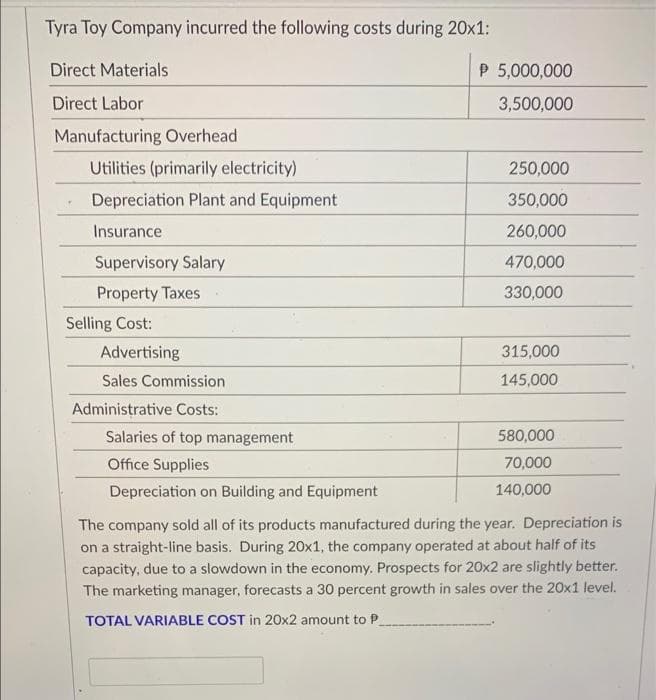

Tyra Toy Company incurred the following costs during 20x1: Direct Materials P 5,000,000 Direct Labor 3,500,000 Manufacturing Overhead Utilities (primarily electricity) 250,000 Depreciation Plant and Equipment 350,000 Insurance 260,000 Supervisory Salary 470,000 Property Taxes 330,000 Selling Cost: Advertising 315,000 Sales Commission 145,000 Administrative Costs: Salaries of top management 580,000 Office Supplies 70,000 Depreciation on Building and Equipment 140,000 The company sold all of its products manufactured during the year. Depreciation is on a straight-line basis. During 20x1, the company operated at about half of its capacity, due to a slowdown in the economy. Prospects for 20x2 are slightly better. The marketing manager, forecasts a 30 percent growth in sales over the 20x1 level. TOTAL VARIABLE COST in 20x2 amount to P

Tyra Toy Company incurred the following costs during 20x1: Direct Materials P 5,000,000 Direct Labor 3,500,000 Manufacturing Overhead Utilities (primarily electricity) 250,000 Depreciation Plant and Equipment 350,000 Insurance 260,000 Supervisory Salary 470,000 Property Taxes 330,000 Selling Cost: Advertising 315,000 Sales Commission 145,000 Administrative Costs: Salaries of top management 580,000 Office Supplies 70,000 Depreciation on Building and Equipment 140,000 The company sold all of its products manufactured during the year. Depreciation is on a straight-line basis. During 20x1, the company operated at about half of its capacity, due to a slowdown in the economy. Prospects for 20x2 are slightly better. The marketing manager, forecasts a 30 percent growth in sales over the 20x1 level. TOTAL VARIABLE COST in 20x2 amount to P

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 7RE

Related questions

Question

Please help

Transcribed Image Text:Tyra Toy Company incurred the following costs during 20x1:

Direct Materials

P 5,000,000

Direct Labor

3,500,000

Manufacturing Overhead

Utilities (primarily electricity)

250,000

Depreciation Plant and Equipment

350,000

Insurance

260,000

Supervisory Salary

470,000

Property Taxes

330,000

Selling Cost:

Advertising

315,000

Sales Commission

145,000

Administrative Costs:

Salaries of top management

580,000

Office Supplies

70,000

Depreciation on Building and Equipment

140,000

The company sold all of its products manufactured during the year. Depreciation is

on a straight-line basis. During 20x1, the company operated at about half of its

capacity, due to a slowdown in the economy. Prospects for 20x2 are slightly better.

The marketing manager, forecasts a 30 percent growth in sales over the 20x1 level.

TOTAL VARIABLE COST in 20x2 amount to P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning