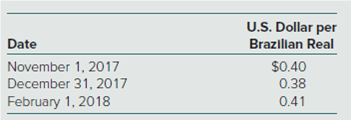

U.S. Dollar per Brazillan Real Date November 1, 2017 December 31, 2017 February 1, 2018 $0.40 0.38 0.41

Use the following information for Problems 21 and 22.

On November 1, 2017, Dos Santos Company

What is the net impact on Dos Santos Company’s 2018 net income as a result of this hedge of a forecasted foreign currency transaction? Assume that the raw materials are consumed and become a part of the cost of goods sold in 2018.

a. $80,000 decrease in net income.

b. $80,600 decrease in net income.

c. $81,100 decrease in net income.

d. $83,100 decrease in net income.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images