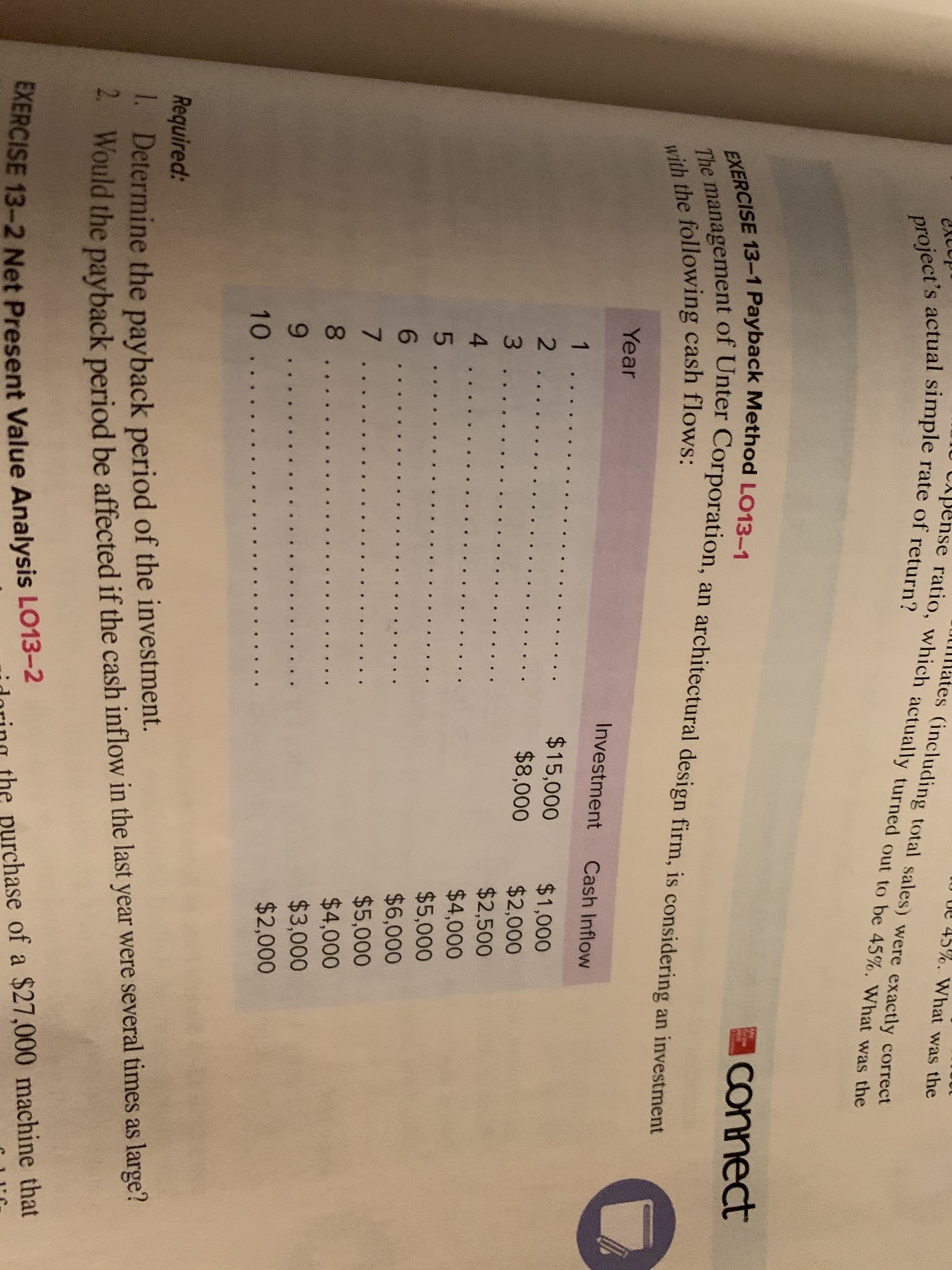

Ue 45%. What was the llates (including total sales) were exactly correct Apense ratio, which actually turned out to be 45%. What was the excop project's actual simple rate of return? EXERCISE 13-1 Payback Method LO13-1 The management of Unter Corporation, an architectural design firm, is considering an investment connect Graw with the following cash flows: Year Investment Cash Inflow 1 ... $15,000 $8,000 $1,000 $2,000 2 ... 3.. $2,500 $4,000 $5,000 $6,000 $5,000 $4,000 5.. 6.. 7 .. 8 .. $3,000 9... $2,000 10 ... Required: 1. Determine the payback period of the investment. - Would the payback period be affected if the cash inflow in the last year were several times as large? EXERCISE 13-2 Net Present Value Analysis LO13-2 the purchase of a $27,000 machine that

Ue 45%. What was the llates (including total sales) were exactly correct Apense ratio, which actually turned out to be 45%. What was the excop project's actual simple rate of return? EXERCISE 13-1 Payback Method LO13-1 The management of Unter Corporation, an architectural design firm, is considering an investment connect Graw with the following cash flows: Year Investment Cash Inflow 1 ... $15,000 $8,000 $1,000 $2,000 2 ... 3.. $2,500 $4,000 $5,000 $6,000 $5,000 $4,000 5.. 6.. 7 .. 8 .. $3,000 9... $2,000 10 ... Required: 1. Determine the payback period of the investment. - Would the payback period be affected if the cash inflow in the last year were several times as large? EXERCISE 13-2 Net Present Value Analysis LO13-2 the purchase of a $27,000 machine that

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 11P: Brook Corporation’s free cash flow for the current year (FCF0) was $3.00 million. Its investors...

Related questions

Question

Transcribed Image Text:Ue 45%. What was the

llates (including total sales) were exactly correct

Apense ratio, which actually turned out to be 45%. What was the

excop

project's actual simple rate of return?

EXERCISE 13-1 Payback Method LO13-1

The management of Unter Corporation, an architectural design firm, is considering an investment

connect

Graw

with the following cash flows:

Year

Investment

Cash Inflow

1 ...

$15,000

$8,000

$1,000

$2,000

2 ...

3..

$2,500

$4,000

$5,000

$6,000

$5,000

$4,000

5..

6..

7 ..

8 ..

$3,000

9...

$2,000

10 ...

Required:

1. Determine the payback period of the investment.

- Would the payback period be affected if the cash inflow in the last year were several times as large?

EXERCISE 13-2 Net Present Value Analysis LO13-2

the purchase of a $27,000 machine that

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you