounts and trial balance have been made.

Q: The comparative financial statements of Marshall Inc. are as follows. The markut price of Marshal co...

A: Ratio analysis helps to analyze the financial statements of the company. The management can take dec...

Q: ieko holds 50 out of 180 shares of Natural Gas, Inc. Natural Gas uses cumulative voting to elect dir...

A: Cumulative voting is used when electing a new director or board of directors.Each shareholder typi...

Q: A budget: A.is used to determine if a product should be continued or discontinued B.complies actua...

A: The budget is prepared by the business organizations so as to know the expected revenue and expenses...

Q: On April 1, Year 1, Halo Co. issued a $5,000 face value discount note to the Capri Bank. The note ha...

A: Formula: Discount amount = Face value amount x Discount rate

Q: REQUIRED: Give the correcting compound entry.

A: Compound entry is the entry which has been entered and recorded by the company in the journal book o...

Q: 1. What is the primary purpose of taxation? 2. What are the secondary purposes of taxation and brief...

A: "Since you have asked multiple question ,we will solve First 3 question for you,If you want any spec...

Step by step

Solved in 3 steps with 3 images

- Use the information for the next four (4) questions.ZXCVBNM Company has an agreement to pay the sales manager a bonus of 5% of the entity's earnings. The income for the year before bonus and tax is P7,875,000 The income tax rate is 30% of income after bonus.A.) How much is the bonus, assuming bonus is a certain percent of the income before bonus and before tax? B.) How much is the bonus, assuming bonus is a certain percent of income after bonus but before tax? C.) How much is the bonus, assuming bonus is a certain percent of income after bonus and after tax? D.) How much is the bonus, assuming bonus is a certain percent of income after tax but before bonus?Requirement: For each of the following independent income-sharing agreements, prepare an income distribution schedule. 1. Monthly salaries are P30,000 to AB, P50,000 to QR and P45,000 to XY AB receives a bonus of 5% of net income after deducting his bonus Interest is 12% of ending capital balances. Any remainder is divided by AB, QR and XY in a 25:40:35 ratio. The Income Summary account has a credit balance of P2,835,000 before closing. 2. Interest is 10% of weighted average capital balances. Annual salaries are P480,000 to AB, P630,000 to QR and P510,000 to XY. QR receives a bonus of 25% of net income after deducting the bonus and his salary, Any remainder is divided in a 2:3:4 ratio by AB, QR and XY, respectively. Net income was P1,050,000 before any allocations. 3. XY receives a bonus of 20% of net income after deducting the bonus and the salaries. Annual salaries are P600,000 to AB, P540,000 to QR and P750,000 to XY. Interest is 15% of the ending capital in excess of P140,000.…Please show your solution in good accounting form V Co. has an agreement to pay its sales manager a bonus of 7.5% of the company's earnings due to an exemplary performance. The income for the year before bonus and tax is ₱6,890,500. The income tax rate is 32% of income after bonus. The bonus is computed after deduction for both bonus and tax. Compute for the amount of bonus for the year.

- Maryland company offers a bonus plan to its employees equal to 3% of net income. Maryland's net income is expected to be $960,000. The amount of the employee's bonus expense is estimated to be? A. $27,961B. $28,800C. $29,000D. $29,691E. $30,000V Co. has an agreement to pay its sales manager a bonus of 7.5% of the company's earnings due to an exemplary performance. The income for the year before bonus and tax is ₱6,890,500. Income tax rate is 32% of income after bonu. The bonus is computed after deduction for both bonus and tax. Compute for the income after tax for the year.Use the information for the next four (4) questions. XYZ Company has an agreement to pay the sales manager a bonus of 5% of the entity's earnings. The income for the year before bonus and tax is P7,875,000 The income tax rate is 30% of income after bonus.How much is the bonus, assuming bonus is a certain percent of the income before bonus and before tax? How much is the bonus, assuming bonus is a certain percent of income after bonus but before tax? How much is the bonus, assuming bonus is a certain percent of income after bonus and after tax? How much is the bonus, assuming bonus is a certain percent of income after tax but before bonus?

- V Co. has an agreement to pay its sales manager a bonus of 7.5% of the company's earnings due to an exemplary performance. The income for the year before bonus and tax is ₱6,890,500. Income tax rate is 32% of income after bonus. The bonus is computed after deduction for both bonus and tax. Compute for the amount of bonus for the year.1. A VAT-registered business makes a sale of P33,600, inclusive of VAT. The amount of sale that is reported in the statement of comprehensive income can be computed as* a. P33,600 x 112%b. P33,600 / 112%c. P33,600 x 12% / 112%d. P33,600 / 12% / 112% 2. You are an employee in the private sector. For the year 20x1, you received a 13th month pay of P110,000 and a Christmas bonus (non-performance based) of P25,000. Of the benefits you have received, how much is taxable?* a. P135,000b. P90,000c. P45,000d. P0V Co. has an agreement to pay its sales manager a bonus of 7.5% of the company's earnings due to an exemplary performance. The income for the year before bonus and tax is ₱6,890,500. Income tax rate is 32% of income after bonus. The bonus is computed after deduction for both bonus and tax. Requirements: Compute for the amount of bonus for the year. Compute for the income after tax for the year.

- 5 A lump sum benefit is payable on termination of service and equal to 1 per cent of final salary for each year of service. The salary in year 1 is P10,000 and is assumed to increase at 7 per cent (compound) each year. The discount rate used is 10 per cent per year. The entity does not fund its obligation to pay lump-sum benefits. The employee is expected to leave at the end of year 5. The amount to be recognized as expense in the second year is Group of answer choices P98 P196 P107 P13111. After three profitable years, Grace company decided to offer a bonus to the branch manager of 25% of the branch income after deduction of the bonus but before deduction of income tax. Branch income for the current year before the bonus and income tax was 1,650,000. The tax rate was 30%. What is the bonus for the current year?15. On March 1, 20XX, ABM company sold 300 one-year subscriptions for ₱15 each. The total amount received was credited to subscriptions revenue. How much should be recorded as liability? A. ₱750 B. ₱4,500 C. ₱3,750 D. ₱0