Tyson Corporation reported pretax income from operations in Year 1 of 92,000 (the first year of operations). In Year 2, the corporation experienced a $96,000 NOL (pretax loss from operations). Management is confident the company will have taxable income in excess of $120,000 in Year 3. Assume an income tax rate of 25% in Year 1 and thereafter. Tyson has no other temporary differences. Required a. Provide the Year 1 and Year 2 income tax entries that Tyson should make.

Tyson Corporation reported pretax income from operations in Year 1 of 92,000 (the first year of operations). In Year 2, the corporation experienced a $96,000 NOL (pretax loss from operations). Management is confident the company will have taxable income in excess of $120,000 in Year 3. Assume an income tax rate of 25% in Year 1 and thereafter. Tyson has no other temporary differences. Required a. Provide the Year 1 and Year 2 income tax entries that Tyson should make.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 3RE: In the current year, Madison Corporation had 50,000 of taxable income at a tax rate of 25%. During...

Related questions

Question

Tyson Corporation reported pretax income from operations in Year 1 of 92,000 (the first year of operations). In Year 2, the corporation experienced a $96,000 NOL (pretax loss from operations). Management is confident the company will have taxable income in excess of $120,000 in Year 3. Assume an income tax rate of 25% in Year 1 and thereafter. Tyson has no other temporary differences.

Required

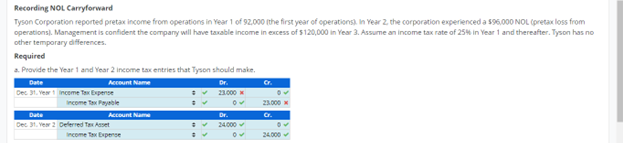

a. Provide the Year 1 and Year 2 income tax entries that Tyson should make.

Transcribed Image Text:Recording NOL Carryforward

Tyson Corporation reported pretax income from operations in Year 1 of 92,000 (the first year of operations). In Year 2, the corporation experienced a $96,000 NOL (pretax loss from

operations). Management is confident the company will have taxable income in excess of $120,000 in Year 3. Assume an income tax rate of 25% in Year 1 and thereafter. Tyson has no

other temporary differences.

Required

a. Provide the Year 1 and Year 2 income tax entries that Tyson should make.

Date

Account Name

Dec 31, Year 1 Income Tax Expense

Income Tax Payable

Account Name

Date

Dec 31, Year 2 Deferred Tax Asset

Income Tax Expense

=

=

Dr.

✔23.000

✓

Dr.

24.000

04

Cr.

23.000

Cr.

24.000✔

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT